The Capped Corridor - An Alternative to the Vanilla Interest Rate Cap

Corridor Overview

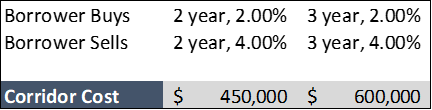

An alternative to a vanilla rate cap is a corridor, which is just two caps: one bought, and one sold. The primary intent is to obtain a cap at lower cost by selling one back at a higher strike. Corridors are especially effective at lowering the upfront cost in today’s environment since the sold cap also has a volatility component which is netted against the bought cap. For example:

- Buy 2.00% - If SOFR resets above 2.00%, the bank owes you the difference between SOFR and the bought strike

- Sell 4.00% - If SOFR resets above 4.00%, you owe the bank the difference between SOFR and the sold strike

The 2.00% strike is always more in the money than the 4.00% strike, and since you’d face the same bank on both, you’ll never actually owe them a payout (payments are just netted). The effect:

- When SOFR is below 4.00%, you feel like you have a 2.00% cap at a discount

- When SOFR is above 4.00%, your effective rate gets pulled up basis point for basis point above 2.00%.

The quick and easy formula to calculate the effective rate when SOFR is above the sold strike is:

- Effective Rate = SOFR – (Sold Strike – Bought Strike)

- E. g., if SOFR resets at 5.00%, the effective rate would be 5.00% - (4.00% - 2.00%) = 3.00%.

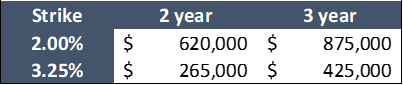

Here’s some corridor pricing assuming a $25mm notional.

Capped Corridor

The challenge with a corridor is that it doesn’t truly cap your rate. For example, if SOFR is at 20% with our example corridor structure, your effective rate would be 18%. For this reason, corridors tend not to satisfy lender hedge requirements.

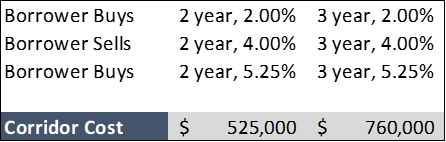

If a lender pushes back on a corridor, one potential solution would be to layer in a disaster cap above the sold strike creating a “capped corridor.” For example:

- Buy 2.00%

- Sell 4.00%

- Buy 5.25%

In this scenario, your max effective rate would be 5.25% - (4.00% - 2.00%) = 3.25%. The strikes can be tweaked to meet the hedge requirement, while balancing cost. The following quotes are for a capped corridor creating a hard ceiling at 3.25%.

Benefit – Using the 2 year structure as an example, if SOFR never exceeds 4.00%, you’ll have effectively capped your rate at 2.00%.

- A vanilla 2.00% cap costs $620,000, which means you’ll have realized $95,000 in savings on the upfront cost to hedge.

Risk – If SOFR spikes dramatically, immediately rising above 5.25% early in the hedge’s term, the corridor would feel and behave like a vanilla 3.25% cap.

- Since a vanilla 3.25% cap costs $265,000, you’ll have effectively overpaid by $260,000 for the same level of protection the vanilla cap would have provided.

Capped Corridor – Staggered Maturities

Capped corridors can also shine when maturities are staggered. For instance, if the initial hedge requirement is only for 2 years, one option would be to purchase the 3 year corridor with a 2 year “disaster” cap at 5.25%. In two years, the disaster cap would be extended for the third year once some of the uncertainty premium has bled off.

The benefit here is that the upfront cost of the hedge would be further reduced while still satisfying the initial hedge requirement. On the flipside, the risk is that rates are above the 5.25% in two years, driving the cost to extend the 5.25% through the third year materially higher. However, this is the same risk a borrower takes by just buying a vanilla 2 year cap.

Generic Cap Pricing

Below we’ve included the generic cap pricing touched on above for reference.