Hedging Your Fixed Rate Financing With The Swaption Corridor

In the midst of all the current market uncertainty, there’s one thing that’s undeniable: hedges have gotten expensive. If you’re familiar with corridors and swaptions, you could reduce the cost to hedge your upcoming fixed rate financing by blending the two instruments, creating what’s referred to as “swaption corridor.”

As a brief refresher, swaptions are options on swap rates and can be used to hedge various future fixed rate issuances. To read about how swaptions work in more detail, check out our Swaptions 101 resource. Although highly effective, swaptions are often cost prohibitive for many deals, leading some borrowers to forego the hedge and accept the risk of their fixed rate climbing by the time they lock.

Swaption Corridors

This instrument is commonly referred to as an option spread or, in this case, a swaption corridor. Just like with cap corridors, a swaption corridor is comprised of two parts: a strike bought, and a strike sold. The primary intent is to offset the premium of the lower strike swaption by selling a swaption back to the bank at a higher strike.

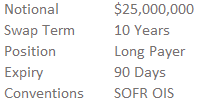

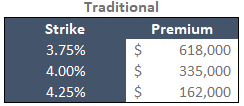

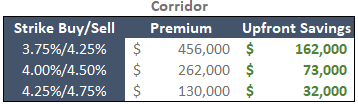

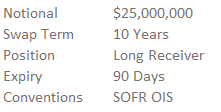

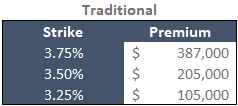

Below, we’ve outlined the cost of a traditional swaption used to hedge an upcoming 10-year rate lock on a $25mm loan closing 90 days out.

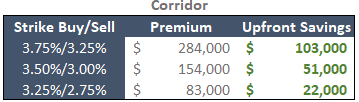

Now, check out the impact on the upfront premium when a higher strike is sold back:

Using the buy 3.75%, sell 4.25% swaption corridor structure as an example, here’s how the hedge could play out at expiry:

- The 10-year rate is below 3.75% - The option expires worthless

- The 10-year rate is above 3.75% but below 4.25% - The option behaves like a traditional 3.75% swaption and the borrower is reimbursed the present value difference between the 10-year rate and the 3.75% strike

- The 10-year rate is above 4.25% - The borrower is reimbursed the present value difference between the two strikes, or 4.25% - 3.75% = 0.50%

Put simply, swaption corridors allow the borrower to put a ceiling on the swaption’s potential payout in exchange for a lower upfront cost. The quick and easy formula to calculate the maximum protection provided with a swaption corridor is…

Maximum Payout = Sold Strike – Bought Strike

The downside risk to this type of hedge is that it doesn’t perfectly hedge increases in fixed rates. For example, let’s say the borrower purchased a buy 3.75%/sell 4.25% swaption corridor and some black swan event occurs that sends fixed rates to 10% at expiry. In that scenario, the borrowers effective fixed rate would be 9.5% after accounting for the maximum payout.

For this reason, swaption corridors tend to make the most sense for borrowers that are concerned rates might increase some, but not by substantially more than the strike they sell back to the bank.

Breakeven

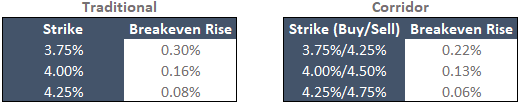

Aside from just the upfront cost savings, another way to look at the benefit of a swaption corridor is its impact on the borrower’s breakeven point. The breakeven point is simply how much the fixed rate needs to climb above the strike by expiry in order for the borrower to breakeven on the cost of the hedge.

The following tables compare the breakeven points of a traditional swaption against a swaption corridor.

Using the buy 3.75%/sell 4.25% swaption corridor structure as an example, let’s assume the 10-year rate is at 3.75% at the time the borrower purchases the swaption. In order to breakeven on the cost of the hedge, the 10-year rate would need to climb to 3.97% by expiry, or 8bps more than with a traditional 3.75% swaption.

Swaption Corridors for Prepayments

Like traditional swaptions, swaption corridors can also be used to hedge upcoming prepayment penalties such as yield maintenance, make whole, swap breakages, and defeasance. The only difference is that you would be hedging against a fall in rates. So, instead of selling back a higher strike, you’d sell back a strike lower than the one you purchased. Below, we’ve outlined indicative pricing to hedge a prepayment 90 days from now on a $25mm loan.

And here’s the impact on the upfront cost when a lower strike is sold back:

Mechanically, this would work inversely to a swaption corridor used to hedge against a rise in rates but, otherwise, is conceptually the same.

Conclusion

Whether hedging a future fixed rate financing or an upcoming prepayment, swaption corridors can be an effective way for borrowers to lower their upfront hedging costs when compared to traditional swaptions. The borrow would essentially be placing a ceiling on their potential payout in exchange for a lower premium.

These instruments are usually more effective when the borrower believes rates won’t rise (or fall in the case of a prepayment) substantially beyond the strike they sell back, but don’t want to leave themselves completely exposed to rate movements.

If you have an upcoming fixed rate lock or prepayment and are concerned about fluctuations in rates impacting your deal, please don’t hesitate to reach out to the experts at pensfordteam@pensford.com or (704) 887-9880.

If you haven’t already, be sure to also check out our recent article on how corridors can reduce your upfront hedging costs on floating rate deals where you might be looking to place a traditional rate cap.