Swaps 201 – Buying Out the Floor

Overview

Given the current rate environment, many floating rate loans now contain interest rate floors. However, floors can add increased complexity when hedging with an interest rate swap. As a solution, banks will frequently propose buying out the floor so the swap matches perfectly with the loan.

Before committing to buy out the floor, there are a few things borrowers should consider. But first, here’s a quick refresher on how cashflows work with a swap.

How Swaps Work

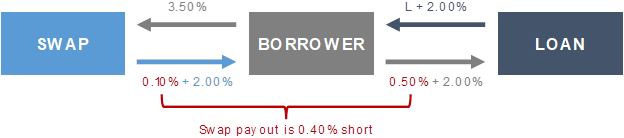

A swap is an agreement to exchange interest rate payments where the borrower pays a fixed rate in exchange for a floating rate. Let’s look at an example of a vanilla swap.

In this scenario, the borrower has a floating rate loan at LIBOR + 2.00% and swaps their floating payment for fixed. For the term of the swap, the borrower will pay 3.50% and receive LIBOR + 2.00%, which nets out against the loan obligation, whether LIBOR resets at 0% or 10%.

For a more in-depth explanation, check out our Swaps 101 whitepaper.

But What if My Loan Has a Floor?

Swapping a loan with a floor adds some complexity. Does the borrower buy out the floor or leave it unhedged?

The floor effectively acts as an increased loan spread as long as the floating rate index remains below the floor. For each basis point the floating rate index is below the floor, the “all-in” rate increases one-for-one.

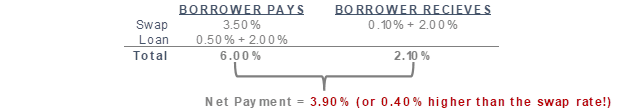

Let’s illustrate this by including a 0.50% floor on LIBOR to the loan from our previous example. In this new scenario, the borrower’s still paying 3.50% and receiving L + 2.00%. However, the borrower’s minimum payment on the loan is now the floor + 2.00% (or 2.50%). If LIBOR resets below the floor at 0.10%, then the swap payout falls 0.40% short of the loan payment.

Here’s this same scenario laid out a different way.

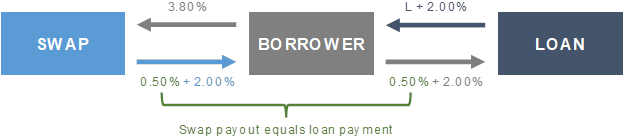

To create a perfect hedge, the borrower would need to “buy out” the floor on the swap so that the swap’s payout matches the loan payment. But that’s going to cost something. In lieu of a 3.50% fixed rate, the borrower might instead be paying 3.80%. Below we’ll explore an example of buying the floor out of a swap.

Like in the last example, let’s assume LIBOR resets again at 0.10%. With the floor bought out, the swap now pays out 0.50% + 2.00%, which nets equally against the loan payment.

Because the bank must hedge the risk that they’ll need to payout on the floor, they charge a premium to buy it out on the swap. Typically, this premium is rolled into swap and paid through an increase to the rate.

Alright, Should I Buy Out the Floor?

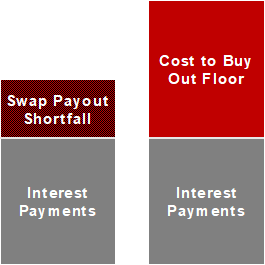

Many banks offer the ability to buy out the floor but don’t make it mandatory. Nonetheless, buying out the floor is another revenue generating activity for the bank, who will frequently try to sell the borrower on doing so. Before committing to buying it out, borrowers should consider the breakeven point.

On our example swap, let’s assume a 10-year term to hedge against a $10mm floating rate loan. For buying out the 0.50% floor to pay for itself, LIBOR would need to average 0.20% (0.50% floor minus 0.30% cost) or lower for the next decade.

The cost to buy out the floor is usually so substantial that many borrowers elect to forego buying it out, understanding their risk will be a one-for-one increase to their fixed rate as long as the floating rate index is below the floor. In many cases, the borrower would wind up better off covering any increase in their fixed rate from the swap payout shortfall themselves.

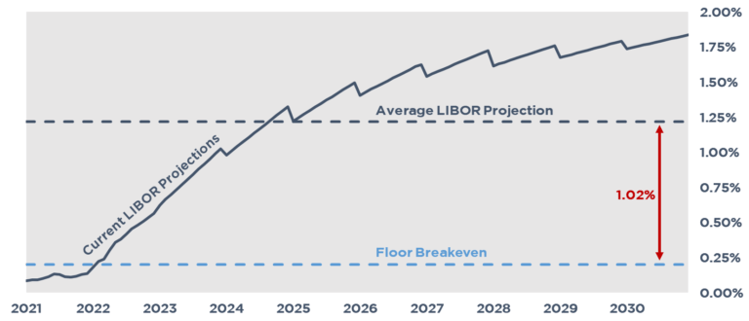

Going back to our example, here’s a comparison of LIBOR’s current projection against the breakeven point from buying out the floor.

The market currently expects LIBOR to average around 1.22% over that same period, well above the breakeven point.

Alternatively, the borrower could buy out a shorter-term floor at a substantially lower cost, which would raise the breakeven point. This approach could especially make sense in a rising rate environment where the risk of the floating index falling below the floor is mostly packed in to the first few years. Should rates start to fall again after the initial floor expires, the borrower could purchase another floor as needed.

Conclusion

Before committing to buy out the floor on a swap, borrowers should quantify the cost to do so and what the breakeven point will be, then consider the likelihood they’ll actually breakeven. In most cases, the premium is so substantial that it doesn’t make sense buy out the floor.

In addition to all other things swaps, helping borrowers quantify their breakeven point is in Pensford’s wheelhouse. For help hedging your next deal, reach out to us at pensfordteam@pensford.com or (704) 887-9880.