Cashflow Constrained? Step Up the Swap

If you’re experienced with interest rate caps, you may be familiar with “stepped strikes,” where rather than having a constant strike throughout the term of the hedge, it changes over time (i.e. 2.00% in year 1, 3.00% in year 2, and 4.00% in year 3).

Aside from the potential cost savings compared to a constant strike with the same average rate, one of the bigger benefits of a stepped structure is that you can tighten your protection during a portion of the hedge term where you need it most. For example, if your deal is cashflow constrained for the first couple years, you could tighten your protection on the front end, trading off lighter protection later on when you expect to have greater cashflow and can absorb a higher debt service.

This same idea of a stepped rate can also be applied to interest rate swaps, where your rate is fixed lower for one portion of the hedge’s term and higher during another. But first, a quick refresher on swap rates.

Swap Rates

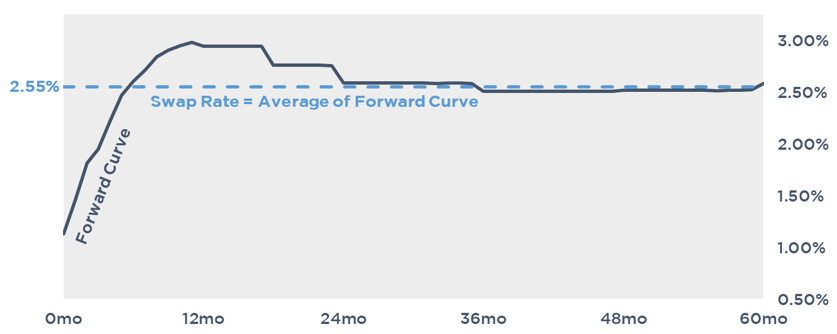

Simply put, a swap rate is just what markets expect the underlying floating rate index to average over a given term. Said another way, you’re swapping your average projected floating rate for a constant fixed rate.

For example, SOFR is at 0.78% today but, over the next five years, the forward curve projects the rate to climb all the way to 3.00% before averaging out at 2.55%, aka the five year swap rate.

Stepped Swaps

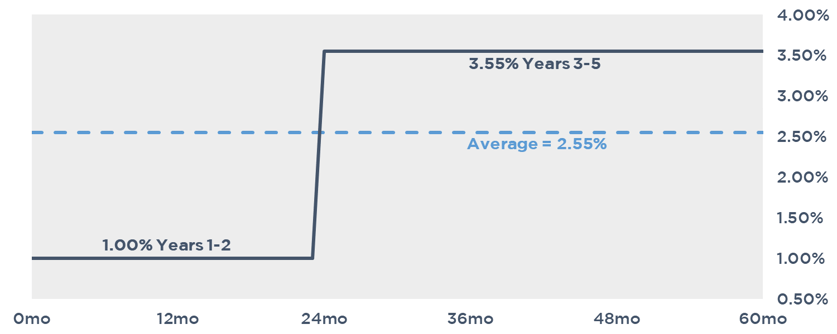

The more exotic swap structure mentioned has a coupon that steps up or down at some predetermined point in the future. So long as the fixed rate averages out to be the same as the swap rate over a given term, the hedge provider would be indifferent between a stepped and constant rate. For example, if the five year swap rate is 2.55%, you could fix your rate at 1.00% for years 1-2 and 3.55% years 3-5 such that the average is still 2.55% over the term of the hedge. We’ve illustrated this structure below.

You can manipulate the fixed rate however you like, adjusting it one or multiple times. It just needs to average out to the swap rate. So, what’s the risk?

The Risk – Outsized Breakage Costs

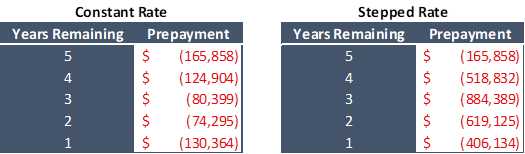

While you’re lowering your debt service on the front end, the deferral of interest by raising the coupon on the tail end risks a higher breakage cost should the swap be terminated prior to maturity. The swap winds up being more against you later in its term because of the delayed payment of the interest that you would already owe with a constant rate.

The following tables compare the projected breakage costs of a constant 2.66% swap against our example stepped swap structure. Both projections assume rates remain unchanged from today.

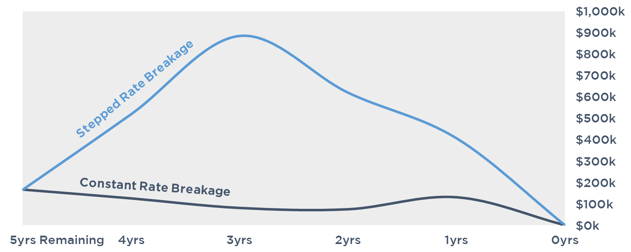

Now, here are those same breakage costs illustrated graphically.

One of the biggest risks of swapping in general is the potential for its breakage cost being a barrier to prepaying early, and this this risk is exacerbated in stepped swaps. When exploring a stepped swap structure, it’s imperative that borrowers weigh the risk of a larger breakage in the future against the lower debt service in the earlier years of the hedge.

Conclusion

Borrowers who are looking for the certainty of swapping but have the need for a more tailored hedge, such as in a cashflow constrained project, could benefit from a stepped swap. This is achieved by manipulating their swap rate, tightening protection in periods where they need it most at the expense of raising the rate in another period where the borrower can absorb a greater interest expense.

Before executing this type of swap structure, borrowers should consider the risk of a greater breakage cost later on.

For more details on swap mechanics, check out our Swaps 101 resource.

If you’ve got an upcoming financing that that you’re considering swapping for fixed or want to explore whether a stepped swap could make sense for your deal, don’t hesitate to reach out to the interest rate experts at pensfordteam@pensford.com or (704) 887-9880.