LIBOR vs SOFR

Introduction

As the planned discontinuation of LIBOR and implementation of risk-free rates (RFR) is less than 2 years away, market participants are seeking greater clarity on what the transition will look like, how the new index will be calculated, what potential effects it will have on their loans/hedges, etc. While progress still needs to be made, relevant regulators around the world have been working with policymakers and private-market participants to continue refining the details for the transition.

The Federal Reserve Board and the Federal Reserve Bank of New York formed the Alternative Reference Rates Committee (ARRC) in 2014 to head the transition from USD LIBOR. The ARRC also actively engaged in work led by the International Swaps and Derivatives Association (ISDA) to determine appropriate fallback language for derivative contracts. The ARRC selected the Secured Overnight Financing Rate (SOFR) in 2017 as the appropriate replacement index and the New York Fed began publishing SOFR in April 2018. SOFR is based on transactions in the overnight repurchase markets (repo), which averages roughly $1 trillion of transactions every day. The massive size of the underlying market makes SOFR a transaction-based rate, better reflecting current financing cost.

We also saw a strong surge of floating rate notes tied to SOFR in 2019, predominately from GSE (Fannie Mae and Freddie Mac) and major banks. In total, more than 300 notes were issued, totaling about $275B.

The ARRC has published formal Fallback Language options (ARRC Recommendations) for various cash products: floating rate notes, bilateral business loans, securitizations, adjustable rate mortgages, and syndicated loans. While efforts were made for consistent Fallback Language across the product types, given the unique characteristics of each product some customization was required.

Implementation of the ARRC’s Recommendations has been slow by market participants, as discussions continue on the advantages and disadvantages to the SOFR variants. While the current situation is in flux, we expect significant developments in 2020.

The focus of this update is for borrowers who finance with floating rate loans (bilateral business loans). Especially significant for hedged loans, as we will focus on the ARRC’s recommended “Hedged Loan Approach” Fallback Language.

Brief Background

LIBOR was originally based on interbank lending transactions, but due to changes in how banks fund themselves the underlying bank-to-bank lending market has shrunk significantly. With few, if any, actual transactions for banks to base their quotes on, LIBOR submissions became dependent on the panel banks’ own judgement. This led to an increase in fraud and manipulation (LIBOR rigging scandals) for an index that is tied to almost $200 trillion in financial products around the world.

Regulators globally have been actively investigating alternative risk-free rates (RFR) that are based on a larger pool of underlying transactions. To help spur the market into action, in July 2017 the UK Financial Conduct Authority announced it would no longer compel panel banks to submit LIBOR quotes after 2021.

Without a mandate to make submissions, banks may elect to no longer provide quotes given the risk and liabilities (including fines) associated with quoting a rate that is lacking depth of reference transactions. Any subsequent LIBOR fixings after 2021, even with the involvement of the current LIBOR administer, ICE Benchmark Administration (IBA), would also need to be compliant with relevant regulations, particularly those regarding representativeness. Per the IBA’s website, “there is no guarantee that any LIBOR settings will continue to be published after year-end 2021. Users of LIBOR should not rely on the continued publication of any LIBOR settings when developing transition or fall back plans.”

Differences Between SOFR and LIBOR

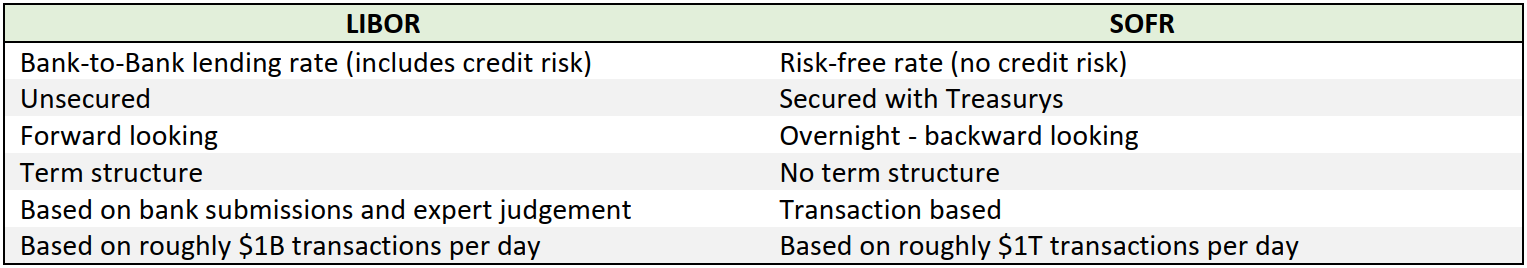

LIBOR is a daily average of what banks say they would have to pay to borrow for another bank for various terms (i.e. 1-month LIBOR, 3-month LIBOR). The rate is forward-looking, so borrowers know the interest rate for a given interest period at the beginning of the period. This bank-to-bank lending is unsecured, so LIBOR also includes a credit risk premium, while a RFR does not.

SOFR on the other hand is a secured, overnight (backward looking), risk free rate based on actual transactions collateralized by Treasurys.

Summary of Key Differences

While there are obvious advantages to moving to a truly market based RFR, there are significant challenges transitioning from an unsecured forward term rate (LIBOR) to a secured overnight rate (SOFR):

- Due to the lack of a large, developed derivatives market, forward term SOFR is not currently available and may not be an option at the time LIBOR is discontinued.

- Without a forward term rate, borrowers and lenders will not know a given interest payment until the end of each interest period.

- What ‘spread’ will be added to SOFR to account for the credit risk premium associated with LIBOR (bank-to-bank lending) and how will that spread be determined.

- Banks have reported significant changes will be required to their operations systems as well as loan documentation to accommodate SOFR in arrears.

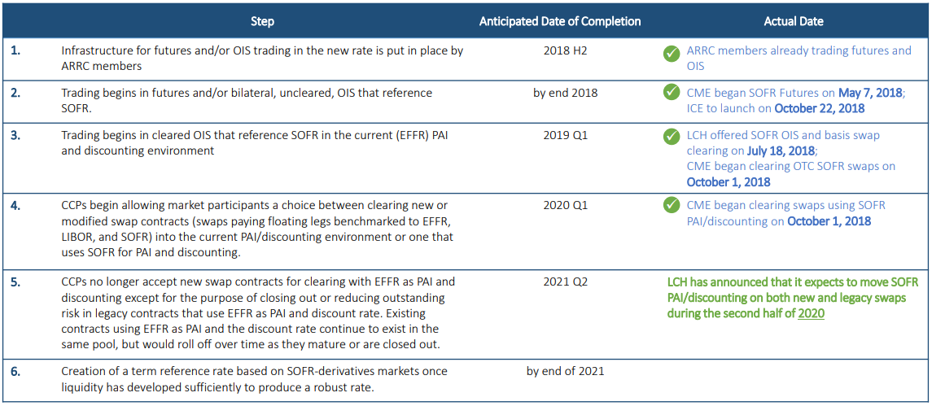

ARRC Paced Transition Plan

The ARRC also released the Paced Transition Plan, outlining specific steps and timelines to ensure a smooth transition. Below is an outline of those steps and the current progress.

ISDA’s Methodology – Compounded SOFR in Arrears

The market will need to come to a consensus as to how SOFR is calculated and implemented in both cash and derivative instruments. Ideally both will have identical fallback language, preventing any potential mismatch between the loan and the hedge.

The International Swaps and Derivatives Association (ISDA) is actively working to amend the 2006 ISDA Definitions to include new language referencing SOFR as the replacement index if LIBOR is no longer available. The amended definitions are expected to be released in the first half of 2020, with Bloomberg beginning to publish compounded SOFR averages shortly thereafter.

ISDA is also planning to issue a 2020 IBOR Fallbacks Protocol, allowing counterparties with existing trades to incorporate the new replacement language.

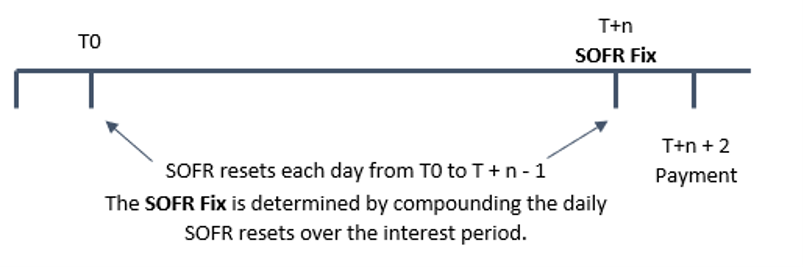

ISDA’s methodology for calculating SOFR will be the compounded average of the daily SOFR over the reference period. Unlike LIBOR, which is set at the beginning of each payment period, the applicable compounded SOFR will not be determined until the end of the period.

For example, on a LIBOR based financing, the rate is fixed, in advance, at the beginning of the period and the interest payment is due at the end of the period. Borrowers and lenders also know the interest payment amount at the start of the period when the rate is fixed.

For a SOFR based financing using the compounded in arrears variant, the SOFR fix is not determined until the end of the period. Borrowers and lenders would not know the precise interest payment until a few days before the payment is due.

To account for the credit risk premium included in LIBOR, a spread will be added to SOFR based on the five-year historical median basis between the two rates. The goal is for the two rates to be economically neutral.

Because ISDA governs all derivative transactions, it has the ability to incorporate changes more consistently and universally than possible on the loan side.

Forward-looking Term SOFR

Some market participants have expressed a desire for a forward-looking, term SOFR (i.e. 1-month or 3-month SOFR) that would represent the market’s expectations for SOFR over the relevant term. This structure would feel very similar to the existing LIBOR loans familiar to borrowers, with the interest rate being set at the beginning of each payment period. It would also be easier to incorporate a forward-looking term SOFR into existing loan docs to replace LIBOR rather than the compounded setting in arrears structure favored by ISDA, which would require a significant amount of changes to existing loan docs.

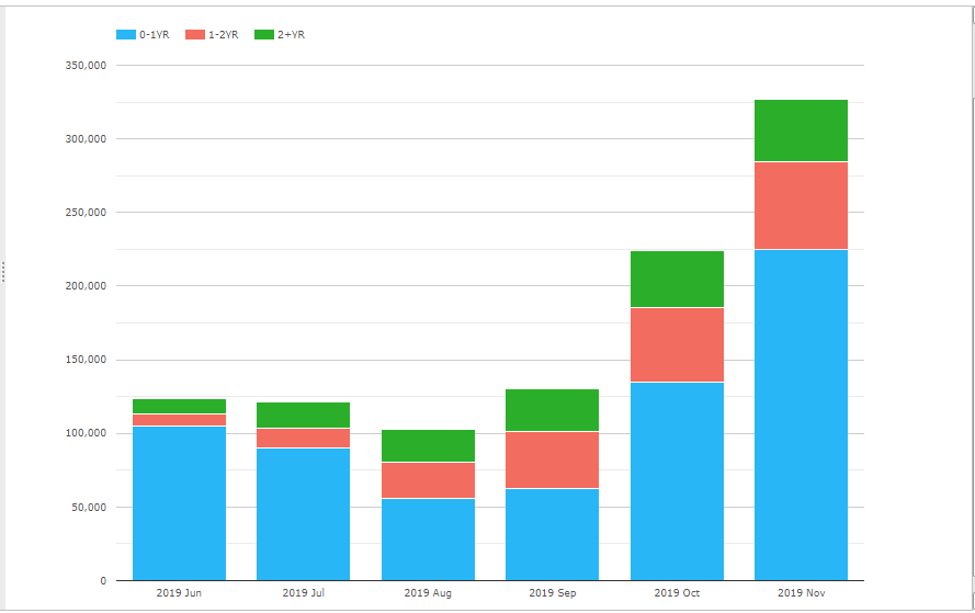

Forward-looking term rates would be based on SOFR futures and are dependent on the development of a large and robust derivatives market. While the CME began offering SOFR futures in May 2018 and trading volume has been growing consistently, the size of the market is still relatively small compared to LIBOR.

For example, at the end of 2019 there was about $345B of outstanding SOFR swaps, which represents just 1% of the notional value tied to USD LIBOR swaps. This is especially true for longer maturities, as roughly 80%+ of current SOFR swaps are for terms of 2 years or less, making the construction of SOFR forward curve challenging 2+ years out. As you can see below, while the proportion of SOFR swaps with tenors of 2+ years is increasing, it still represents a relatively small percentage of the total market.

LCH SOFR Swaps by Tenor

A Brief History – Forward-looking SOFR term rates since inception

Futures derived forward SOFR term rates not likely available by the time of LIBOR’s discontinuation

Unfortunately, regulators believe there is a strong possibility that SOFR derivatives markets will not reach the required breadth and depth by 2021 to produce regulatory compliant forward rates. The International Organization of Securities Commissions (IOSCO) is recognized as the global standard setter for securities regulation. The New York Fed updated its Statement of Compliance with the IOSCO Principles for Financial Benchmarks to cover SOFR. The NY Fed “independently reviewed the organizational and operational framework used to administer the SOFR…with respect to governance, quality of the benchmark, quality of the methodology, and accountability and determined that these reference rates are also in compliance with the (IOSCO) Principles.”

A forward-looking rate would be more akin to the current LIBOR structure and easier for banks to implement both from an operations and documentation perspective. But as previously mentioned, ISDA has elected to use the compounded in arrears methodology as the replacement index, creating a potential mismatch between the fallbacks on the loan and on the related hedge. And while a forward-looking term rate could still be hedged, it involves additional complexity and cost.

Given the current lack of a robust SOFR derivative market to derive forward-looking SOFR term rates and ISDA implementing compounded SOFR as the fallback for hedges, most CRE borrowers should seriously consider the ARRC’s Hedged Loan Approach discussed below.

ARRC Recommendations

The ARRC has provided three recommended approaches for borrowers of Floating Rate Loans to consider: Hardwire Approach, Amendment Approach, and Hedged Loan Approach. While these approaches were originally designed for new financings, the language can be amended into current loan docs. If you are a floating rate borrower that often enters accompanying interest rate hedges, the Hedged Loan Approach needs to be seriously considered. The other recommended approaches create a potential mismatch between your loan and hedge.

Hardwire Approach

This approach provides a waterfall of benchmark replacements. The first option in the waterfall is a forward-looking term SOFR (if available), which will cause mismatches in how the interest expense on the associated hedge is calculated compared to the loan, as the hedge will use the ISDA fallback.

Note, the market has been slow to adopt the Hardwire Approach, likely due to the lack of flexibility.

For more details on the Hardwired Approach and the options in the waterfall, please view the ARRC’s presentation here.

Amendment Approach

While the Hardwire Approach includes a waterfall of specific fallback rates, the amendment approach does not identify the successor rate or spread adjustment. Instead, it provides an amendment process for negotiating the fallback rate in the future. Similar to the language commonly included in current loan agreements for “LIBOR Replacement”, but the Amendment Approach expands that language to include specificity around the process and parameters for selecting the benchmark replacement, specific trigger events for the transition, and inclusion of a benchmark replacement adjustment.

For example, following a trigger event, the lender is required to give consideration to any selection or recommendation by the Fed, the ARRC, or any then-prevailing market convention for similar loans.

Hedged Loan Approach

The intent of this approach is to ensure the replacement index is identical in both the loan and associated hedge. Essentially, the loan side will default to whatever fallbacks ISDA implements for derivatives. Per the New York Fed, “To the extent borrowers wish to ensure their bilateral business loan fallbacks are aligned with those for related derivatives referencing the ISDA definitions, the hedged loan approach provides certainty in this regard.”

This language would need to be negotiated and agreed upon upfront or amended into existing loan docs. While it may make some borrowers unsettled to not know the exact interest payment for a given period until days before the payment is due, this is the only option that ensures the hedge and loan match. And while the interest expense is not known upfront, it does have the benefit of better reflecting actual funding cost over the period, not the market’s projections.

For more details on the mechanics of each approach, please find the “ARRC Recommendations” here.

LIBOR v SOFR – Historic Comparison

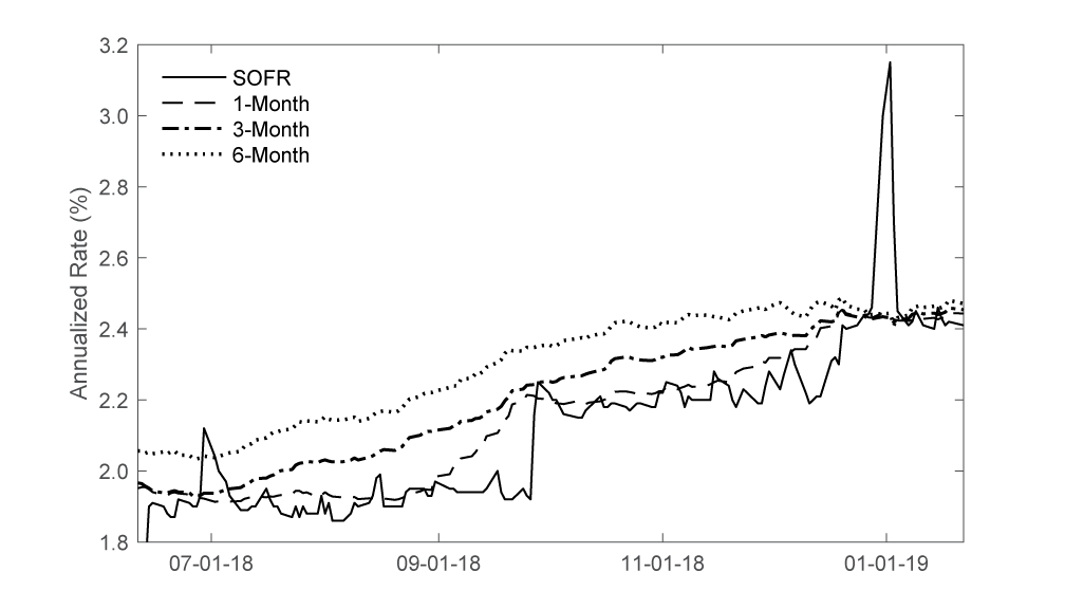

A common concern with borrowers is the volatility in the repo market. While SOFR is more volatile than LIBOR on a day-to-day basis, much of the volatility is smoothed out when we take the compound average of SOFR over a 1-month or 3-month period. Even if SOFR spiked for a couple days during the interest period, the overall effect on the compounded SOFR reset for that period is significantly muted.

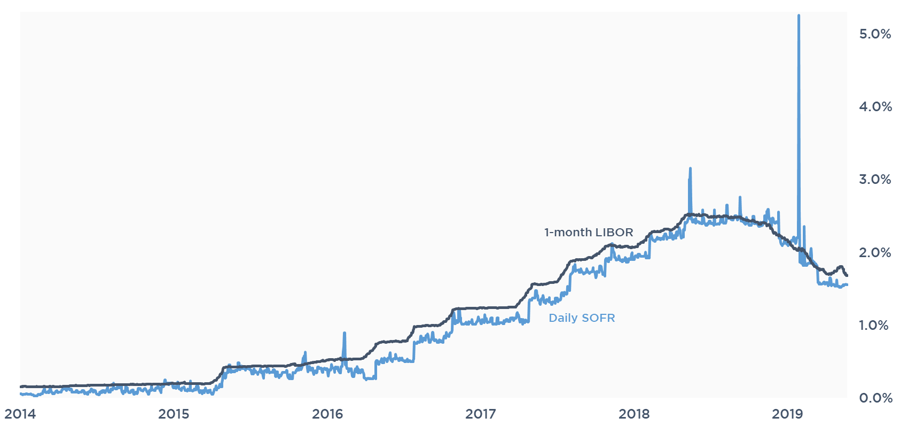

As shown below, daily SOFR prints can experience sharp spikes, especially around quarter and year end, while 1-month LIBOR is relatively smooth.

1-month LIBOR vs daily SOFR

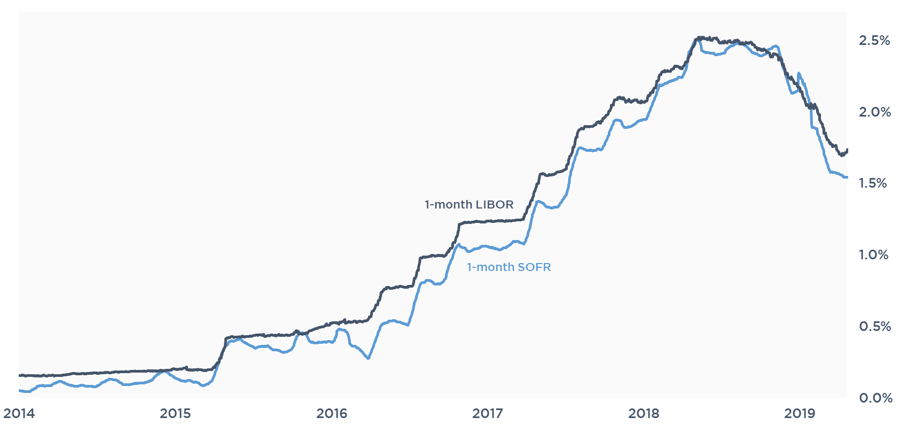

Fortunately, a borrower’s SOFR reset for a given period will not be based on a single SOFR print. The effect of averaging daily SOFR over a 1-month term significantly reduces the volatility. For example, SOFR spiked at the end of 2018, but as you can see below the impact on 1-month compounded SOFR was minimal.

1-month LIBOR vs 1-month compounded SOFR

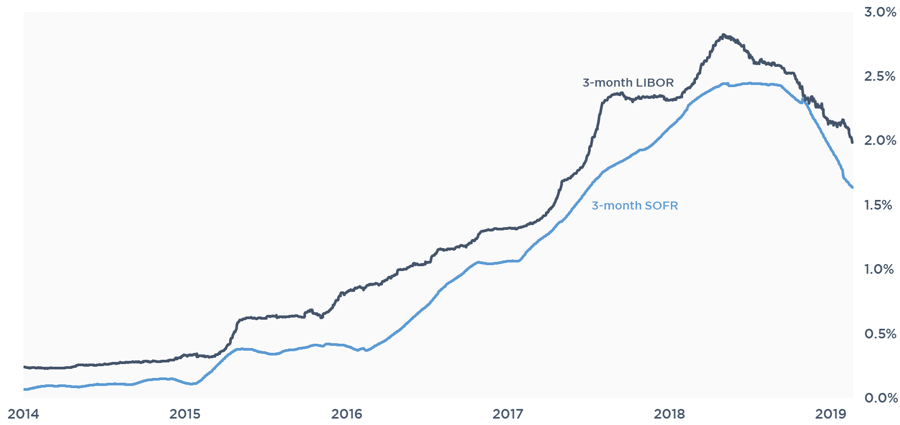

The smoothing effect is more evident as we increase the reference interest period. For example, 3-month compounded SOFR actually displays less volatility than 3-month LIBOR.

3-month LIBOR vs 3-month compounded SOFR

LIBOR vs SOFR Conclusion

Many details are expected over the coming months that will help provide great clarity and direction to borrowers as to the best ways to prepare for LIBOR’s cessation. At the top of the list is ISDA’s amended fallback definitions for both new trades and legacy trades. Bottom line, a LIBOR hedge today is not going to suddenly be worthless when LIBOR is discontinued. Intense focus is on making any replacement RFR economically neutral to current LIBOR.

For the time being, it is worth discussing the Hedged Loan Approach regarding replacement language in new financings. Once lenders have a chance to review and get comfortable with the details of ISDA’s calculation methodology for the SOFR fallback (triggers for transition, look-backs, pay delays, compounding in arrears, etc.), they are more likely to encourage adoption on the loan side.

So how much should you care right now? While the situation is certainly in flux, progress towards a consensus is being made. Again, we should see a further bump in SOFR activity following ISDA’s release of their amended 2006 Definitions. If lenders start adopting the Hedged Loan Approach, the overall impact on your financing cost should be minimal. Regulators are paying close attention to any potential value transferal between parties due to the transition.