Forbearance and Hedges

Lenders are negotiating forbearance agreements with a lot of borrowers right now, so we thought it would make sense to explain the potential impact on hedges, most notably swaps.

Caps

No impact. Wasn’t that easy?

Swaps

Let’s assume you locked in a swap a year ago at 4.25%. I’m going to round some of my calculations just to keep the math simple.

Notional $25,000,000

Term 5 years

Amortization 25 years

Loan Spread 1mL + 1.75%

Fixed Rate 4.25%

Monthly P&I $136,000

The lender has agreed to give you a three month forbearance on loan payments. What about the swap?

First, you have to put your swap marketer hat on. How does a swap marketer look at this?

Here’s how the swap looked to the swap desk on the day you locked. They were able to lock at 3.90%, but they quoted you 4.25%. You locked in and they booked a $350k profit. That is now the starting point for your MtM going forward.

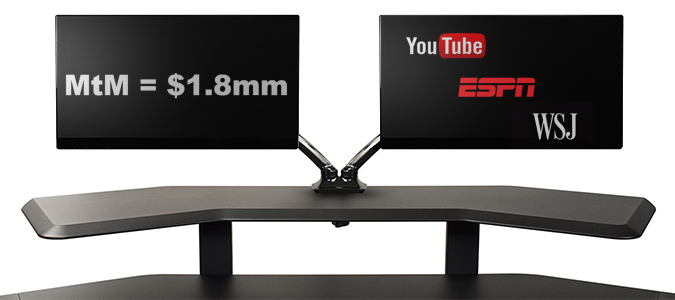

You and your banker call the swap desk together to discuss modifying the swap. The swap marketer pulls up your swap. Rates have plunged, so the MtM is now $1.8mm. Nearly $350k of this is from the revenue they generated when you locked.

When it comes to a modification, the swap desk really doesn’t really care about matching payments, amortization, maturity, etc. The swap desk takes its cues from the loan side of the house. What they really care about is making sure that MtM matches. They pull the existing swap up on their left monitor, and the modified swap up on the right monitor, and solve for the MtM.

If you change something over here, they will change something over there in order to make the MtM’s match. Let’s say they try to model it up where you skip three payments, the MtM might look like the next image. Notice how this results in a $200k lower MtM. If they modified the swap that way, they would book a $200k loss.

Since swap desks are not in the business of losing money, they won’t agree to this. If you make a change over here, they will make a change over there to compensate for the loss. Most commonly, this is done through a higher rate. “Yes, we can skip three months of payments but we need to increase your rate from 4.25% to 4.45%. Does that work for you?” Here’s what their trading screens look like in that scenario. Everyone is happy again.

But not only are swap desks not in the business of losing money, they are in the business of making money. When it comes to a modification, what they usually do is something more like this. “Yes, we can skip three months of payments but we need to increase your rate from 4.25% to 4.65%. Does that work for you?”

In this scenario, the swap desk generated an additional $200k of swap revenue.

Every time you modify a swap, it is an opportunity for the swap desk to generate additional revenue. Banks may choose to not generate swap revenue since these are unusual times, but at least be aware that a modification could result in additional revenue.

OK, so now what?

The swap desk will take its instructions from the loan side of the house. Your lender will call the swap desk, ask about the potential impact, and then report back. But the swap desk will not be the one driving the decision, your lender will be.

Negotiate with your lender first, then account for the impact on the swap.

Before we examine the potential impact on the swap, it’s important to remember that a swap payment is actually separate from the loan payment.

The swap payment is just a net of fixed rate vs floating rate. In our example, here’s the monthly payment for just the swap when 1 month LIBOR is 1.00%.

Swap Payment = 4.25% – (LIBOR + 1.75%)

Swap Payment = 4.25% – (1.00% + 1.75%)

Swap Payment = 4.25% – 2.75%

Swap Payment = 1.50%

The net interest payment on the swap this month is 1.50%. Here’s the math for the actual payment.

Outstanding Principal * Net Rate Difference * # of days in the month/360

Swap Payment = $24.5mm * 1.50% * 30/360

Swap Payment = $30,625

What you would normally pay this month is actually the combination of a floating rate loan payment combined with a swap payment.

Breakdown of a monthly loan payment

Principal $ 47,500

Floating Interest $ 57,300

Loan Payment $104,800

Breakdown of monthly swap payment

Fixed $88,500

Floating $57,300

Total $31,200

Total Monthly P&I is $104,800 + $31,200 = $136,000

If the lender says, “Go ahead and skip the loan payments for the next three months”, you don’t have to pay the $104,800 each month for the next three months. That’s over $300k over the next 90 days. This is exactly the reason why you work so hard to maintain a good relationship with your lenders.

But the swap still has to be accounted for. There are two main options I can think of off the top of my head.

Option 1 – Keep making the swap payment during forbearance period

Breakdown of monthly swap payment

Fixed $88,500

Floating $57,300

Total $31,200

You may be comfortable paying $31k instead of $136k each month and decide to just keep making the swap payments.

This will be even more attractive for those that have locked a swap in recently. Let’s say instead of a 4.25% fixed rate, you have a 3.00% fixed rate.

Breakdown of monthly swap payment

Fixed $62,500

Floating $57,300

Total $ 5,200

You only have to pay $5,200 this month to keep the swap current and avoid the hassle/transaction cost of a modification. I suspect a lot of borrowers with relatively new swaps will go this route.

This will cause a slight mismatch after three months. In this example, the swap assumes the outstanding notional decreases by about $150k over the next three months. In three months, the loan balance will not have amortized, but the swap amortization kept stepping down.

- Amend hedge

- Remember our earlier scenarios where a modification sets the stage for additional revenue

- Leave hedge as-is and have a slight mismatch

Option 2 – Modification

Hopefully by now you recognize that a modification of any kind has economic consequences and that banks commonly use this as an opportunity to earn additional revenue.

The most likely modification is to simply push the next payment of the swap out three months.

This will feel a little bit like a forward starting swap. Instead of the swap being effective today, you just push it out to start in July or August. What has happened before today has no impact going forward, so don’t get hung up on the fact that your swap may have been in place for years. It doesn’t matter from a swap perspective. All that matters is that the MtM doesn’t drop after the modification. Left monitor = right monitor.

Pushing out the next payment date by 3 months will cause a decrease in the MtM by the same amount of the projected 3 payments.

The swap desk will likely increase your rate to compensate for this.

Left monitor = right monitor.

Conclusion

Don’t worry about the swap until you have figured something out with the lender.

There are probably a million flavors of what we are describing here. There may be some lenders that modify the balloon payment, or extend the loan term by three months, or some variation thereof.

Just remember, if the swap is modified, the bank is solving to keep the MtM the same…or better.

Call us. Email us. We are here to help.