Bank Swaps vs CMBS Swaps

Why are the swap rates I see online different from what the bank quotes?

One of the benefits swaps offer is complete customization. Each swap can be structured independently of the financing to allow for flexibility for things like notional amount, term, amortization, and prepayment flexibility.

This makes publishing a “standard” swap rate challenging since each loan has unique characteristics that affect the final rate.

CMBS Swaps – Semi-Bond Conventions

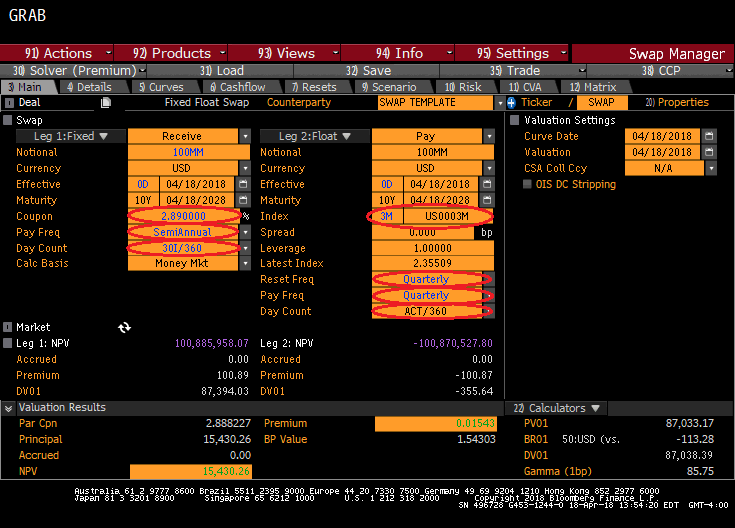

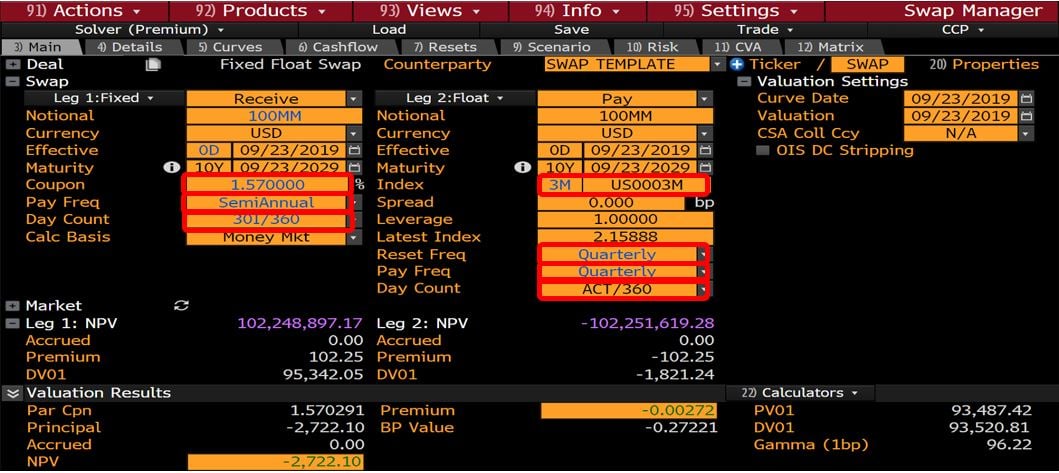

In general, the rates published online, in the WSJ, or quoted by a CMBS desk utilize something called “semi-bond conventions”. That is a fancy way of saying that the fixed rate side makes payments every six months using 30/360 daycount conventions, while the floating rate side makes payments quarterly on 3 month LIBOR using actual/360 daycount conventions. Both sides of the swap are interest only. These rates are meant to replicate standard conventions found on corporate bonds.

We pulled the rates below from three commercial real estate brokerage websites at the same time. As you can see, the rates are pretty similar and any difference is probably attributable to different curve refresh times.

1.570%

1.561%

1.574%

If you are ok being off by a few basis points, these rates will do a reasonably good job of showing where the market is trading within about a 15–30 minute lag. But these are semi-bond convention rates, which means they are really only applicable to your financing if your financing has the structure and daycount conventions highlighted above.

And there is really only one financing mechanism in commercial real estate that uses these conventions – CMBS.

If you are pricing a CMBS deal, online rates will do a relatively good job of getting you close. Just as importantly, they do a good job of illustrating directional movements. If you went to a site and noticed the 10 year swap rate had increased from 1.57% to 1.67%, it’s likely the rate a borrower can lock in has increased by about 0.10%.

Semi-Bond Swap Rates

Here is a generic Bloomberg screen capture showing a variety of rates. We have highlighted the generic 10 year semi-bond swap rate, 1.569%. As you can see, these are pretty close to the online rates we found.

Source: Bloomberg Finance, LP

Here is a more precise swap model. We have set all the parameters to semi-bond conventions, also highlighted. As you can see, the 10yr swap rate here matches the 10yr swap rate above because they both use semi-bond conventions. The rate in both cases is 1.57%.

Source: Bloomberg Finance, LP

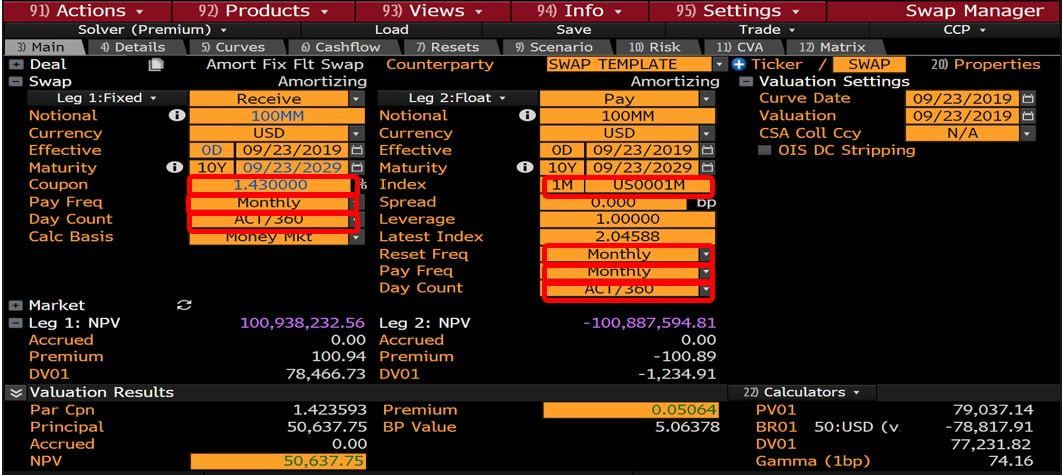

Bank Swaps – Monthly Money Conventions

Here’s the rub – bank loans use monthly money conventions, not semi-bond conventions. Payments on most commercial real estate loans are made monthly using actual/360 daycount conventions and 1 month LIBOR. Additionally, these loans usually have an amortization (sometimes customized). This means there is a discrepancy between the online published rates and the rates you are locking in with your bank.

As you can see here, the rate for a 10×25 swap is 1.43%, a full 14bps lower than the generic 10 year swap rate. On a $100mm swap, that is roughly $1,100,000 in present value. Even on just a $25mm swap, that’s still $275,000.

You may believe that as long as the rate is close to 1.57%, you are getting a fair deal. But as you can see, that would embed an additional 14 basis points today.

Source: Bloomberg Finance, LP