Yield Curve Don’t Lie

Last Week This Morning

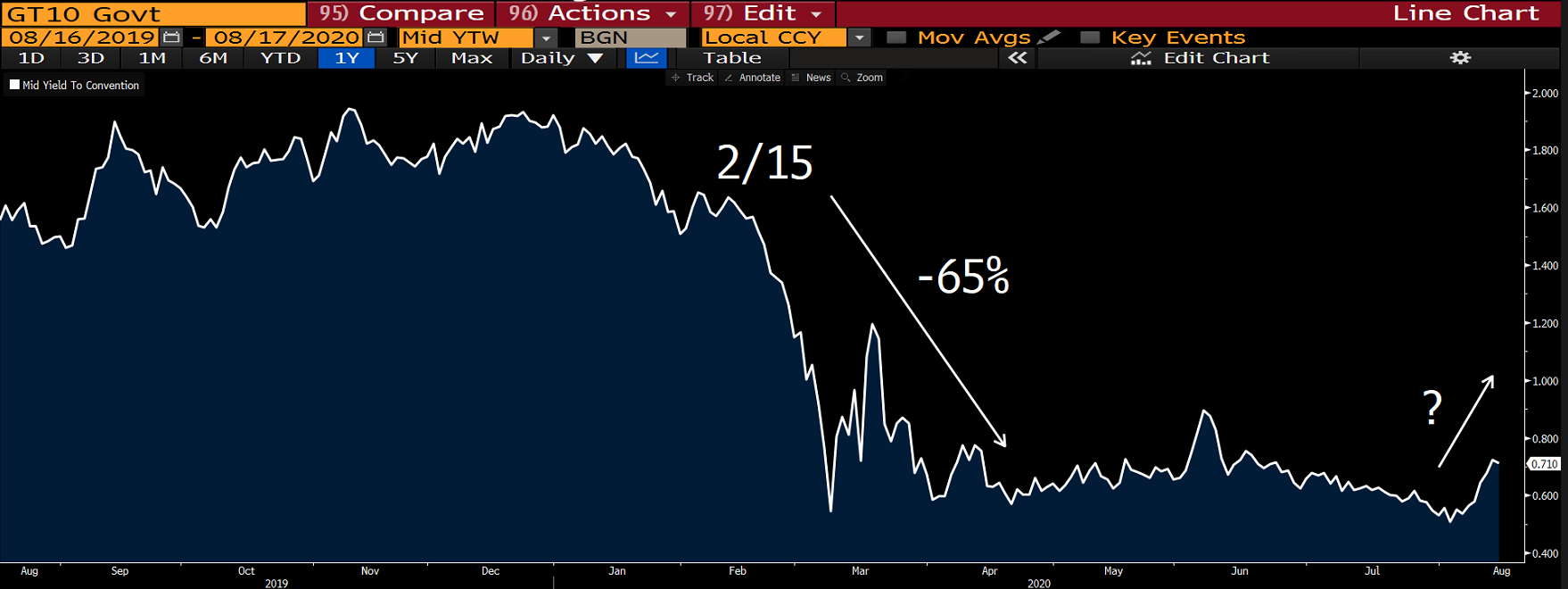

- 10 Year Treasury rebounded all the way to 0.71%

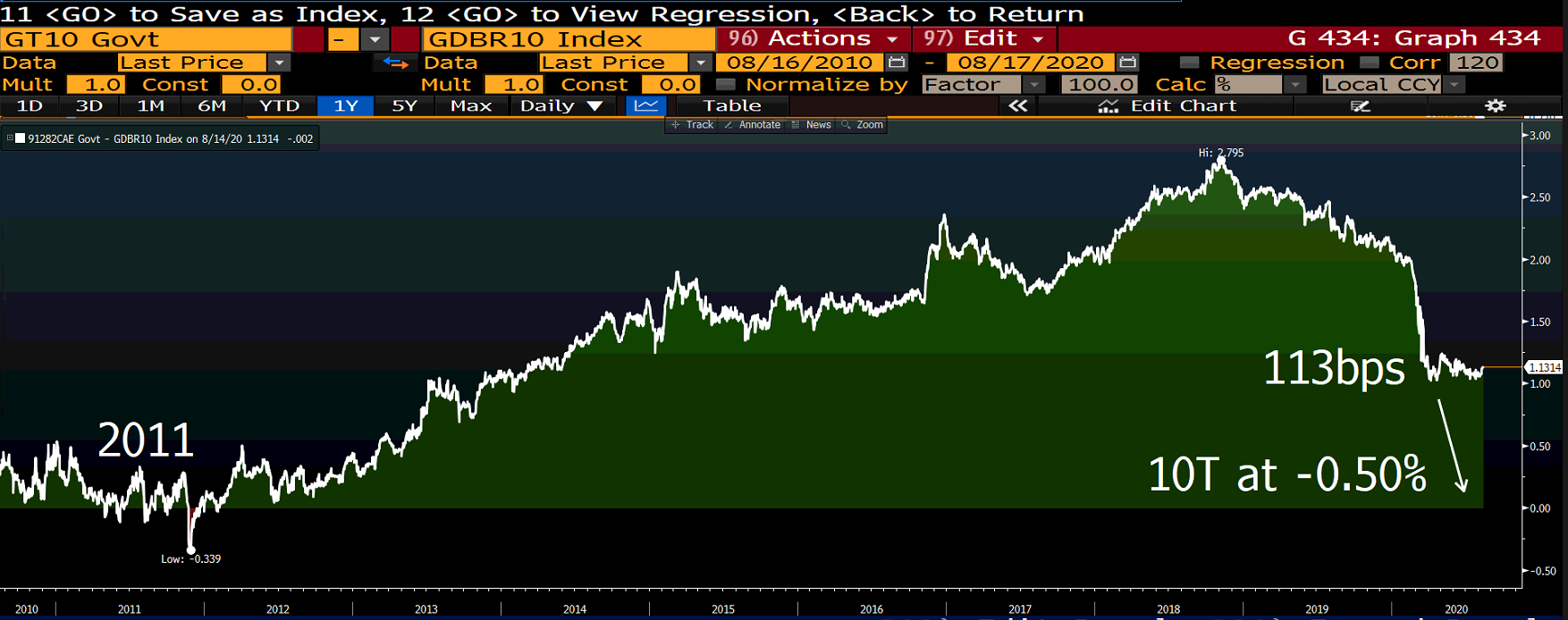

- German bund up 12bps to -0.42%

- 2 Year Treasury at 0.14%

- LIBOR at 0.15%

- SOFR is 0.09%

- Trump signed an Executive Order extending enhanced unemployment benefits of $400/month and a payroll tax holiday and there’s no way McConnell was playing hardball to give Trump the opportunity to swoop in and appear to save the day.

- I had expected a deal no later than August 15th. When will I learn to stop underestimating the ineptitude of Congress?

- Dear Congress – pretty please, with sugar on top, get your stuff together

- Rates jumped primarily on the back of a few reports

- CPI/PPI came in much higher than expected

- Weekly jobless claims were under 1 million for the first time since the initial wave of shutdowns

- Industrial production climbed 3%

- Record sized 10T auction ($38B) had very strong demand at 0.68%

- Q2 productivity jumped more than 7% (vs 1.4% forecasted), which can only mean they failed to survey my kids and their #slothsaretooambitious quarantine goals

- Bank of Japan’s 10bps incentive to banks to lend is working, with Japan seeing record lending levels since April, so go ahead and add that to the potential arsenal of the FOMC

- Russia claims to have a vaccine, so I guess all that pandering to Putin will finally pay off…

Negative Interest Rates

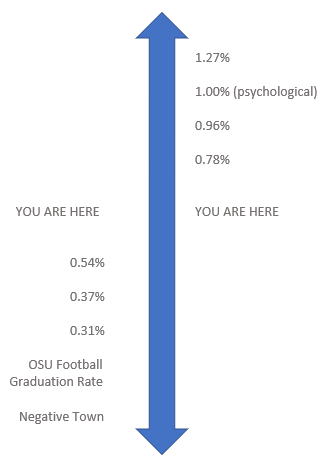

Two weeks ago, I wrote about how real rates would be negative right up until the moment they aren’t. The market puts the 10 Year Treasury at 0.94% in 2-3 years. I concluded with, “But I can’t shake this feeling that the market is underestimating long term rates 2-3 years from now. Not a 5.00% 10 Year Treasury, but 2.0%? Or 3.0%? Just something higher than 0.94%.”

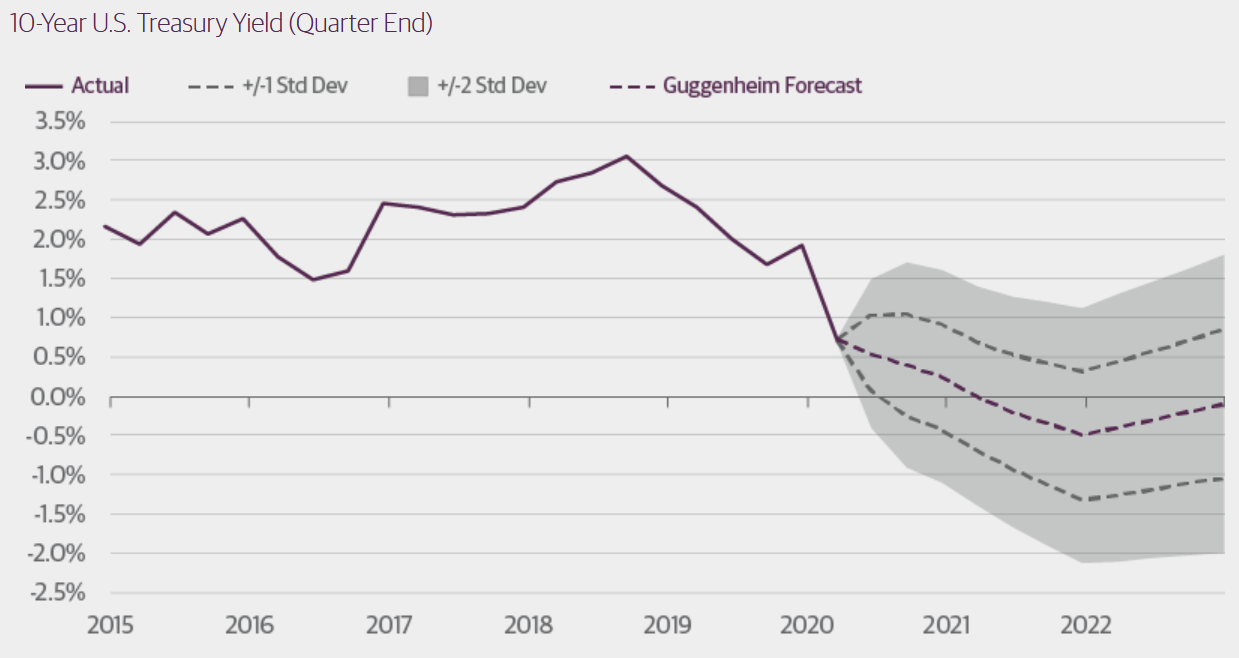

Scott Minerd, CIO of Guggenheim Partners, disagreed this week. “I see the yield on the 10-year Treasury note falling to 25 basis points or lower very soon, with a possibility that it will go negative in the intermediate term—our target is -50 basis points, and in certain circumstances it could go meaningfully lower.” On an interview with Bloomberg television, he suggested some outlier events could lead to a -1.00% or even -2.00% 10 Year Treasury yield.1

I’ve written countless times about the possibility of negative rates here in the US, so I should be happy to finally have some credible support! Then again, it doesn’t take a genius to jump aboard the bond bull train and ride it for 40 years a la Bill Gross.

Instead of celebrating that someone far smarter than me is finally forecasting negative yielding 10 Year Treasury, I find myself skeptical.

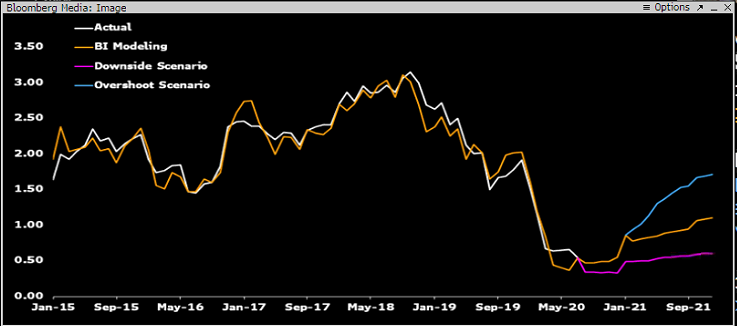

Here’s Bloomberg’s forecast of the 10T, with the downside miss closer to 0.50% than -0.50%.

The spread between the Treasury and the German Bund would have to collapse back to levels not seen since the financial crisis. That, or the bund drives below -1.00%.

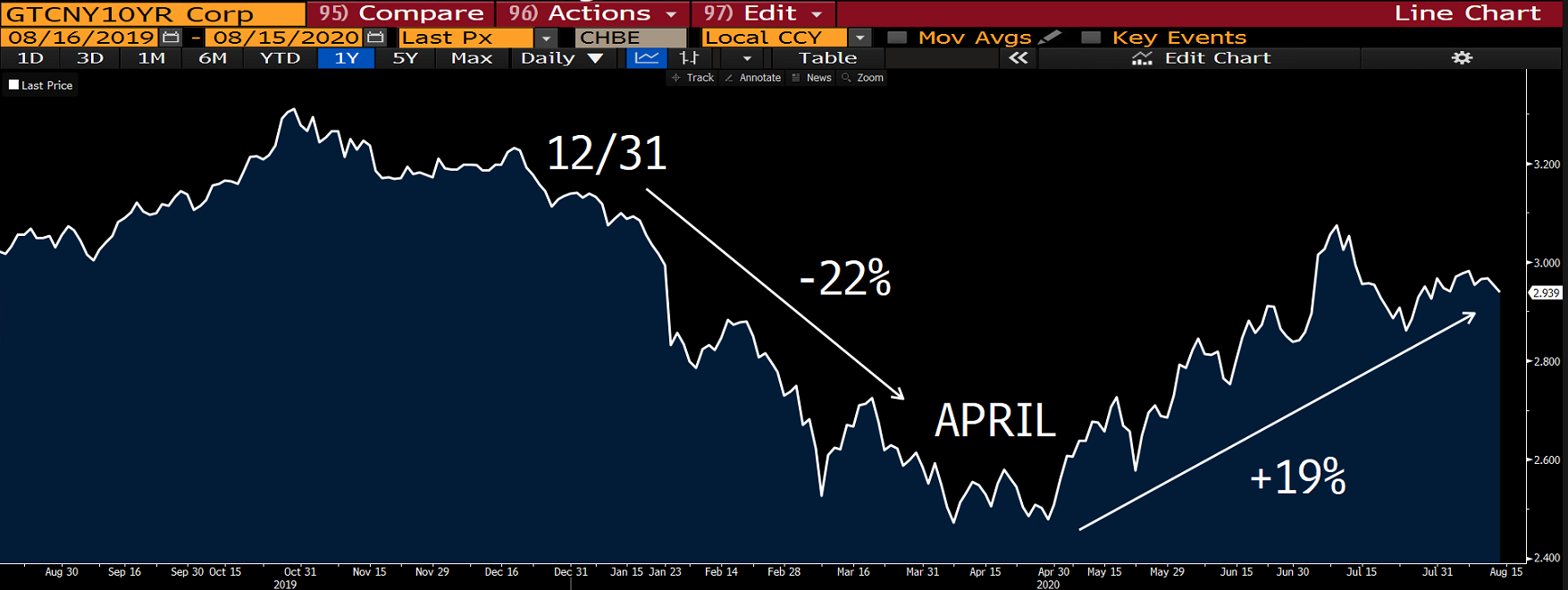

China is likely ahead of us by a few months, and their 10 year bond has rebounded 19%.

Here’s our 10 Year Treasury. Should we expect some type of rebound? Perhaps not coincidentally, a 19% increase off the recent 0.60% bottom would put the 10T right at 0.71%, so maybe we’ve already experienced our 19% correction?

Pandemic. Low growth. Deflation, not inflation. $16T in negative yielding global debt. I get it. A negative yielding 10 Year Treasury can not be ruled out. But again, I just can’t shake the feeling…

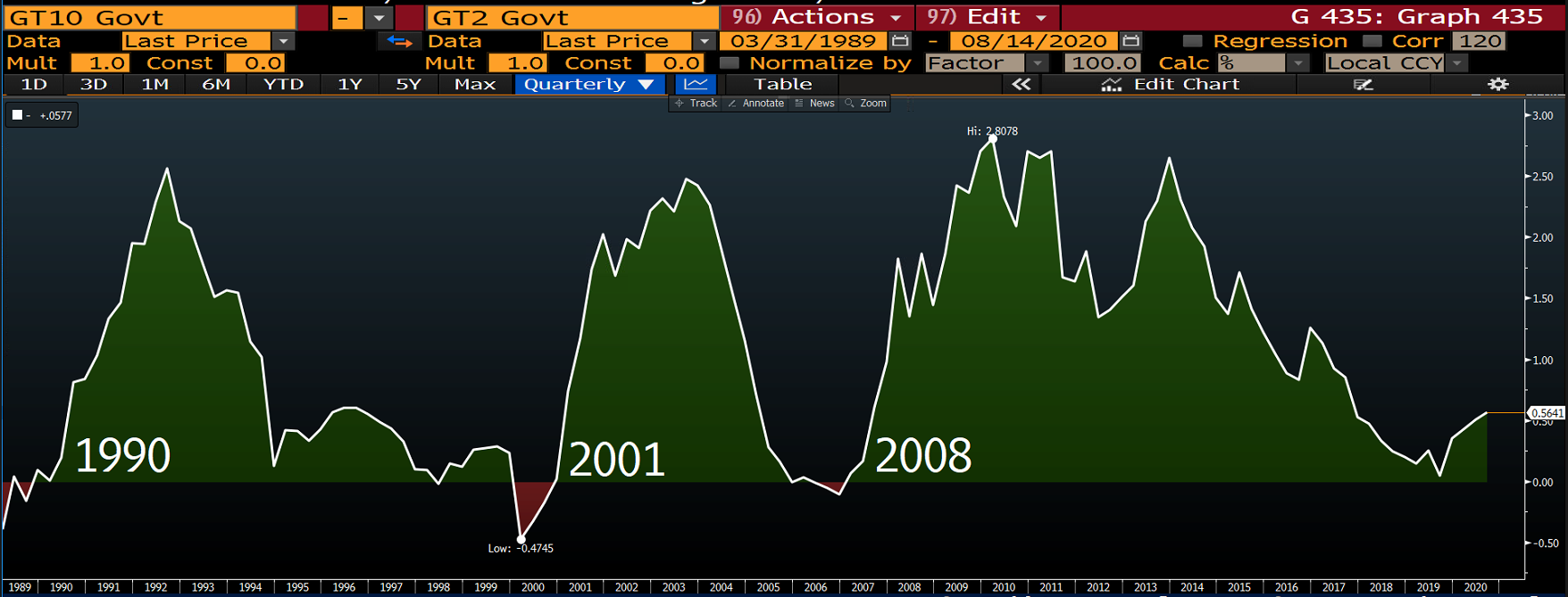

Yield Curve Don’t Lie

In March 2018, we did a study on yield curve inversions. Here’s how that newsletter concluded:

But unlike the stock market, the yield curve doesn’t lie. If it inverts, we’re headed for a recession – it’s probably just two years away.

March 2018.

The biggest reason I don’t think the 10T will go negative, it’s the yield curve. The yield curve inverts before, not after, a recession.

After a recession, the yield curve steepens.

All sorts of arguments can be made about why this time is different. But that suggests to me that the yield curve may not steepen as much as it has in the past, not that it will invert again.

In January 2019 when the 10 year swaps were dropping below LIBOR , we wrote “But before you pull the trigger on a ‘no brainer’ fixed rate, carefully consider the historical track record of locking in during an inversion.”

The newsletter opened with, “Punchline first – an inversion is usually the absolute worst time to lock in a fixed rate.”

The 10T was 2.50% back then. If you remained floating, you’re pretty happy with that decision right about now.

Turns out, the yield curve knows what it is doing.

The Fed is keeping the front end anchored and wants a positively sloped yield curve. A deeply inverted curve would require fighting the Fed for an extended period of time or for it to cut rates into deeply negative territory.

Jay Powell has said time and time again, the FOMC does not plan on taking rates negative. If he sees long term rates plunging and wants to counter it, how hard is it to drop a little nugget about tapering purchases of bonds? Remember in May 2013 when Bernanke said, “If we see continued improvement and we have confidence that that’s going to be sustained then we could in the next few meetings … take a step down in our pace of purchases.” That’s all it took for the 10 Year Treasury to spike more than a point in six weeks.

The fiscal deficit is likely to hit $4.5T and $3.5T next year. That will be funded through increased Treasury issuance. Even after accounting for the massive monthly QE, the market has to absorb a net $1T in 10 year bonds this year. An economic rebound coupled with Treasury oversupply and a vaccine at some point feels like a recipe for at least some upward pressure on yields.

Key technical levels

As this week’s Treasury auction reminded us, the US is still the world’s mattress. I’m not proposing the 10T is about to spike to 2.00%, just that it is unlikely to go negative.

Some ways Minerd could be proven right and I could be wrong:

- For the first time ever, the yield curve inverts after a recession (tough to ignore this possibility with all of the spam email I receive that begins with “in these unprecedented times…”)

- There’s another recession looming and an inversion would imply a second wave of economic contraction.

- The yield curve doesn’t invert because the 2 Year Treasury front runs the 10 Year Treasury, with the 2T running down to something lower than -0.50%

- Because the 2T is controlled by Fed policy, this would imply the market believes the FOMC is going to cut FF to at least -0.50%

- Powell’s term expires February 2022. We should not become overly reliant on Fed-guidance through that window because he could be replaced.

- Global yields, like the bund, drive lower and drag the 10 Year Treasury with them

- Deflation becomes a real issue

Week Ahead

Good luck to all kids out there who will get to see a new side of their parents during home schooling.

Sources