Why a Trade Dispute Resolution Won’t Drive Rates Up

Last Week This Morning

- 10 Year Treasury tested 2.00% before rebounding and closing out at 2.08%

- German bund at an all-time low again, down to -0.26%

- Japan 10yr at -0.13%

- 2 Year Treasury closed at 1.85%, but got as low as 1.77%

- LIBOR at 2.41% and SOFR at 2.40%

- Market now has just a 16% probability that the Fed hasn’t cut rates by July 31

- Market has a 56% probability of three cuts by year end

- Economy added just 75k jobs last month

- The unemployment rate held steady at 3.6%

- Average hourly earnings (inflation) also missed forecast by coming in at 3.1%

- Tariffs with Mexico are gone just as fast as they came after that country agreed to post national guard troops along the border…and after Congressional Republicans convinced Trump they wouldn’t support it

- I learned that the moon is a part of Mars

Jobs – Is Bad News Good News Again?

The economy added just 75k jobs last month vs the forecasted 175k. March and April were revised lower by a combined 75k. The monthly average so far in 2019 is 164k, vs 223k per month in 2018.

Just 3,000 manufacturing jobs were added, suggesting trade war fears are directly impacting hiring plans and likely investment.

The unemployment rate remained at a 50-year low, 3.6%, while the U-6 unemployment rate (the “real” unemployment rate) fell from 7.3% to 7.1%, the lowest since 2000.

Firms are not yet laying off employees, but have likely slowed hiring plans.

Stocks moved up 1% on the disappointing report, since the Fed has to cut rates, right? It appears bad news is good news again as the market hopes weak data forces the Fed to act.

FOMC Policy Shift?

Will the Fed cut rates at the June 19th meeting? Probably not.

One of the arguments for a rate cut next week is that the Fed prefers to make policy changes at the SEP meetings. Every other meeting, the Fed updates its Summary of Economic Projections (SEP), aka Blue Dots. Additionally, these meetings come with press conferences after the release. During the tightening cycle, the Fed only hiked at these meetings, considered the “on” meetings.

Since June is an “on” meeting, it’s reasonable to wonder if the Fed is deciding between a change at the June meeting or waiting until the September meeting (skipping the “off” July meeting). Do they move in June – potentially too early? Or try to wait until September – potentially too late?

But starting this year, Powell now has a press conference after every meeting. This means they could cut rates at an “off” meeting and still have a regularly scheduled press conference to massage the message.

Additionally, while rate hikes are typically slow and steady (25bps every meeting, every other meeting, etc), rate cuts don’t adhere to the same polite decorum. Rate cuts are slash and burn. Cutting 75bps at a time is not unusual. Cutting rates in between meetings is not unusual. For example,

- In 2001, the Fed cut rates more than 4% in twelve months.

- In 2007 and 2008, the Fed cut rates more than 5% in 18 months.

We should not assume rate cuts will only come at every other meeting the way that rates hikes did over the last three years. Or that cuts can only be 25bps. The Fed’s goal may be methodical cuts (25bps in July, 25bps in Sept, 25bps in Dec), but they could also just simply cut 50bps in July and then pause to measure the effect.

For those reasons, I don’t think Powell is constrained to deciding between June or September. He can move in July if conditions continue to deteriorate.

And one disappointing job number is not enough to force the Fed’s hand next week. And Powell may want to signal to the president that he will not bail him every time he spooks markets with tariff tweets. And what if Trump announces a surprise resolution with China? Maybe Powell is nervous that 3.6% unemployment might still translate into inflation at some point, so why pour gasoline on a smoldering fire? And what if I keep starting all rhetorical questions with a grammatically incorrect “and”?

Instead, I think the Fed will likely strongly signal a willingness to cut rates if conditions warrant. And behind closed doors, there will be talk about making that move in July if data and market sentiment deteriorates.

Treasury Yields

What does this mean for long-term fixed rates?

Not only will yields struggle mightily to climb again, it might require a Fed rate cut to push 10 year rates higher.

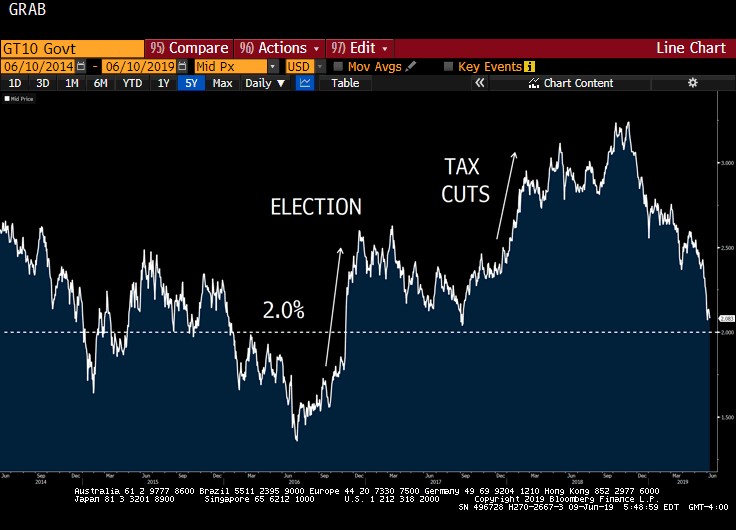

Below is a graph of the 10 Year Treasury over the last five years. Firstly, note how significant the 2.0% threshold is – rates will not simply drift lower to 1.75%. We will need a catalyst.

Secondly, over the last five years there have been two distinct spikes in yields. The first was the election, and the second was the tax cuts.

What do both of those spikes in rates have in common?

Inflation.

Or rather, the expectation of inflation.

When Trump was elected, yields spiked on the expectation that would take off. Tax cuts, stimulus package, less regulation leading to stronger growth, tariffs, etc.

When rates fell in the spring of 2017, it was the result of the failed attempt to repeal Obamacare. The thinking went that if Trump couldn’t repeal Obamacare with a unified Congress, the other, economically more important, policies would fail as well. If those failed, inflation wouldn’t run up as much as the market had priced in, and so we had a correction.

This year, the fading impact of the tax cuts and a self-inflicted wound from a trade dispute with China have help dragged down yields again. But while the simple “flight to safety” explanation helps explain the magnitude and speed of the recent drop in rates, it overlooks a fundamental change in inflation expectations since the start of the year.

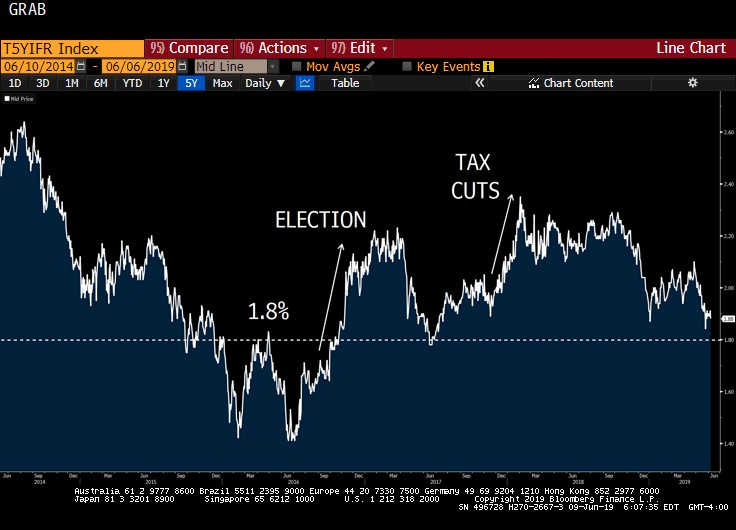

Take a look at the Fed’s own 5 Year Forward, 5 Year Inflation Expectations. Quite a mouthful, but it’s targeting inflation expectations in the future. Looks an awful lot like the previous graph of the 10 Year Treasury yield, doesn’t it?

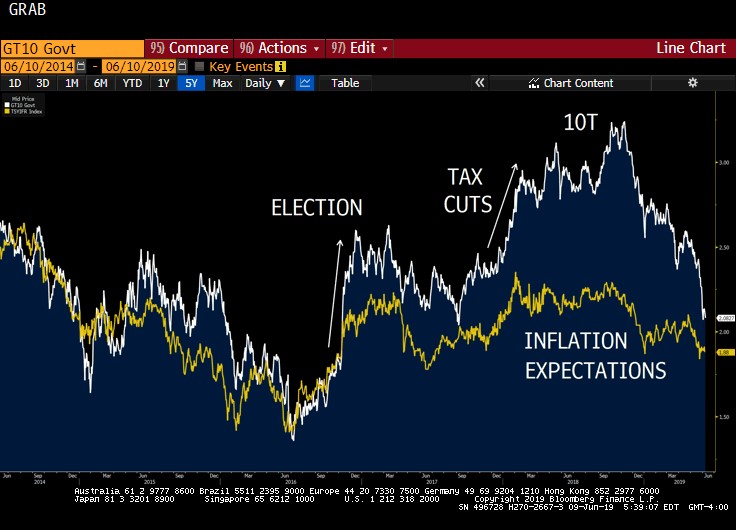

And from the Department of Beating a Dead Horse, let’s take a look at them together. Correlation much?

We argued a few months ago that the flattening yield curve was the result of the lack of inflation, not recessionary fears. At that time, the 2 Year Treasury was 2.50% and the 10 Year Treasury was at 2.60%. The conclusion was that the despite a yield curve steepness of just 0.10%, the market wasn’t really signaling a recession, it was signaling its inflation expectations of basically 0%.

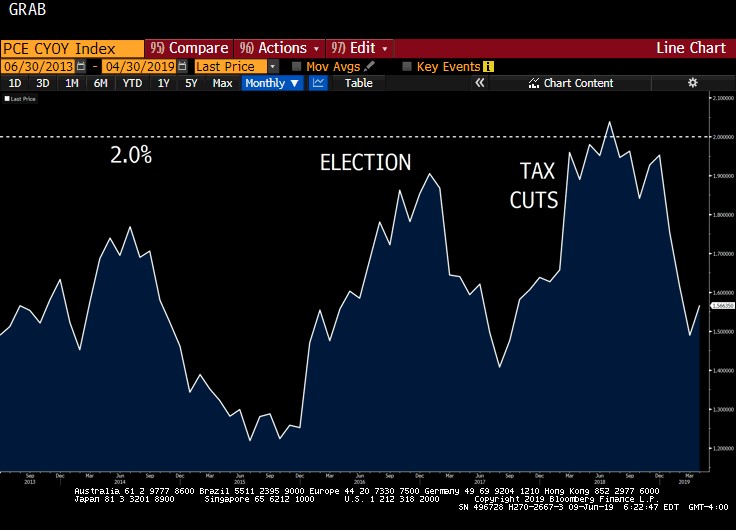

Here’s a graph of Core PCE, the Fed’s preferred measure of inflation. Note the two spikes at the election and the tax cuts, as well as the recent plunge to its current level of 1.6% (well below the Fed’s stated goal of 2.0%).

Now let’s revisit the flight to safety argument. If Trump tweets out a resolution to the trade war dispute, will 10 Year Treasury yields suddenly spike to 2.75%? Or even 2.50%?

I don’t think so.

Because even without that dark cloud hanging over the market’s head, lack of inflation is dragging down yields. We need a trade war resolution and more inflation for the 10T to move materially higher.

There will of course be repositioning risk-on trades with a resolution, but until the market starts to foresee inflation on the horizon, it will be challenging for the 10T to climb materially.

Alternatively, couple falling inflation with trade war fears and the 2.0% threshold is in play.

But even if the 2.0% resistance level isn’t breached, it’s tough to envision a scenario where the 10 Year Treasury Yield spikes without inflation or inflation expectations moving higher.

And that’s where the Fed comes in.

Federal Reserve Dual Mandate

The Fed has two mandates – price stability (2.0% inflation) and maximizing employment. A more cynical observer would argue it has a third mandate, propping up stock prices, but long-time readers know I’m not the least bit cynical…

Core PCE is currently 1.6%. Since the financial crisis, it has been above 2.0% for exactly one four months. At some point, Powell will have to acknowledge that inflation is not returning to 2.0% any time soon and the Fed will cut interest rates.

One of the best ways to spur inflation or at least expectations of inflation? Cut interest rates.

And if the Fed cuts rates to spur inflation, rather than to bail out the economy from a recession, the market could respond positively and the 10T start climbing again.

Bottom line – We need rising inflation expectations for the 10 Year Treasury to climb materially. Fed rate cuts could give the 10 Year Treasury cover fire to move higher by spurring inflation expectations. But lagging inflation will keep a lid on yields even if there’s a resolution with China.

How to Hedge Prepayment Penalties

Prepayment penalties, defeasance, yield mx, make whole, swap breakages, etc have gotten ugly over the last month, forcing a lot of deals to reprice, transition to assumptions, or just fall through.

There is a way to hedge against falling rates – swaptions.

Generally, swaptions are used to hedge against rising rates between now and when you expect to price. For example, you’re locking in a CMBS deal in 45 days but are worried rates will move up between now and then. The 10 year semi-bond rate is 2.10%, and you don’t want anything above 2.25%. Buy an option on 10 year swap rates that hedges for any rate movements above 2.25%. A swaption.

But swaptions can also hedge against falling rates to protect against the prepayment penalty from spiking.

For example, you have 3 years remaining on your loan and have an agreement to sell the property. If the 3 year swap rate today is 1.85% and it falls to 1.50% before closing, your prepayment penalty will spike.

You can buy a swaption against falling 3 year swap rates to help mitigate this risk.

Let’s assume you have a $25mm loan. For each basis point drop in 3 year rates, your prepayment penalty increases by approximately $7,500. Over the last month, 3 year rates have fallen by 0.40%, so your prepayment penalty has increased by $300,000.

You buy a swaption today that will hedge against any further drop in 3 year swap rates between now and August 1 (your projected closing). You pay an upfront $110,000 for this option.

On August 1, here’s what the settlement looks like.

- If 3 year swap rates are above 1.85%, the option expires worthless and you are just out the $110k you paid upfront

- If 3 year swap rates are below 1.85%, the hedge provider pays you the pv difference

In both scenarios, what you pay on the actual prepayment penalty fluctuates with the market movements. But if rates fall, you receive an offsetting payment from the hedge provider, helping to wash out that decline in rates.

The upfront cost is driven by the strike (the lower the strike, the cheaper it costs) as well as the tenor (the shorter the remaining term on your loan, the cheaper the cost).

This is obviously a very simplistic explanation and we would need to spend more time to walk through the risks and considerations, but that is the basic gist. And while swaptions hedge swap rates, they also are highly effective (but not perfect) hedge against Treasury yields, so they work well with defeasance and yield mx as well.

Here’s our white paper on the topic if you want to dig in further. https://www.pensford.com/resources/swaptions-101/

I suspect the recent drop in rates has put a lot of deals on hold already, so protecting against a further decline from here may not make sense. But…if rates were suddenly reverse and spike 25bps in a few weeks, it could make sense to hedge at that time to protect against a quick correction thereafter.

Or if you have a deal pricing in the coming months but can’t lock yet, you could use a swaption in the more traditional way of hedging against rising rates.

This Week

G20 meeting in Japan will be focused on trade disputes, so there is headline risk there. We also get CPI and PPI, so markets could swing based on inflationary data.