What a Biden Win Means for Rates

Pennsylvania really took its sweet time counting those votes, didn’t it? Pittsburgh actually took the day off from counting votes on Thursday! My wife said PA is trying to have its Lizzo moment, whatever that means.

Trump is going to lose the popular vote by something like 7mm votes. How does that happen? If he was any other Republican president, he’s on cruise control this year, right? I think McCain/Romney/Kasich/Bush/Rubio are totally let off the hook for COVID’s impact on the economy as long as they didn’t shoot themselves in the foot repeatedly…which Trump did…repeatedly.

- If you consider Trump a Republican, GOP candidates have lost 7 out of the last 8 presidential popular votes.

- A 7mm vote difference is a big loss, regardless of the electoral college outcome…and no there wasn’t some huge conspiracy to rig the election. He lost.

- I can’t think of a more flawed individual leader in recent history, but Trump nearly won the election.

- I don’t think Dems can wrap their brains around that. I hate the cop-out, “I vote the policy, not the person,” but I don’t think Dems appreciate the spirit behind that statement as it relates to Trump. Can Biden prove Dems aren’t trying to turn the country socialist? Was this more a repudiation of Trump than conservatism? Do Dems understand the difference?

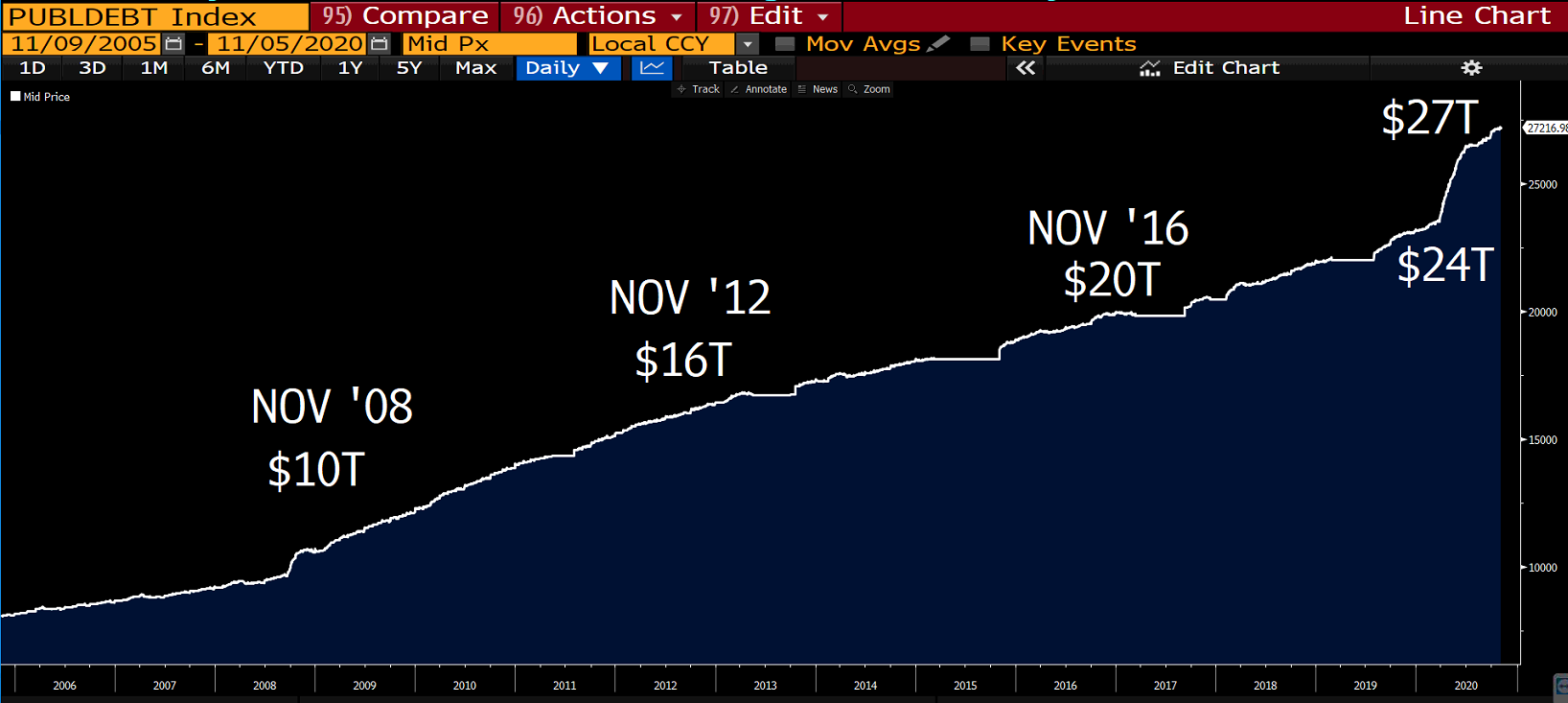

If you’re unsure whether Republicans believe Trump’s legal challenges and calls for recount will prevail, look no further than the esteemed Senator from South Carolina, who said, “If we keep the Senate—which I think we will—and I become Budget chairman, I’d like to create a dialogue about how can we finally begin to address the debt.”

Really, Senator Graham? Now you want to create a dialogue? The Federal government has added more to the debt in the last four years than it did the four years before that. To be fair, COVID has skewed those numbers this year, and I am fully onboard with stimulus during a sharp downturn. But even taking pre-COVID and extrapolating through year end, the US debt burden grew proportionately by the same amount during Trump’s term as it did during Obama’s last term. Federal debt isn’t just a Democrat thing.

Obviously, Graham is not alone in his hypocrisy – every politician is like this. He just happened to make a comment on Friday that appropriately represents the challenges ahead. But I do think we need to be careful about assuming Democrats are going to be the ruin of fiscal responsibility, just like I cautioned Trump wouldn’t be the end of democracy.

Emotions run high during elections, but let’s maintain some perspective. Time to get back to work.

Last Week This Morning

- 10 Year Treasury at 0.82%

- German bund down to -0.64%

- 2 Year Treasury closed at 0.15%

- LIBOR at 0.13%

- SOFR is 0.11%

- The Fed kept rates unchanged (yeah, there was an FOMC meeting last week!)

- NFP + 638k vs forecasted 580k

- UR 6.9% vs 7.6% (underemployment rate 12.1%)

- Durable Goods came in exactly as expected

- ISM Manufacturing came in better than expected

- I assume TrumpTV to be on channel 45?

Labor Market

The economy added 638k jobs last month and the unemployment rate dropped to 6.9%. The participation rate actually ticked up by 0.3%, meaning the gains didn’t come from people dropping out of the count. Plus, 147k census workers offset the gains.

It’s not all rosy, unfortunately. The number of unemployed for six months or longer grew from 2mm to 3.4mm. Plus, the rate at which we are adding jobs is slowing and we’re still down a net 10mm since the start of the year.

It’s still a good sign that things are moving in the right direction. Hopefully Biden is taking notes about how badly the US job market wants to recover. Top gains…

Leisure and hospitality 271k

Food service 191k

Retail 104k

At the current rate, the labor market would return to pre-COVID levels in early to mid-2022. We have a long way to go and a lot will be dependent on the federal response. But the strength of this report has likely emboldened fiscal conservatives like Lindsay Graham that have conveniently suddenly decided they need to monitor government spending again.

In fact, regarding the report, McConnell said on Friday, “that clearly ought to affect the size of any additional stimulus package we do.” So yep, $2T is off the table and Pelosi might be wishing she had taken a deal.

FOMC

The FOMC meeting was about as boring as possible, which is exactly what we needed. Powell did once again call for a fiscal response, but one complicating factor could be the GA Senate runoff on January 5th. Pelosi may stall talks with McConnell on the hopes that Dems actually can take control of the Senate.

Powell also referenced the fiscal response post-financial crisis, noting, “Fiscal policy was pretty tight.” That’s basically FOMC Chair trash talk, even if it’s tough to interpret it. And he’s right. The Fed had never bailed out the economy all by itself before, and then Congress realized it was way easier to let it be someone else’s problem.

Powell is concerned about the Fed being bullied by Congressional inaction into more accommodation and these statements are meant to shame Congress into passing stimulus.

The only other real takeaway is that the Fed signaled some shifts to QE purchases, likely to be more formally announced at the December meeting. Big picture – they will move out the curve and push duration from 6 years to about 8 years. Liquidity has been great, so I don’t expect a change to the amount of purchases.

Election

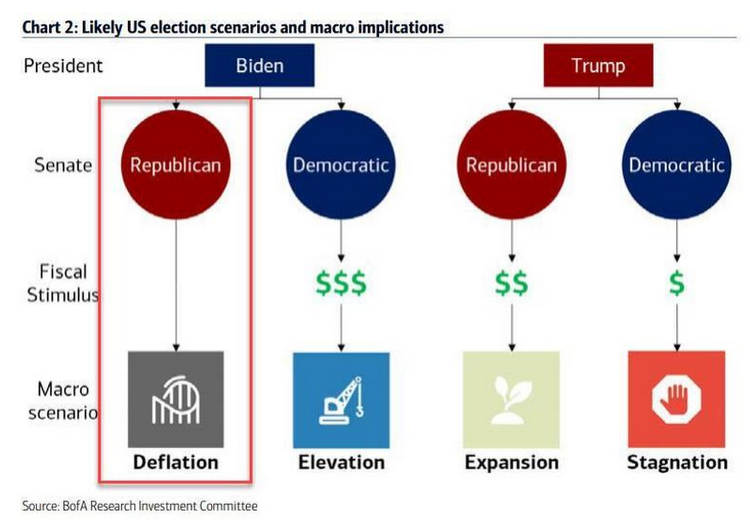

Wait, Republicans and Democrats might have to play nice?! Here’s a chart from BofA’s research team that suggests last week’s outcome was the only scenario that resulted in deflation. This is why Powell is urging Congress to do something.

Is it too early to talk about 2022? Of course it is, but since when has that stopped me?

Jay Powell’s term ends February 2022. Biden will have an opportunity to replace Powell. I have no idea if he will, but my gut right now is no. Even if he does, how much more dovish could a replacement be?

The cards were always stacked against the Democrats to take control of the Senate this year because there were just so few vulnerable Republicans up for election. But in 2022, there will be 21 GOP Senators and just 13 Democratic Senators up for re-election (depending on how January 5th plays out in GA). Of those, about 6 GOP seats are considered vulnerable today, compared to just 3 vulnerable Dems.

McConnell knows this and it will factor heavily into every decision he makes over the next two years. Just as we saw after the financial crisis, there is some chance that gridlock leads to ho-hum growth.

A blue wave would have resulted in a $3T stimulus package. GDP would have been higher over the near term, but at a cost McConnell was unwilling to accept. Additionally, Dems would have pursued higher corporate taxes and a sharp increase to the federal minimum wage.

The split government means Biden will rule by executive order, which can directly impact things like tariffs and regulations. Stocks will be happy to have McConnell run interference on things like taxes. And with the Fed accommodation machine running full-tilt, stocks will probably be just fine (if not gangbusters).

The economy, however, is a different story. Heading into the midterm elections two years ago, we highlighted the following data1 from a Forbes article that addressed economic growth under various political outcomes.

Democratic President and Democratic Congress 4.3%

Democratic President and Republican Congress 3.7%

Republican President and Republican Congress 2.7%

Republican President and Democratic Congress 2.5%

Any President and a Divided Congress 2.4%

Barring a shocker in GA in early January, the stage is set for a flat economic trajectory. Like Trump, Biden will divide the blame between COVID and Congressional gridlock.

Rates

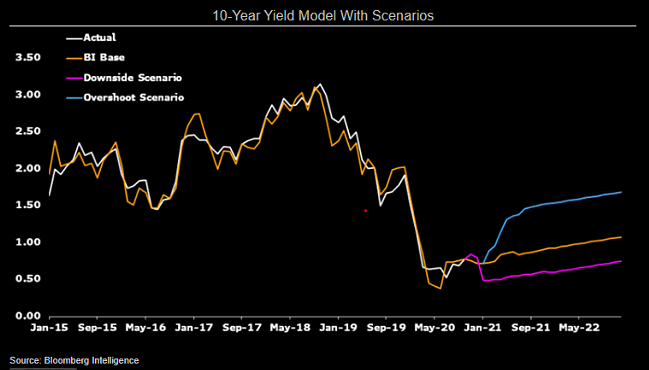

Bloomberg models suggest the 10T is appropriately priced right now. Over the next year:

- High side 150%

- Base case 90%

- Low side 60%

Absent positive news on the stimulus front or a vaccine, it just seems unlikely that the 10T will continue climbing significantly. If anything, I would expect a reversal over the near term. Trump’s legal challenges will drag on, we’re stuck in a lame duck limbo period, COVID cases are setting daily records, etc.

As we noted in our last newsletter, the high side outcome is far more likely the result of surprise Treasury supply, not surprise GDP.

I’ll say it again: big 10T swings next year are more likely to be the result of Treasury supply, not an economic recovery. If you’re pricing a deal in Q1 and are losing sleep on the recent run up, keep an eye on stimulus negotiations, not GDP or job reports.

That also means you have to keep an eye on the GA Senate elections on January 5th because if the Dems win both seats, the blue wave scenario is back on the table.

Week Ahead

Markets will be closed on Wednesday for Veteran’s Day and then a concession speech at some point…jk.

Lots of inflation data, but it will take a backseat to election news.

Sources

- https://www.pensford.com/midterms-a-love-letter-to-texas/