The Fed Pause Could Be Around the Corner

In line with market expectations, the FOMC decided to hike rates 25bps, bringing the target range for Fed Funds to 4.50%-4.75% and decelerating their pace of tightening for the second straight meeting.

Their written press release remained largely unchanged from the previous meeting with the notable exception of one point: “Inflation has eased somewhat but remains elevated,” acknowledging easing inflationary pressures for the first time in their official statement this tightening cycle.

Is the Pause Just Around the Corner?

In the post-meeting press conference, Powell acknowledged that we’re finally starting to see the disinflation process begin but was careful to warn that we’re still in the early stages of getting back to sustained 2% inflation.

“The full effects of our rapid tightening have yet to be felt,“ Powell remarked, but “ongoing increases in the Federal Funds rate will be appropriate” and they’d “need substantially more evidence to be confident that inflation is on a sustained downward path”

The biggest questions this meeting were around the timing of the last rate hike, to which Powell was careful to avoid alluding to occurring next meeting. Instead, he suggested that “shifting to a slower pace will allow the committee to better assess future increases.”

Remember that inflation expectations and where the market thinks the Fed will take rates can be just as influential as actual changes to Fed policy. So, even though Powell acknowledges that we’ve already started the disinflation process and that there’s a significant lag between policy changes and their impact, he’s going to keep banging the hawkish drum to avoid spurring an already overeager market.

Even if Fed policy is already sufficiently restrictive to reign in inflation once the effects are fully felt, the Fed is going to avoid a scenario where they undershoot rate hikes. They’d rather over-hike and deal with the repercussions than have to go back in 6 months from now and start hiking again in an even weaker economy.

Labor Market

Powell commented that the US economy showed signs of slowing last year with reductions in GDP growth and consumer spending, a cooling real estate market, and interest rate increases heavily weighing on business investment. Despite these signs, he made certain to note that they’re still waiting to see signs of a slowing labor market as one of the indicators that their job is done.

But why do we keep looking to the labor market to guide Fed policy?

If you’ve read some of our recent articles, you’re probably already aware that job market resiliency doesn’t usually dictate Fed policy.

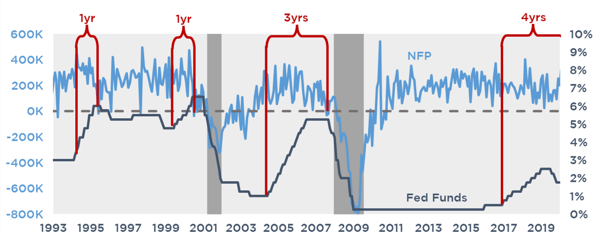

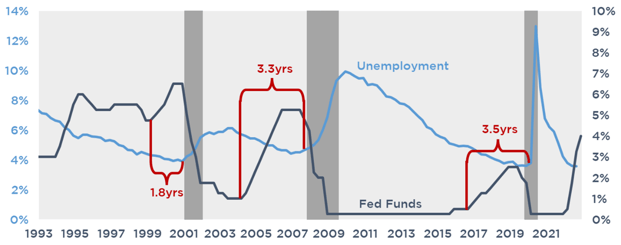

For example, nonfarm payrolls doesn’t normally turn negative until after the last hike and an average of 2 years after the start of the cycle.

And the same is true for unemployment, but with an even greater delay between the last hike and any significant increase, averaging 3 years from the start of the cycle.

Market Reaction

In response to the press conference, yields slid across the curve, interpreting the comments as less hawkish.

.png?width=796&height=137&name=image%20(1).png)

Expectations for future rate hikes remain unchanged, with one more hike in March followed by a pause until September, when the market has the first cut priced in.

.png?width=573&height=273&name=image%20(2).png)

However, the Fed’s most recent projections and Powell’s comments this meeting suggest that we may see more than one additional hike this year. Powell also warned that divergence between Fed projections and market forecasts are likely being driven by markets expecting inflation to cool substantially faster than their estimates, stating that “based on our outlook, I don’t see us cutting rates this year.”

Powell will likely avoid any statements to the contrary until they actually stop hiking.

Takeaways

Floating rates will shift towards 4.75%.

We could be quickly approaching the last hike this tightening cycle but, even if that’s the case, the Fed will avoid alluding to a pause to keep inflation expectations suppressed.

If you’re waiting on signs of a weakening labor market to signal the pause in rate hikes, you might not see those signs until after the Fed has already cut.