The 2020 Rate Cut

Last Week This Morning

- The 10T grinded lower to 2.83% on the back of Trump’s “How to Win Friends and Influence People” European tour

- German bund finally pushed higher, closing at 0.34%

- 2 year Treasury closed Friday at 2.58%

- Yield curve steepness is now just 0.25%

- It’s just…whatever

- LIBOR at 2.07%

- SOFR at 1.90%

- Politico reported articles of impeachment have been drawn up against Rod Rosenstein

- Fed’s balance sheet normalization process, initiated in November, has been gradually ratcheting up and has reached the planned plateau of $50B/month.

- Global debt set a new high, hitting $247T

- Global debt to GDP climbed to 318%, the first increase in two years

ECB Check In

If you believe the German bund and the 10 year Treasury are highly correlated, than ECB monetary policies should be top of mind. It’s been a while since we checked in to see where things stand.

Big picture – the Eurozone, and the ECB, are 24-ish months behind the US in the recovery process. It also seems to have more tail risk events than in the US (Greece, Italy, Brexit, tariff tit for tat with much stronger US, etc) which could derail the recovery and slow the process by which the ECB removes accommodation.

Currently, the ECB is still buying bonds each month as part of its QE programme (see how I spelled it differently? I’m so worldly). Draghi & Co have made it clear that tapering should conclude by December 31st, although that hasn’t been formally announced.

Similar language suggests the ECB plans to begin hiking Q3 or Q4 of next year. Assuming the ECB doesn’t have a similar false start hike like we did in December 2015, this strongly suggests 2019 will be a big year for the removal of accommodation by the ECB.

It’s also important to remember that market expectations will move well in advance of the actual change in monetary policy. As the ECB sends signals, markets will start pricing those future changes into rates.

Summer 2016 in the US, markets became convinced the Fed was set to embark on a true tightening cycle by year end. The 10 year Treasury spiked 1.20% in the six months leading up to the December 2016 hike, nearly doubling.

In the following 18 months, the T10 climbed just 0.50% despite the Fed actually hiking almost 2.00%.

In those six months leading up to the hike, there’s a lot of jostling as the market tries to guess at the various potential outcomes.

If the ECB is set to hike in Q3 of 2019, that means the first half of 2019 could be a volatile one for the German bund as markets start jockeying for position.

If the bund climbs dramatically in anticipation of an ECB tightening cycle, it could give our 10 year Treasury all the cover fire it needs to move higher.

Treasury Yields

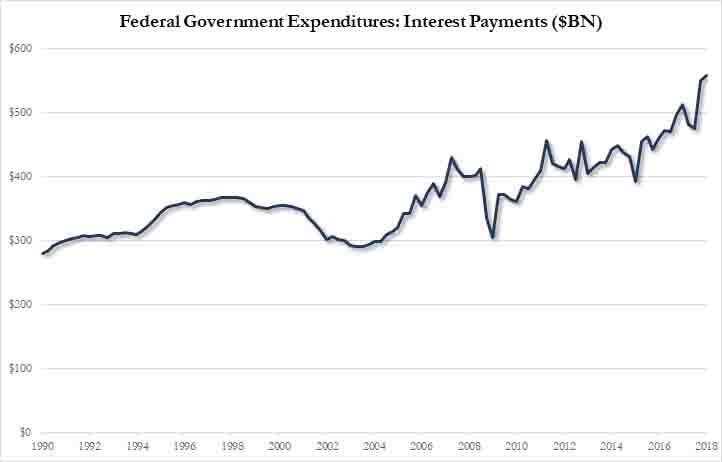

Federal government interest expense is on the rise, and not only because rates are higher. Inflation is up, which drives up the interest on inflation-linked securities. Compared to this time last year, interest paid on these securities is up nearly 55%. And of course, the total amount of debt continues to set all-time highs.

Economists are revising budget deficits forecasts higher and the CBO is already projecting a trillion dollar deficit by the start of 2020. Goldman released a report last week suggesting the federal financing gap will exceed $300B next year and could reach as high as $750B by 2021.

In order to fund this gap, the Treasury has to issue more bonds. That’s why Treasury issuance is breaking records each month and total US debt is projected to hit $30T in the next decade.

So what’s the impact on long term yields? Goldman concluded that deficit pressures should apply about 0.25% of upward pressure on the T10 yield.

Couple this with balance sheet normalization, which most economists believe should apply about 0.40% of upward pressure, and it’s pretty easy to envision a scenario where the T10 is above 3.25%.

Near term, tariff fears should help keep a lid on yields. The next key lower thresholds are 2.75% and 2.62%. This may be a good window to lock in long term fixed rates.

Longer term, there are a lot of compounding pressures that should push yields higher…especially if the Fed softens its stance on taking Fed Funds to 3.25%. Segue alert…

Fed Funds – The 2020 Rate Cut

Last month, we suggested the Fed tightening cycle was closer to the end than to the beginning. Just last week we said the Fed would struggle to hike beyond the new commonly accepted neutral rate of 2.50%-2.75%.

Of course, the looming yield curve inversion should be one of the biggest constraints…but the Fed seems hellbent on ignoring those signals. The market, however, is not.

In an article last week, Bloomberg pointed out that the spread between Dec ’19 and Dec ’20 eurodollar contracts fell below zero for the first time, suggesting markets don’t expect the Fed to hike after 2019.

In fact, the odds of a cut in 2020 are higher than the odds of a hike.

In fact 2.0, futures imply just a 12% probability of Fed Funds exceeding 3.00% in 2020.

If the tax cuts/spending bills pulled economic growth forward and a yield curve inversion is followed by a recession 790 days later (https://www.pensford.com/inverted-yield-curve-analysis/), it’s not a coincidence the market is projecting a dip in 2020 LIBOR rates.

2020 LIBOR Futures

January 2.85%

April 2.80%

July 2.76%

December 2.80%

This Week

Trump: “Did you interfere with our elections?”

Putin: “Donny, I’m offended you would even suggest that. You won that election fair and square with a clear mandate. You are the man!”

Trump to press: “I asked him and he said no, so there you have it. No one is a better judge of character than me. If he was lying, I would know it. He’s an honorable man. He said he didn’t interfere and I believe him.”