SOFR, Jurassic Park, and Fannie/Freddie Ending LIBOR Loans

Fixed rate borrowers can take this week off because we are focusing on LIBOR/SOFR today. Talk to you next week.

I started getting calls from brokers at NMHC a few weeks ago about Fannie/Freddie strongly suggesting an announcement was coming soon that regulators would require a transition to SOFR. We decided to update our SOFR White Paper to reflect changes over the last six months, with the goal of releasing that today.

We did not know that the agencies would be making an announcement last week, ending their purchases of LIBOR-based loans by the end of the year.

Today, we will spend some time explaining the potential impact, highlighting risks, and providing steps you should be taking as a result of this announcement.

Before we dive in, here are those statements from the agencies about their changes this year in case you haven’t seen them.

Fannie announcement here.

Freddie announcement here.

Last Week This Morning

- 10 Year Treasury finally reversed course and climbed 8bps to 1.58%

- German bund climbed 5bps to -0.39%

- Japan 10yr at -0.03%

- 2 Year Treasury climbed to 1.40%

- LIBOR at 1.67% and SOFR at 1.59%

- Manufacturing had its first positive week in several quarters

- China announced accommodation policies to soothe markets, as well as cutting tariffs on $75B of US goods

- Headline job reports looked strong, but 2018’s revised total was the weakest since 2009

- December credit card debt jumped the most since 1998

- China GDP forecasts are being revised down to between 0%-1%

Trump was acquitted on impeachment charges and the Dems can’t figure out how to count votes in Iowa high school gymnasiums. Also, Lindsey Graham please hit me up to defend the treatment of Lt Col Vindman.

SOFR Update

With the benefit of hindsight, it makes so much sense. The Alternative Rate Reference Committee (ARRC) comes up with an alternative to LIBOR. It works great. But no one uses it. They put a deadline out, but not much happens.

So they call their buddies at the Federal Housing Finance Agency (FHSA) who oversee the agencies and say, “You know, it would be great if you could ‘encourage’ Fannie and Freddie to start using SOFR and then maybe everyone else will follow…”

Surprise surprise, Fannie and Freddie put out statements announcing they will no longer be accepting LIBOR-based loan applications after September 30th and will no longer purchase LIBOR-based loans after December 31st.

In the world of LIBOR transitioning, things just got interesting. Let’s take a look at how this might impact various aspects of your financings in the coming years.

Floating Rate Loans

Let’s start with the basics. Forget hedges for now. Don’t focus on the announcement dates and the deadlines. What is the impact of moving from LIBOR to SOFR?

LIBOR is created by taking a survey of banks, not from actual transactions. Daily volume of underlying LIBOR-based borrowings is almost non-existent, so the people filling these surveys at the banks basically say, “Yeah, maybe right in the middle of the Fed Funds range.” Then they say the same thing tomorrow. And the next day. It’s just their best guess. That’s problematic.

SOFR is a repo rate, meaning a loan backed by Treasurys as collateral. SOFR is based on actual transactions and more accurately reflects actual market conditions. That’s the good news.

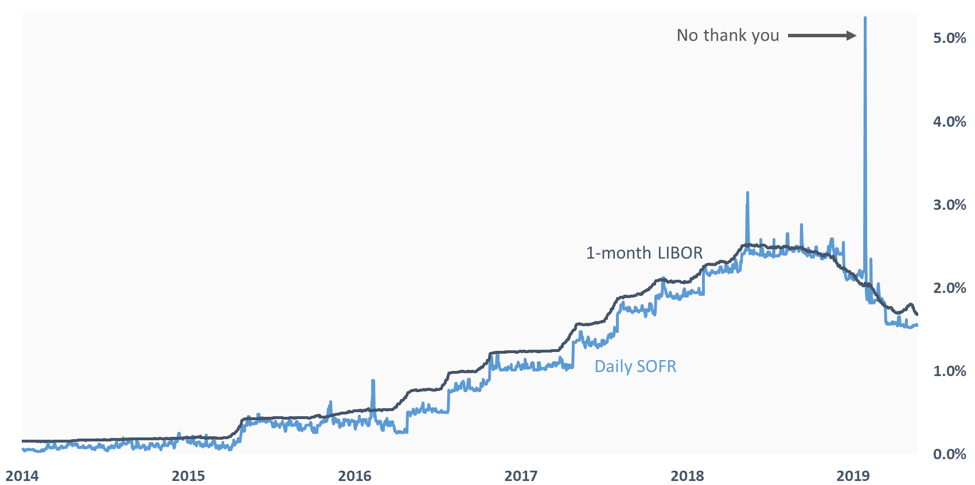

The bad news is that it’s volatile because, you know, it’s based on actual transactions. When the repo market imploded in September, SOFR spiked while LIBOR did not. SOFR also tends to spike each quarter and year end.

The primary complaint about SOFR thus far is that it’s too volatile. We’ve grown accustomed to a nice, smooth, predictable LIBOR.

Who wants their payment to be based on a day that just happens to be a day SOFR spikes?

But these regulators are way smarter than me, so they say, “let’s just take the daily average.” That smooths things out considerably.

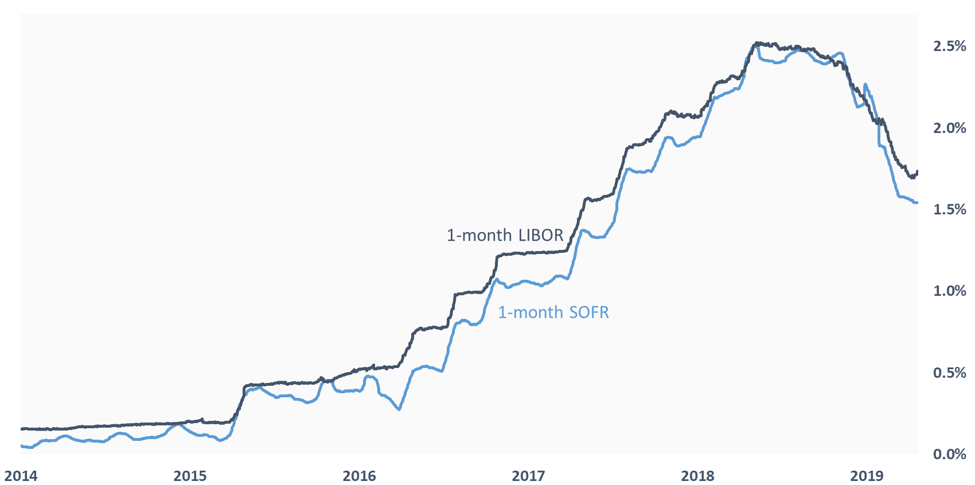

On average, SOFR has been about 0.11% less than LIBOR. Intuitively, that makes sense. SOFR is less risky because there’s collateral backing it.

That means when SOFR replaces LIBOR, it will likely come with a spread of about 0.11%. In other words, SOFR + 0.11% = LIBOR.

If you close on a floating rate loan in the future based on SOFR, the net effect is that it will look/feel/behave/reset an awful lot like LIBOR. That’s the intention.

Even during a month of extreme volatility like we saw in September, the net increase after averaging was less than 2bps. In September 2019, while repo was imploding, your floating rate invoice would have only been 2bps higher using SOFR than LIBOR.

Whether you close on a SOFR loan in the future, or if you have a LIBOR loan that matures after the transition to SOFR, the impact should be minimal. The regulators are doing this to improve markets, not to yank the rug out from under people. Because the market was moving too slowly to adopt SOFR, they probably instructed asked Fannie/Freddie to be first movers.

This announcement does not mean other lenders will do the same this year. But it increases the odds that more and more banks start moving towards SOFR. If agencies face the most regulatory pressure, next on the list are the big banks. Then it’s a waterfall, working its way down to the regional banks and the debt funds.

Conclusion – whether you have a LIBOR or SOFR loan, the floating rate over the life of the financing should be materially the same under normal market conditions (more on that later).

Floating Rate Loans How-Much-Do-I-Care-O-Meter?

SOFR Loans with Caps

I spoke with four agency-approved hedge providers on Thursday following the news. I asked them how many SOFR caps they had ever sold. The combined total?

0

I asked them if they could sell a SOFR cap right now?

No.

But all felt confident they would be in a position to trade SOFR caps by year end. Very reassuring…

Based on last week’s announcement, Fannie/Freddie floating rate loans will be on an index that banks can’t currently hedge. I suspect the regulators knew if they said “jump” the markets would say “how high?” and rush to accommodate the change. The regulators gave them the rest of the year to figure it out.

I think the hedge providers will mostly get there, and if push came to shove, they might simply use LIBOR to hedge a SOFR cap. They use LIBOR to hedge Prime caps right now, so they could do the same with SOFR.

I wouldn’t be surprised to see cap providers charge more on SOFR caps while they try to figure out the market and analyze how much a month like September 2019 would have cost them.

Conclusion – there is some potential for disruption (or increased cost) if SOFR caps are required by the agencies but the hedge providers aren’t fully equipped to handle it. Or maybe if market liquidity isn’t sufficient. It’s probably manageable unless hedge providers simply can’t offer SOFR caps at all.

SOFR Loans with Caps How-Much-Do-I-Care-O-Meter

Existing LIBOR Loans/Hedges that Mature after 2021

The most common question we receive about SOFR is, “If I currently have a LIBOR hedge, will it be worthless if the market moves to SOFR?”

No.

The intent is for SOFR to slide seamlessly in for LIBOR. That’s why banks haven’t stopped offering LIBOR-based hedges going beyond 2021. At some point in the future, SOFR will step in for LIBOR and the impact on rates/hedges should be negligible.

A swap with a 3.50% fixed rate isn’t going to suddenly jump to 6%. Maybe the net result is 3.52%, or maybe 3.48%, but it should still be about 3.50%. If that potential variance makes you uncomfortable, just choose Lifeco or CMBS or internally fixed rate alternatives.

And a 3.50% cap isn’t suddenly worthless. The MtM might change a little. Maybe the capped rate really ends up being 3.52% or 3.48%, but it’s not worthless.

Ultimately, the transition may not be completely seamless, but regulators aren’t doing this to cause market-wide disruptions.

On the loan side, you probably started negotiating LIBOR fallback language over the last few years. If your lender moves the loan to SOFR, your floating rate should be pretty much the same over the life of the loan as we discussed earlier.

Until now, lenders have been reluctant to reference SOFR in the loan docs because there’s no guarantee that the replacement rate would, in fact, be SOFR. But last week’s moves by Freddie/Fannie may cement that and you may see more and more specific references to SOFR replacing LIBOR, rather than generic language.

Conclusion – Given the extreme sensitivity on this topic and the fact that floating rate loans are generally pre-payable at par, I just don’t see banks trying to use this as an opportunity to take advantage of a borrower. Everyone is in this together and the best outcome is a painless one.

Loans/Hedges Maturing Beyond 2021 How-Much-Do-I-Care-O-Meter

SOFR-LIBOR Mismatches

Here’s one potential rub I see. The regulators have never said LIBOR will be prohibited. They simply said they will stop regulating it and markets should not assume it will be available after 2021. Their goal has been to provide a superior alternative the market will adopt on its own, but it’s possible that LIBOR continues in some form or fashion (maybe the same way Prime has) after 2021.

Therefore, there’s some chance that your hedge will reference SOFR while your loan remains on LIBOR. Or vice versa. Then what?

It’s probably not a big deal because SOFR and LIBOR are so highly correlated. A hedge on one should still be highly effective on the other. It’s not like you’re using pork belly futures to hedge LIBOR.

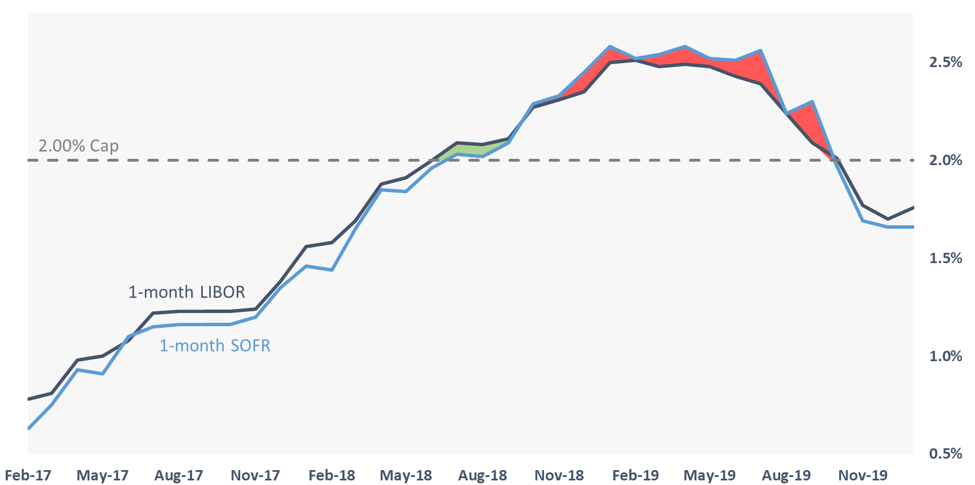

We ran some analysis to check this. Imagine in January 2017 you had bought a LIBOR cap for a LIBOR loan.

Notional $50mm

Term 3 year

Strike 2.00%

Index 1 month LIBOR

Now imagine the day after the loan closed, your lender switched the loan to SOFR. You pay SOFR on the loan, but the hedge is still on LIBOR. What would have happened over the next three years as rates climbed? How effectively did the LIBOR cap hedge the SOFR loan?

Very effectively.

The ineffectiveness worked out to 2bps per year, or about $30k over the life of the financing. Not perfect, but probably not a deal killer for most clients, either. In the illustration below, the red highlights the periods of ineffectiveness that would have cost you money.

More than half of that ineffectiveness came during September 2019 when SOFR spiked north of 5% and would have cost you about $17k in ineffectiveness that month.

Again, this is only in the event of a mismatch between the loan and the hedge. If instead you had a SOFR loan with a SOFR cap, there would have been no ineffectiveness, even with the spike.

Conclusion – the two indices are so highly correlated that a hedge on one is likely to be highly effective on the other. There may be some basis risk, but probably a small enough amount that our clients can live with it.

SOFR-LIBOR Mismatch How-Much-Do-I-Care-O-Meter?

Jurassic Park and SOFR?

This may have been the least cynical newsletter of all time because I just don’t view this as a massive market disruption. And it’s the right thing to do. It’s probably not a big deal. But…

It’s probably not a big deal.

Those earlier scenarios assume SOFR behaves normally. But as we saw last quarter, repo markets can go haywire. The very reason we need to switch to a market driven index is the same reason that creates risk in the transition. We are spoiled by the artificial smoothness of LIBOR, but it’s not real. It’s an illusion.

SOFR is market-driven, which means it is susceptible to extreme volatility swings. Sure, we can run analysis on what it would have behaved like over the last 6 years and test correlation and all those sort of things to comfort ourselves. But aren’t those really just another form of (dis)illusion?

Remember in Jurassic Park when Jeff Goldblum’s character, Dr. Ian Malcolm, debates with the geneticist’s ability to control the dinosaur embryos’ development? They have a back and forth about controlling the dinosaur population by simply making them all females. The park controls the dinosaur population, types, habitat, diet, etc. The entire park is built on this type of control. Goldblum is skeptical. He believes they are fooling themselves. It’s the illusion of control, not actual control.

Dr. Ian Malcolm: But again, how do you know they’re all female? Does somebody go out into the park and pull up the dinosaurs’ skirts?

Henry Wu: We control their chromosomes. It’s really not that difficult. All vertebrate embryos are inherently female anyway, they just require an extra hormone given at the right developmental stage to make them male. We simply deny them that.

Dr. Ellie Sattler: Deny them that?

Dr. Ian Malcolm: John, the kind of control you’re attempting simply is… it’s not possible. If there is one thing the history of evolution has taught us, it’s that life will not be contained. Life breaks free, it expands to new territories and crashes through barriers, painfully, maybe even dangerously, but, uh… well, there it is.

John Hammond sarcastically: [sardonically] There it is.

Henry Wu: You’re implying that a group composed entirely of female animals will… breed?

Dr. Ian Malcolm: No. I’m, I’m simply saying that life, uh… finds a way.

SOFR has behaved just fine in a climate-controlled lab room under the close supervision of financial geneticists. It looks like it would have behaved just fine when we run back testing on hypothetical SOFR resets.

But when we let it out into the wild and the repo market seized up, SOFR spiked. It had nothing to do with Fed Funds or FOMC monetary policy. Markets froze, and SOFR responded.

Asset pricing, like life, finds a way.

Remember that cap in the earlier example? Half of the ineffectiveness came during that one month of volatility. What if volatility lasts longer?

The Fed’s massive repo intervention (Definitely Not QE4.0) last year makes even more sense if their goal was to also keep SOFR nice and smooth. SOFR had some individual transactions pop to 10.0%, with the average for the day coming in north of 5.0%. Double digit interest rates are not smooth like we are used to with LIBOR. They more accurately reflect market conditions and prices, but smooth they are not.

This raises some questions:

- Had the Fed not intervened, would that one-day spike in SOFR lasted longer?

- After averaging, a few elevated days translates into a few extra bps, but what if SOFR’s elevated for an entire month? Or six months?

- Is the Fed now in the business of providing liquidity in repo markets just to help smooth out SOFR?

- If so, is that really any better than LIBOR? Are we exchanging one potential risk of manipulation for another?

We can’t have it both ways. Smooth, but fake? Or volatile and real?

Conclusion – transitioning away from LIBOR is the right thing to do and SOFR will largely feel like LIBOR. But a market driven index is subject to volatility we haven’t experienced in LIBOR, so there are likely to be some unintended consequences.

Jurassic Park How-Much-Do-I-Care-O-Meter

Takeaways

In the summer of 2017, Andrew Bailey made headlines by putting a deadline on the LIBOR transition. Last week, Freddie/Fannie made headlines by doing the same. This is not a coincidence. While I am still skeptical LIBOR is no longer available after 2021, the agencies are forcing the market to adopt SOFR in a way that other institutions cannot.

Much more will be known in the coming months as the ARRC and ISDA make announcements, so we will keep you posted.

SOFR White Paper

In the meantime, please check out our white paper on SOFR. Written by the head of our LIBOR transition team, Tra Kelly, it provides more specifics on timelines, actual SOFR calculations, impacts on financings, what you should be negotiating in your loan documents, and other considerations. If the newsletter you just read was, “How much should I worry?”, the white paper is, “What should I do now?”

Click here for our white paper on SOFR.

SOFR Forward Curve

And don’t forget, our Forward Curve download includes a SOFR forward curve.

Click here for our Forward Curve.