Powell Just Went Full Hawk

The FOMC statement is released 30 minutes prior to Powell’s testimony and after reading it, my initial thought was “the FOMC is Dovishly Hawkish”. No specific timelines given for rate hikes or balance sheet reduction. Maximum flexibility.

But then Powell started taking questions. And the longer he spoke, the more hawkish he sounded.

He made it clear the Fed is moving away from extremely accommodative policies through four steps:

- QE tapering will be done by early March

- The first rate hike will be “soon”, presumably March

- Additional rate increases as appropriate (four or more this year)

- The Fed will have balance sheet reduction discussions over the next couple of meetings and begin after the Fed starts hiking

Powell really hammered home on the following topics and reiterated the Fed will be substantially less accommodative this year.

Labor Market

“The labor market is very, very strong. And the labor market is going to be strong for some time.”

- He repeatedly said the labor market is so strong that the Fed can hike quite a bit without jeopardizing the labor market.

- He has no fear that rate hikes will cripple the labor market recovery.

Inflation

“It is our job to get inflation down to 2%.”

- I’m sure Biden’s approval ratings didn’t have anything to do with that statement…

- Inflation risks are to the upside

“The inflation situation is slightly worse than it was in December.”

“Supply chain pressures will ease, but it is taking longer than expected.”

- I think this is the real driver of why the Fed is pivoting. He talked about how factors not tied to interest rates are contributing to inflation, but since those factors are unlikely to dissipate soon, the Fed can’t afford to wait.

This cycle is different

“We fully appreciate that this is a different situation. Right now, we have inflation running substantially above 2% and growth substantially higher than the potential growth rate, and a labor market that is, by many historical measures, is very tight.”

- He repeatedly said how much better the economy is today than in 2016 when the last tightening cycle began.

“As we work our way through these meetings, we are aware this is a different set of circumstances and those differences are likely to be reflected in the policy decisions we implement.”

- My main takeaway here is that the Fed could very well hike every meeting, rather than every other meeting like the last cycle. It used to be that once the Fed started hiking, it was typically 8 hikes a year, or 2.00%. The last cycle was different, 4 hikes per year, or 1.00%. Powell sent incredibly strong signals that we should not assume the Fed will follow the path of the 2016 tightening cycle.

- I do not believe there is much risk of a 0.50% hike. The odds aren’t 0%, but they are close to 0%. The last time the Fed hiked 50bps at a meeting was May 2000, when it took Fed Funds from 6.0% to 6.5%”

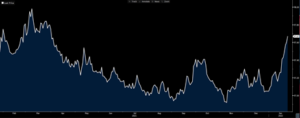

Rates spikes, particularly on the front end of the curve. The T2 is up 13bps in the last hour, a 2+ standard deviation move. The market is pricing in more hikes.

The T10 is up 10bps to 1.86%, the highest level since January 2020. The last time it hit 2.0% was July 2019.

Takeaway

Powell put everyone on notice the Fed will be aggressively removing accommodation this year. I believe some of this is saber-rattling to shake markets awake that 4+ hikes and balance sheet reduction are on the table.

But there is no doubt that the Fed is set to tighten dramatically this year. Financial conditions have already jumped to pre-pandemic levels and will undoubtedly climb all year.

Source: Bloomberg Finance, LP