Pivot Party!

Ain’t no party

Like a Pivot Party

Cuz a Pivot Party

Don’t Stop!

Thanks to the Shellback Squad for sending a video of a big “pivot party!” cheers and letting me steal borrow that phrase for my year end newsletter.

For those new to the newsletter, this is where I make Lead Pipe Lock Predictions that are guaranteed 100% to be right. I am never rong. In fact, I don’t even know how to spell rong right, that’s how right I am.

Also, review last year’s Lead Pipe Lock Predictions to show how perfect I am. RIP reputation

- Last Week This Morning

- 10 Year Treasury at 3.915%

- German bund at 2.032%

- 2 Year Treasury at 4.45%

- SOFR at 5.31%

- Term SOFR at 5.36%

- FOMC held rates steady, but signaled the great Pivot of 2024

- BoE holds rates steady

- ECB holds rates steady

- Retail Sales MoM 0.30% vs. -0.10%

- I don’t think Rudy Guliani has $148mm

- Core PCE, GDP, and personal spending this week heading into the holidays.

- 10 Year Treasury at 3.915%

Lead Pipe Locks for 2024

Lead Pipe Lock #1 - Unemployment will rise above 5%

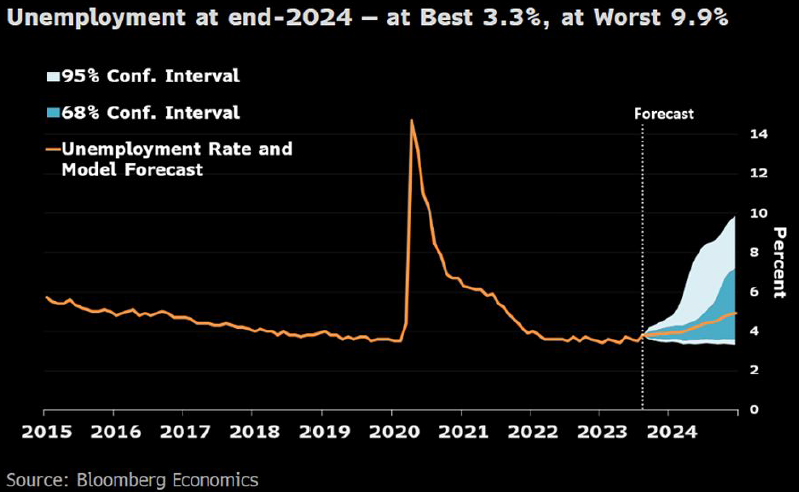

Bloomberg Chief US Economist Dr Anna Wong wrote a compelling piece a few months ago about how we are underestimating the possibility of significantly higher unemployment in 2024.

A one standard deviation move?

- 3.6% best case

. - 7.2% worst case

A two standard deviation move?

- 3.3% best case

. - 9.9% worst case

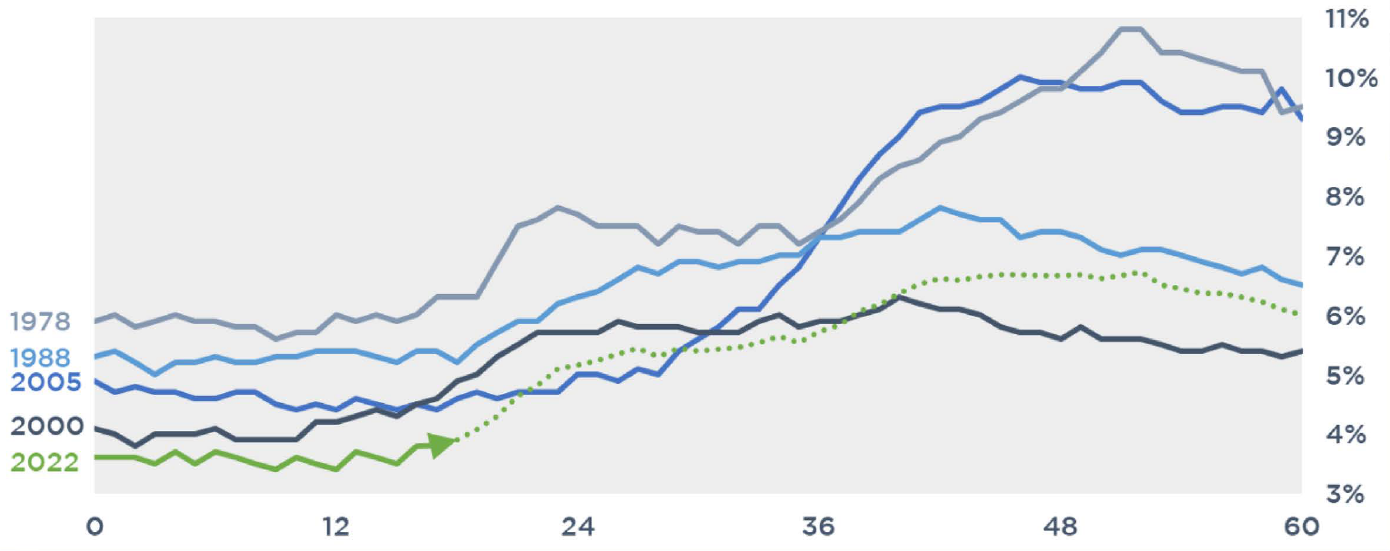

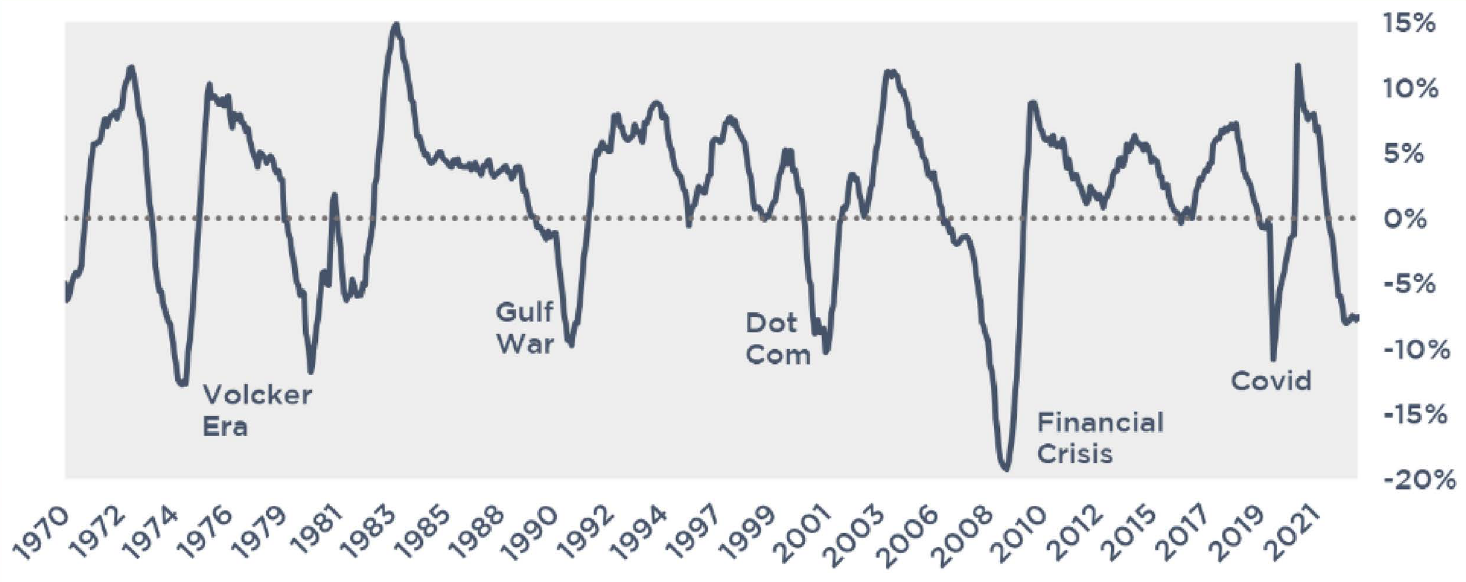

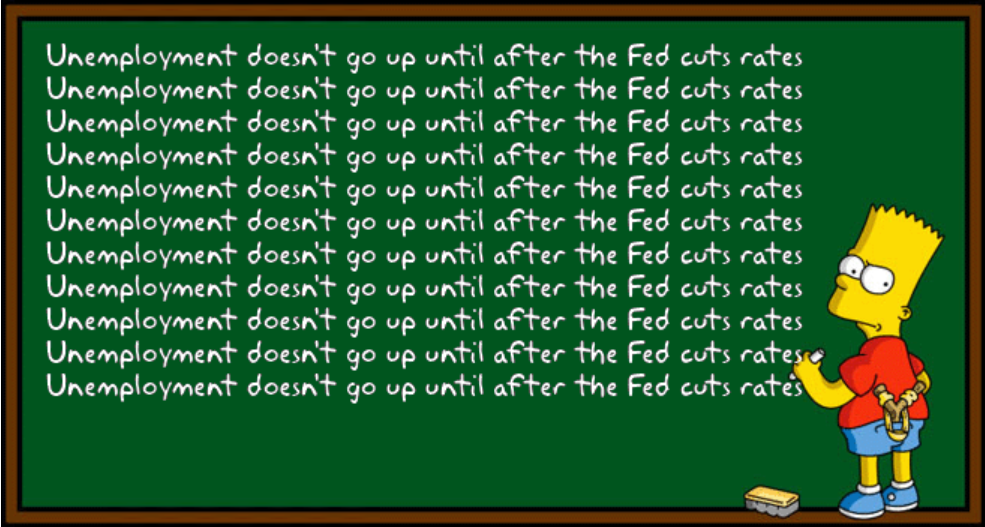

Unemployment is a terrible leading indicator. The Fed is usually cutting rates before unemployment is climbing materially. Heck, in the financial crisis it took a full year to peak after all the banks collapsed. In many ways, the labor market is behaving like it always does at this point in the cycle. Consider the inverted yield curve.

For the first 18 months after an inversion, on average the UR climbs just 0.27%.

- We’ve seen 0.4% increase

But during the next 18 months, the UR climbs 2%.

- That would put the UR at 5.7% in mid-2025

Unemployment does not grind higher…it surges. Everything seems fine until it isn’t. Biden will be confronted with a much higher unemployment rate on election day.

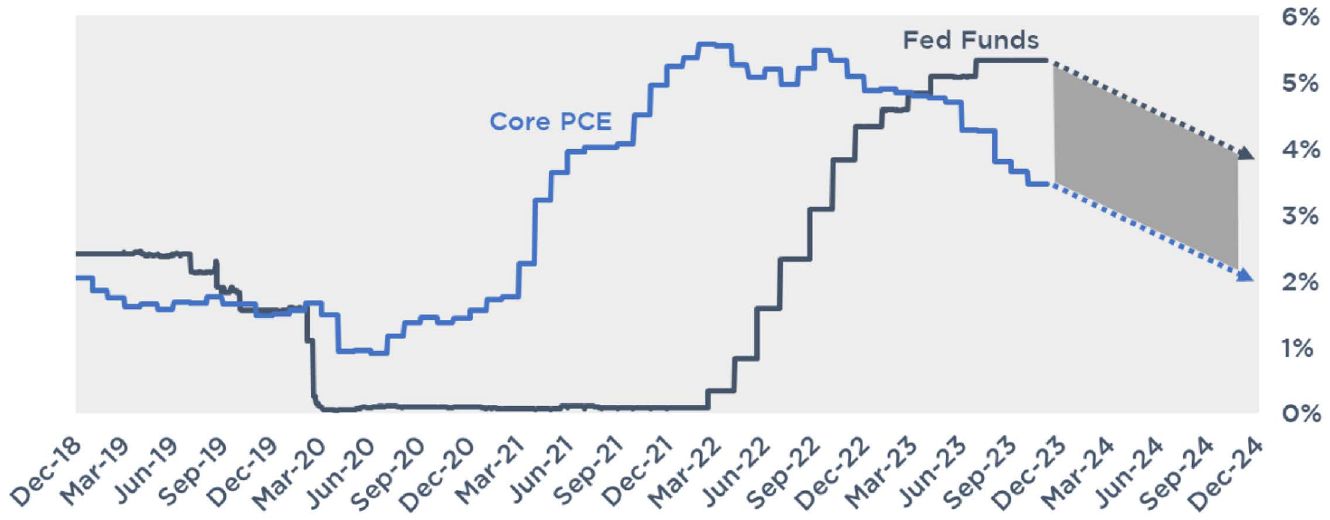

Lead Pipe Lock #2 – Core PCE will hit 2%

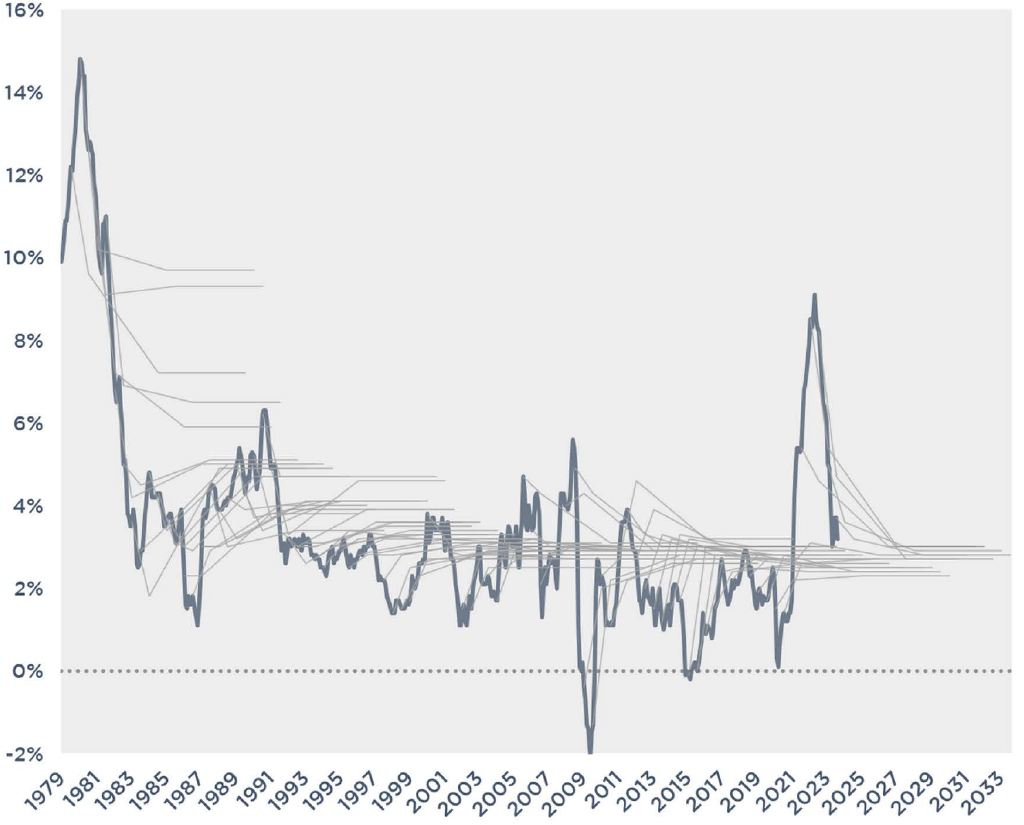

I’m not a big believer in the “last mile” argument about inflation. Inflation tends to move sharply up or down, not sideways. We expect inflation to level off once it starts moving, but it never does. We took the infamous hairy chart of forward curves and used the same concept for inflation expectations. Expectations center around 3% while actual inflation swings wildly.

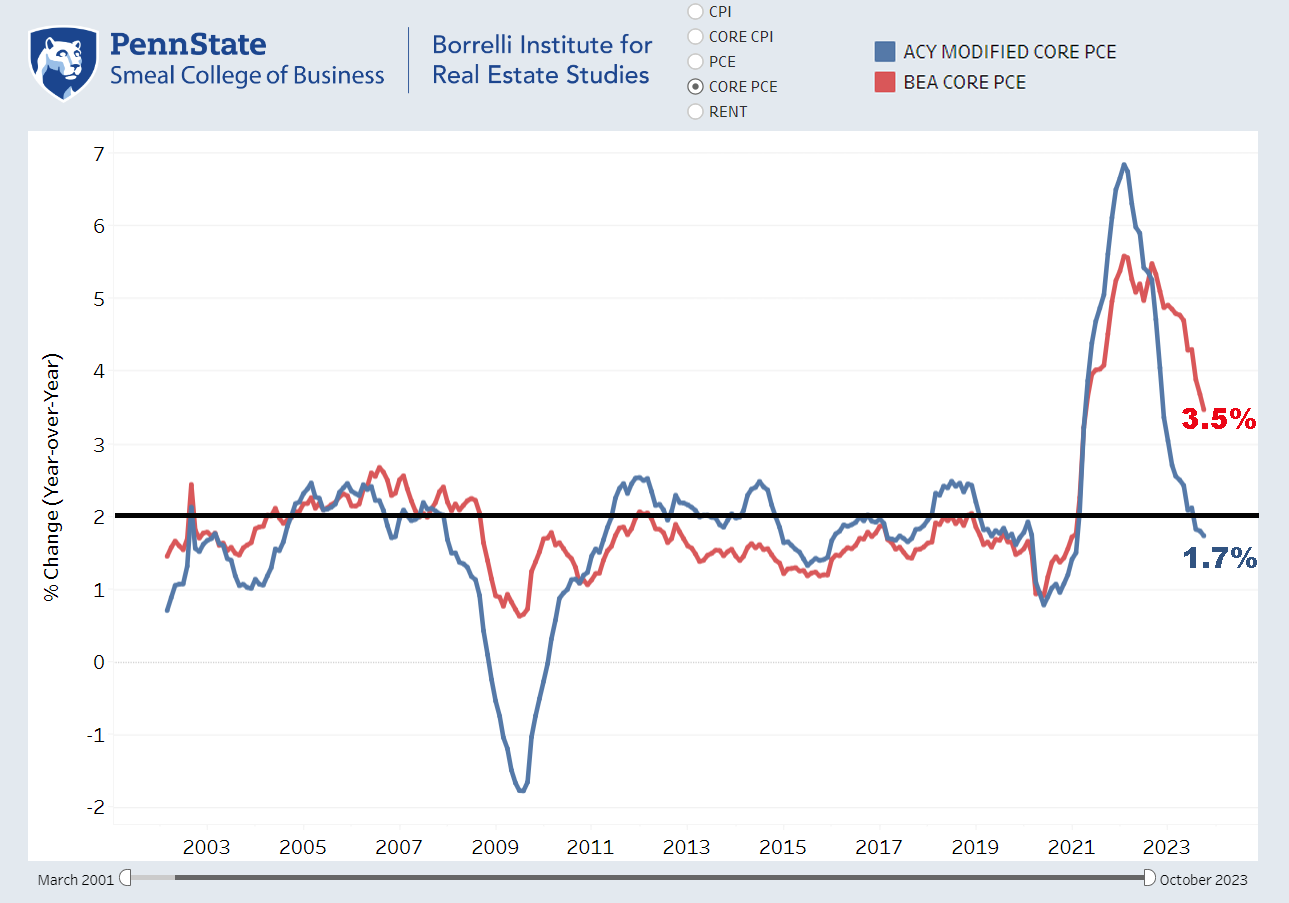

Core PCE is marching to 2%. In fact, more sophisticated measures of inflation show Core PCE is already below 2%. Here’s the PSU Alternative Index showing Core PCE at 1.7%.

If you don’t think there’s been a lot of progress made on inflation, you don’t believe in math. PPI peaked at 18% and is negative. CPI peaked at 9.1% and is 3.1%. Core PCE has moved from 5.5% to 3.5% and the last three monthly prints annualize at 2.3%.

All of this without a recession or a spike in unemployment. Imagine what happens if either/both occur.

Lead Pipe Lock #3 – There will be a recession

I don’t believe there will be a soft landing because those aren’t a thing in the real world. Bloomberg’s Wong’s piece also highlighted how calls for a soft landing always precede a recession.

In fact, we are right on schedule.

- The curve has been inverted for 18 months, the average amount of time before a recession

- Unemployment has started climbing

- Leading Indicators Index has bottomed out

o The UR tends to peak about 8 months later

o GDP tends to bottom out about 3 months later

The economy is not equipped to deal with rates at these levels. There will be blood.

Lead Pipe Lock #4 – the Fed will cut at least 1%

I don’t think the Fed cuts in March unless the wheels fall off between now and then. But I think they start cutting in June and Fed Funds finishes next year around 4% - 4.25% but is still moving lower.

The market puts a 60% chance of Fed Funds below 4% at year end. I think that’s too high given the Fed’s track record of waiting too long. They will be playing catch up.

That being said - if I had to pick, I’d say it’s more likely to finish sub-4% than above 4.50%.

Lead Pipe Lock #5 – Cap prices will plunge

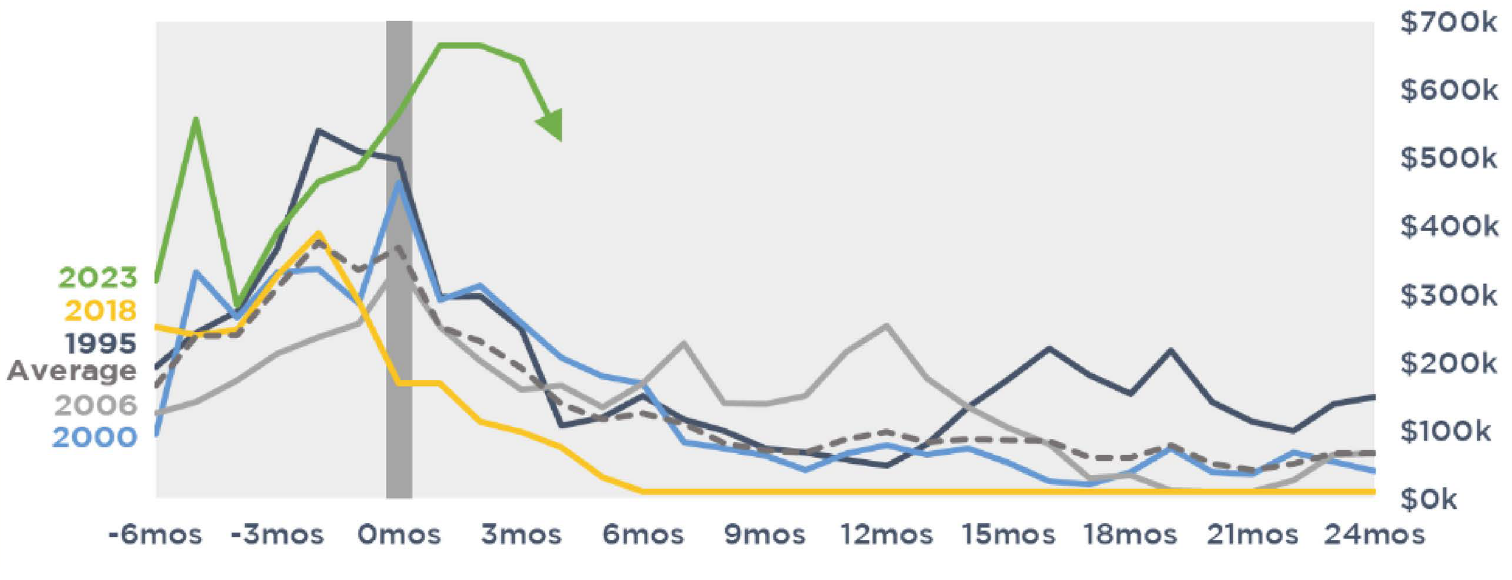

I’m cheating here a little bit because cap prices are already down 25%+ in the last month. Although the Fed last hiked in July, Powell’s “higher for longer” mantra worked so well the market kept pricing in more hikes, postponing the break lower.

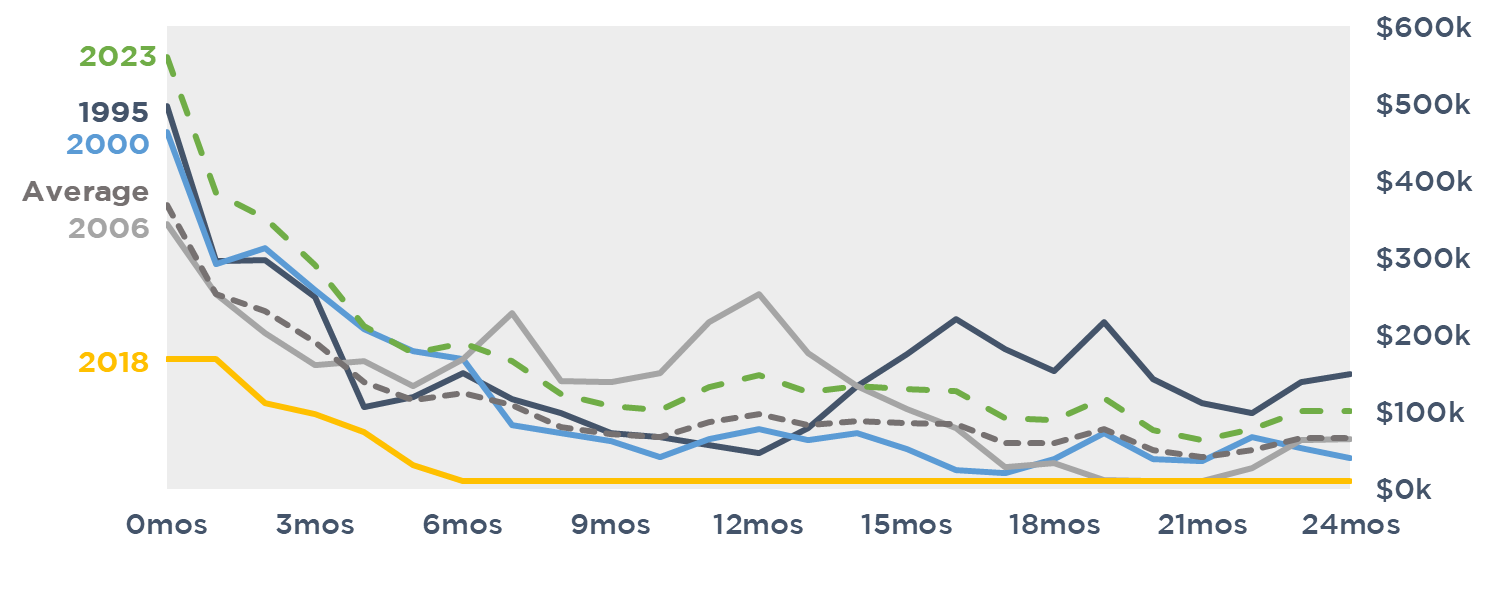

We created this graph about a year ago to illustrate how cap prices collapsed after the last hike. We kept saying, “wait for the pause, then cap prices will plunge.” In the past, Fed-speak was less successful than it was this year at keeping expectations of additional hikes on the table. The “pause” didn’t really happen until the market woke up to the fact the Fed was actually done.

Lead Pipe Lock #6 – Higher for longer applies to real rates, not nominal rates

Our youngest just got his driver’s license. Over the course of five kids, we successfully navigated five week long driver’s ed summer classes, fifteen trips to the DMV, five actual driver tests, etc. A kid getting his license isn’t really for them, it’s for us. Ditching the chaperone role is very freeing. But it also means we had to have some tough talks about the responsibility that involves. Just because you can drive a car doesn’t mean you can get higher for longer. In fact, higher for longer doesn’t even mean 5.50% Fed Funds. It means 2% “real rates”.

Real rates are just rates adjusted for inflation.

Fed Funds – Inflation = Real Rates

5.50% - 3.50% = 2.00% real rates

That 2.0% is the highest level of real rates since the month our 16 year old was born. Bet you thought I couldn’t bring that full circle. Oh yee of little faith.

But that was when real rates were plunging. You have to go back to January 2006 to find 2.0% positive real rates on the way up. That means the economy handled 2.0%+ real rates for 22 months.

Higher for longer means 2.0% real rates, not 5.5% Fed Funds. If Core PCE falls to 2.0% next year, that means the Fed could cut to 4% and maintain 2.0% real rates and still fulfill the higher for longer mandate.

In fact, in order to pull off the soft landing, I think the Fed needs to lower real rates. I can imagine a scenario where the Fed applies less brakes, cutting faster than inflation is falling. 2.0% becomes 1.50% becomes 1.0%. Real rates remain positive, still applying the brakes to the economy – but trying to come to a nice gradual stop instead of slamming into a wall.

Lead Pipe Lock #7 – The T10 will finish the year above 3.25%

The historical spread between Fed Funds and the 10 Year Treasury is 1.40%. With the T10 at 3.90% today, that would require Fed Funds at 2.50%.

A big chunk of the move on the T10 has already happened. The curve will start to uninvert once the cuts are imminent, but it will be tough to see the T10 with a sustained move below 3.25% -3.50% unless the economy really tanks.

If you are traditionally fixed rate borrower, I’d be mindful about looking a gift horse in the mouth. I think the T10 moves lower from here, but I don’t expect it to plunge.

That’s it. Thanks for a great year and here’s to a busier 2024! Pivot Party!

If you choose to read on to see how last year’s predictions panned out, please keep one thing in mind.

On a long enough timeline…I am always right.

A Critical Review of Last Year’s Lead Pipe Lock Predictions

Some people have selective memory. They have correctly predicted everything every time. They are never wrong. They always saw it coming.

I am not those people. I am wrong constantly.

I do have a very selective memory, but what separates them from me is their IQ. They are smart enough not to put it in writing. I, the dumb state school kid, talk smack while I’m writing it down to make it really easy for people to send it to me and rub my nose in it when I am inevitably wrong. Put down the hatorade Warren and join your friends at Shellback!

Here are my 2023 Lead Pipe Lock Predictions from the December 27, 2022 newsletter. I’m sure I got it all right. I am not nervous at all. This is fine.

Lead Pipe Lock #1 - Unemployment will remain below 4.5%

The “resilient” job market that means the Fed “still has work to do” is rapidly becoming a major pet peeve.

In fact, there is a significant lag between rate hikes and job losses.

The Great Rate Hikes of 2022™ will have an impact on the job market, but it takes time. I’m not sure how much, if any, the unemployment rate will climb this year, but I don’t think it should be used as a yardstick for how well the Fed is cooling the economy.

Grade: A+++

Coming out hot! I am amazing! Bow down before me!

Lead Pipe Lock #2 – Forward Real Fed Funds Will Dictate The Pause™

Rates minus inflation = “real rates”

Fed Funds minus Core PCE = Real Fed Funds

4.50% minus 4.70% = - 0.2%

Therefore, Real Fed Funds is still negative.

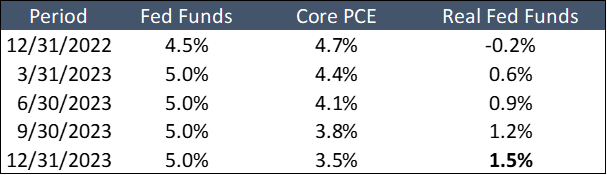

But if the forward trend shows inflation pushing lower, the Fed will take this into consideration. If Core PCE is going to hit 3.50%, the Fed can pause before it actually hits 3.5%. At the December meeting, the Fed’s own projections call for Core PCE to hit 3.5% at year end. Using that as a guidepost, here’s what Real Fed Funds might look like this year.

The Fed will update its projections at the March 22nd meeting. If expectations for year end inflation are 4.0% instead of 3.5%, the Fed will hike to 5.5% to make up for that.

In essence, they are solving for a 1.50% Real Fed Funds and working backwards. Whatever they expect for inflation on a forward looking basis will dictate The Pause™.

Grade: A++++++++++

I mean what?!?!?! I predicted a pause at 5.50%!!! I am drowning in my own hype! Someone send me green M&Ms again! This is going so much better than I expected I never doubted myself for a second.

Lead Pipe Lock #3 - Cap Costs Will Fall Significantly

Cap prices are primarily comprised of two components.

- Rate expectations (eg, forward curve)

- Uncertainty (eg, degree of confidence about the forward curve)

Put yourself in a trader’s shoes – you don’t think Fed Funds will go to 6%, but can you rule it out? Can you rule out 7%? So you have to charge for that possibility.

The key to cap costs in 2023 will be The Pause™. Once the Fed pauses, and the market believes the Fed is done for good, cap costs will plunge. The Pause™ will suck the uncertainty premium out of cap costs.

Here’s how cap prices have behaved after The Pause™. Generally, prices fall about 50% three months after the last hike.

After The Pause™, markets will start pricing in The Cuts™, which will further help costs.

Grade: C+.

Welp, you can’t get them all right. Cap prices basically finish the year where they started. I underestimated the naivete of the market in falling for the Higher for Longer manta. So it’s not my fault, it’s the market’s fault. Stupid market.

Lead Pipe Lock #4 - The Fed Will Cut Rates

This one might not age well, but that has never stopped me before…

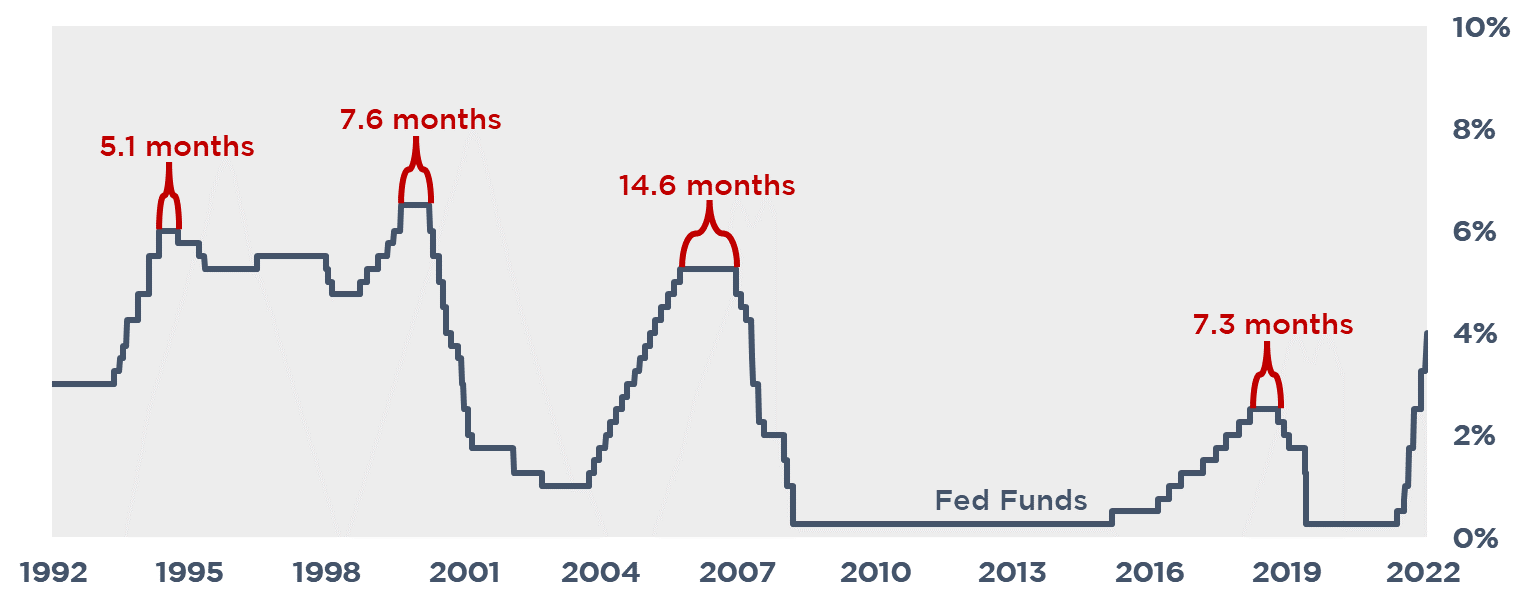

Once the Fed pauses, it is typically cutting rates within 9 months. A pause in March could mean a cut in December.

Grade: D

This is one of those D’s I got in college that was really an F most of the year but then I ran to office hours a few times to pretend I cared, threw in a passing grandparent or two sob story, and the professor got real generous with the grading curve at the last second to bail me out with a D.

The wheels are getting wobbly on my overall report card. My parents might be threating me with sending me off to the Army again if I don’t get this next one…

Lead Pipe Lock #5 – We Will Experience 3 of the 4 Biggest Banking Failures in US History

JK, I obviously didn’t call this. But there are plenty of people that claim they did. They should start a newsletter.

Lead Pipe Lock #6 - The 10T will finish below 3.0%

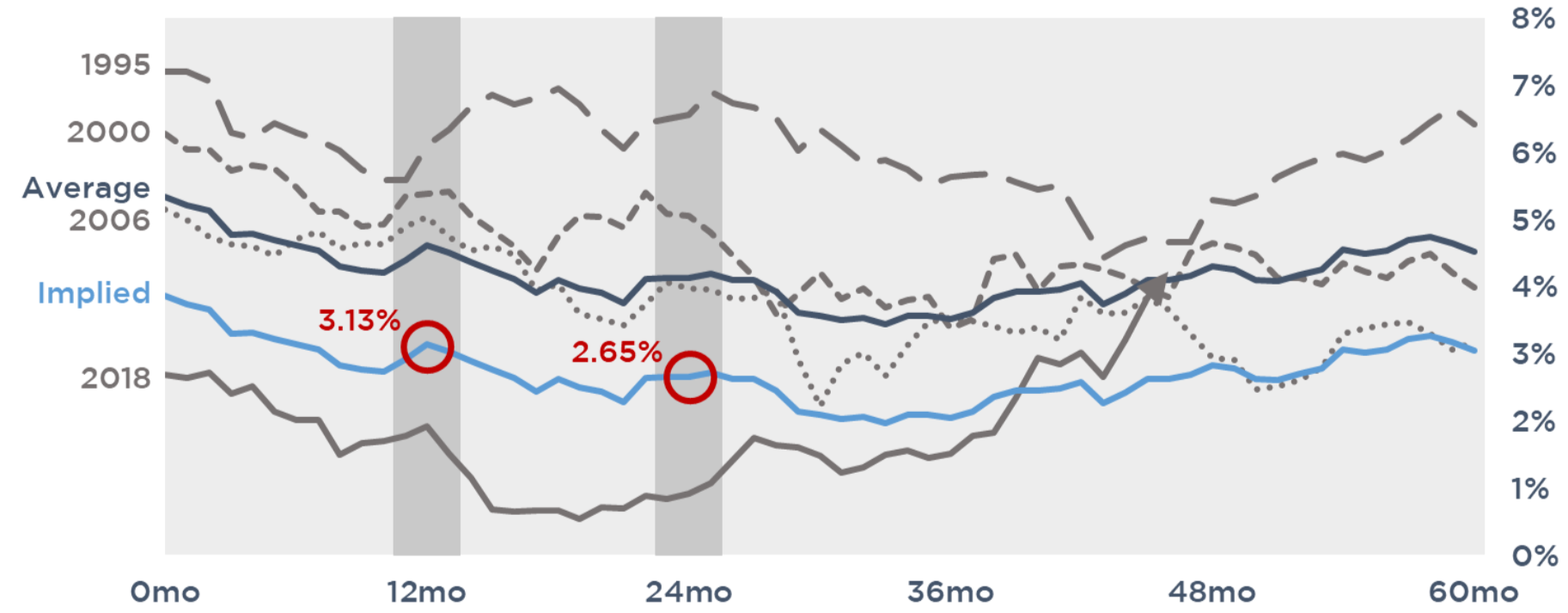

The 10T is already pricing in a recession and rate cuts. If we look at previous cycles, the 10T has always trended lower in the 12 months after The Pause™. In only one scenario, 1994, did the 10T climb by month 24 and that was because the Fed cut 75bps.

If this cycle follows previous cycles, the 10T will be at 3.13% a year after The Pause™ and 2.65% two years after The Pause™. I think the impact will be more dramatic this year because the pace of hikes has been so accelerated.

Grade: F

Not only did I miss by a full percentage point, the only reason it wasn’t significantly worse was because of one of the biggest drops on record in the last month. In fact, in the middle of the year I was saying I didn’t think the T10 would get to 4%, let alone 5%.

It might be time to consider a new profession. Or maybe just join the Army again to get straightened out.

I can already hear my mom, a big believer in tough love, chiming in. “You’re too old and frail for the Army now, they don’t want you anymore.” Tough, but fair.

So what do you have in mind mom?

Lead Pipe Lock #7 – Mexican Polka is Having its Lizzo Moment

You can’t really understand true musical genius until you hear a grown man play an accordion for 9 hours uninterrupted.

Nooooooooooooooooooooooooooooooooooooooooooooooooo!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!