Not Much, What’s Up with You?

I worked for a bank so long ago we didn’t have an online CRM system. We literally tracked everything with paper. We typically covered up to 100 bankers, so we fielded calls all day long. Generally, a banker would call asking for a swap rate on a loan they were trying to win. We would track them on a Quote Sheet and then stack them on our desk. That was our filing system.

As bankers would call back over and over again to update the rates, we would keep adding notes. Then stick it back in the stack of papers. When they closed, we would move it to a filing cabinet. I can’t make this up.

But if a client didn’t swap (usually because I had failed to convince them that rates were going to the moon and they were staring down the barrel of double digit interest rates), their quote sheet would stay in the stack so we could update them when markets moved. On slow days or when rates swung wildly, we would go through this stack of papers and email borrowers, trying to get them off the fence.

We called it the “hot stack”.

Last week’s rate plunge would have sent us scrambling to go through the hot stack. While the technology has (hopefully) changed, the concept is the same. I’d bet the farm many of you heard from swap marketers last week. Or from brokers talking refinancing. It wouldn’t be a thing if it didn’t work.

Inevitably, the question likely comes up whether last week’s move has more room to run or if it’s overdone. Don’t look at me, if I knew the answer you wouldn’t be reading this right now. But total and complete ignorance has never stopped me from sharing my ideas.

As the kids would say these days, I lean in to my ignorance.

If you believe the headlines will continue to worsen (death count, travel restrictions, quarantines, supply chain disruptions), then you may believe it has more room to run. Fair. Just keep in mind that markets are forward looking and today’s levels aren’t based on today’s headlines, they are based on how much worse the headlines may become.

So today’s rate levels are probably overdone and if those headlines don’t get worse, may rebound. 100%. Totally. But, you know, just in case, maybe we should take a peek to see how we should respond to those hot stack emails…

Last Week This Morning

- 10 Year Treasury down just a touch to 1.15% (it got as low as 1.12%), apparently an all time low or something?

- 30 Year Treasury is 1.675%, just 10bps over Fed Funds

- German bund down to -0.61%

- Japan 10yr at -0.16%

- 2 Year Treasury sharp drop to 0.91% (all-time low is 0.155%)

- LIBOR at 1.51% and SOFR at 1.58%

- How did stocks do? I was traveling.

Same Result, Different Catalyst

A few weeks ago we discussed how the driver of these fears isn’t really coronavirus. The fear is global recession.

Not to be callous in the face of human tragedy, but the market doesn’t care about a few thousand deaths. Or 10,000. Or 100,000. When was the last time we talked about the market response to genocide? Lots of CNBC talking heads going on and on about the Syrian genocide pushing yields down to all time lows? No.

The fear is global recession. What can cause a global recession? How about one of the two largest economies in the world having a recession?

The market fear is largely the same as last year – Chinese recession. The difference between the recent movement and last year’s fears is the catalyst.

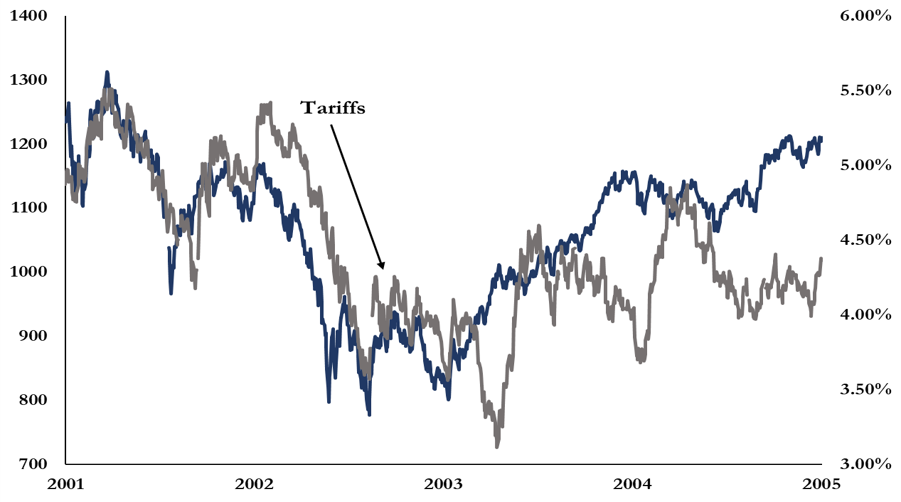

In the spring of 2018 (two years ago), I got a lot of hate email from Trump supporters for the following illustration. Sometimes I know it’s coming. For example, if I say, “Coronavirus finally does what Trump hasn’t been able to – build a wall on our borders,” I know I’m getting some responses (but since I didn’t actually say that and was only using it as an example, no need to email me). But the tariff analysis didn’t seem to be an indictment of the President, but of tariffs. Apparently, being a non-believer is nuanced.

In the six months following the 2002 steel tariffs, the S&P fell 34% and the 10 Year Treasury yield fell 33%.

A corresponding move this year would place the S&P at 1801.58 and the 10 Year Treasury at 1.92%.

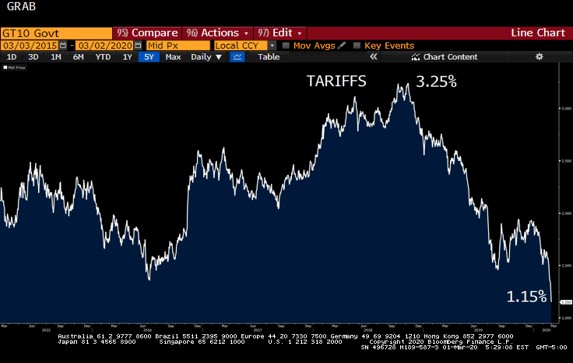

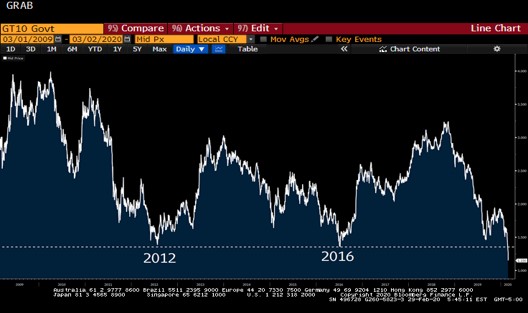

Since the start of the trade war, the 10 Year Treasury has fallen from a peak of 3.25%. Rates have been falling since mid-2018 in large part because the market feared a global slowdown.

Trade War ——-> China Recession ——-> Global Recession

Prior to the coronavirus headlines, the 10T was around 1.75%. The 10T had fallen 50% since the start of the trade war. But it was a slow grind as the data slowly weakened.

From the market’s perspective, the coronavirus means the same thing.

Coronavirus ——-> China Recession ——-> Global Recession

Same result, different catalyst.

A 50% drop from 1.75% would put the 10 Year Treasury at 0.875%.

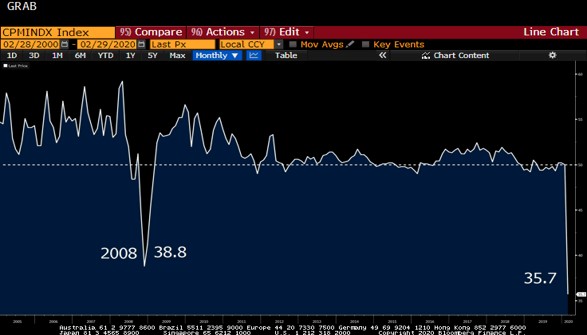

How much impact might coronavirus have on the Chinese economy? Let’s take a look at China Manufacturing data that was released on Friday, the first insight into Chinese data since the headlines broke in January.

Holy sh*t. Chinese manufacturing had its worst month ever. This isn’t a stock price that can plunge wildly on a bad day of trading, this is the entire Chinese manufacturing industry collapsing in one month.

Same fear, different catalyst. And this catalyst is acute, whereas the trade war was a slow burn.

Look at the drop off between China and Japan. It’s basically the US, China, then everyone else. I only included Japan to provide a sense of context. China makes up as much of the world economy as Japan, Germany, India, and France combined.

Country GDP % of Global GDP

USA $21T 23.6%

China $15T 15.5%

Japan $ 5T 5.7%

Some fun facts to brighten your day:

- Travel and tourism is 11% of China GDP

- United Airlines is the biggest domestic carrier of flights to Asia. They are cancelling flights and offering month long vacations at discounted pay to pilots as a cost saving measure.

- China is 40% of the textile and apparel market

- China is nearly 20% of the mining industry

- Oil lost 20% last week on fears of a sharp decline in demand

- About 25% of optic fiber cables and devices are made in the region where Wuhan is located

- Research analysts worry that firms like Apple may experience a 10% drop in smartphone sales

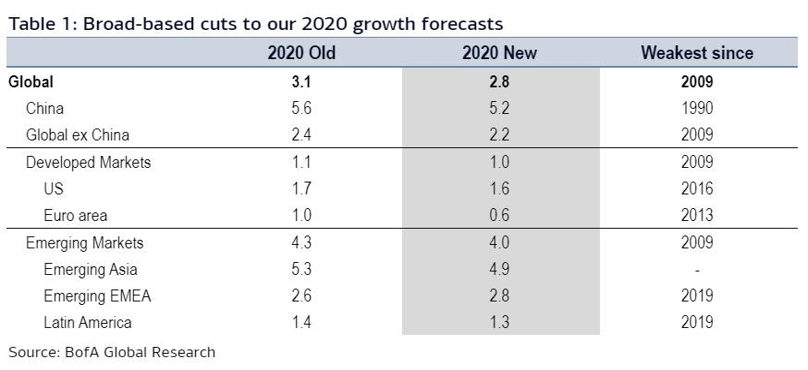

Bank of America revised its 2020 economic forecasts on Friday and is now calling for China to have its worst year since Bell Biv DeVoe Poison convinced me I had sick middle school dance moves and the movie Ghost was blurring the rules around consent when it comes to the spirit world (ps – 1990).

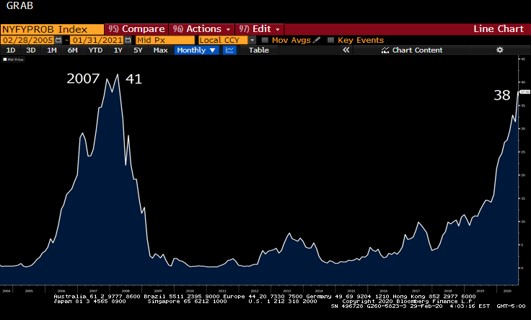

The New York Fed Recession Index spiked, too and is nearly back to levels seen pre-crisis.

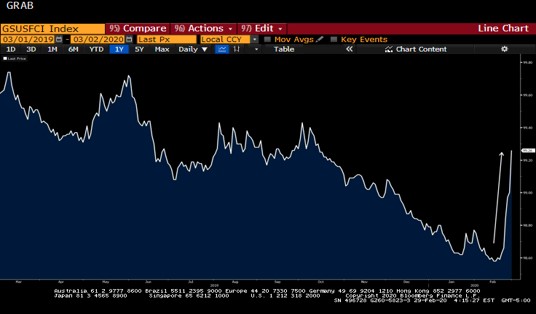

But what about my favorite graph, Financial Conditions? They tightened materially last week.

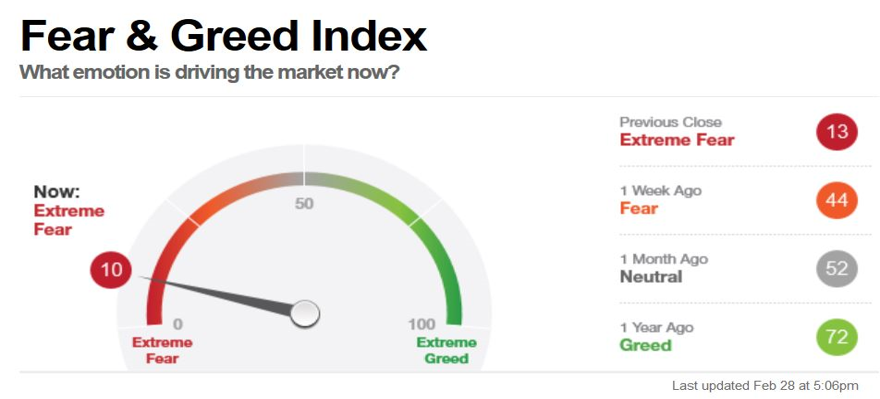

How about The Fake News CNN Fear & Greed Index? I emailed CNN and asked if this measured fear about the economy, or instead measured fear about the Democrats nominating a socialist? I have not heard back yet.

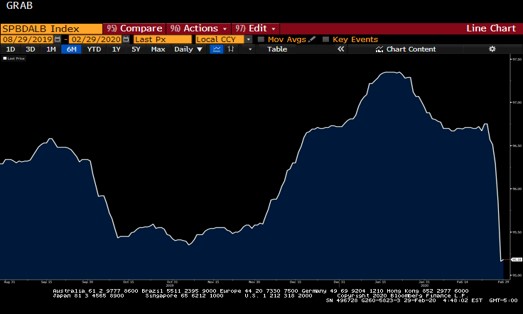

Lower quality assets typically feel the pain first, right? How are junk bonds doing?

Most of us remember how the 2008 crisis was fueled in part by over-leverage. How is the Leveraged Loan Index doing?

Fed Response

Things are so totally fine that Fed Chair Jay Powell made an unscheduled statement Friday afternoon at 2:30pm,

“The fundamentals of the U.S. economy remain strong. However, the coronavirus poses evolving risks to economic activity. The Federal Reserve is closely monitoring developments and their implications for the economic outlook. We will use our tools and act as appropriate to support the economy.”

The market now has between three and four rate cuts priced in this year. That’s not a typo – the market is expecting LIBOR below 1.00% this year. Here are year-end LIBOR resets.

2020 0.74%

2021 0.80%

2022 0.90%

The next FOMC meeting is on March 18th. The market is pricing in 1.5 cuts, meaning the Fed is definitely cutting at least 25bps and there’s a 50% chance of 50bps cut.

In other words, there’s a 50% chance LIBOR is at 1.00% in three weeks…if the Fed can wait that long.

If headlines keep getting worse, there’s a very real chance the Fed doesn’t bother waiting until March 18th to announce measures. Heck, the Fed might cut rates 50bps today. Or tomorrow. But it might not have the luxury of waiting three weeks.

Another key Fed monetary policy tool is forward guidance – what they say is just as impactful as what they do. If Jay Powell says he expects the Fed to cut rates 1.00% over the next year, rates will immediately fall 1.00%. Powell will attempt to reassure markets that the Fed will move aggressively in an attempt to calm markets.

- The longer the Fed waits, the more the market will puke.

- The less aggressive the Fed intervenes, the more the market will puke.

These are both especially true given how little ammunition the market believes the Fed has this time around. Just one week ago the Fed said it can cap Treasury yields (https://www.pensford.com/yield-curve-control-the-japanification-continues/) in the hopes of convincing themselves markets that they have more tools than we think. We’ll see how that works…

In case you skipped ahead, there is a very real chance LIBOR is 1.00% in the near term and 0% by year end.

At some point, fiscal policy (gasp!) may need to make an appearance in order to help offset a downturn.

PS – Quantitative Easing Time. Turn those printing presses back on!

PPS – market shocks are usually a good time to toss aside an index like LIBOR for an unproven replacement index, so that’s good at least. “Cry ‘Havoc!,’ and let slip the dogs of war” – Regulators.

Treasurys

In seven trading sessions, the T10 fell from 1.57% to 1.15%, a 27% drop from near historic lows. It broke 1.36% for the first time ever.

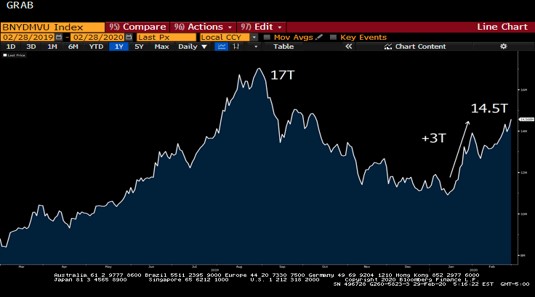

Global negative yielding debt is on the rise again.

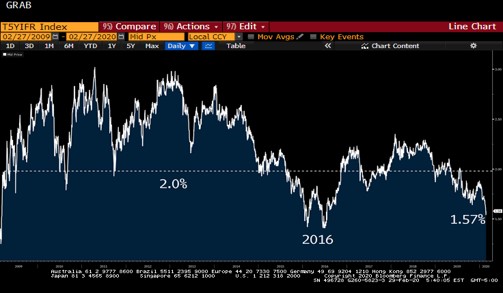

Well, at least inflation expectations aren’t collapsing, right?

I’ve been pounding the drums about the three factors that generally dictate long term fixed rate movements.

- GDP – decent, but this is a lagging indicator so the Chinese impact isn’t showing up in today’s numbers

- Inflation – low and falling

- Global yields – negative and falling

Not exactly a recipe for higher yields.

Rates could certainly rebound as the market oscillates with each headline, but be wary of a dead cat bounce. It may just be a brief reprieve before the march lower continues.

Thanks for the Pep Talk, Now What?

Don’t worry, I’m sure the swap desks are already emailing you with some of these. To the hot stack we go!

Floating Rates – Low and Going Lower

1. Just keep floating – so easy even this state school kid gets it

2. Buy a lower strike cap or a longer term cap

a. A 5 year cap on $25mm at 2.00% costs $150k. That same cost $1mm pre-election.

b. Buy a shorter term cap at today’s LIBOR and replicate a fixed rate deal without a prepayment penalty.

3. Negotiate those floors

a. A $25mm 3 year floor at 1.50% has a value in the market of $625,000 – that’s the equivalent of an 0.83% higher loan spread!

b. Use the value of that floor to negotiate improved terms if the lender won’t lower the floor.

Fixed Rates – Overdone or Room to Run?

1. Swaps

a. 2yr swap mids at 0.74%

b. 3yr swap mids at 0.73%

c. 5yr swap mids at 0.78%

d. That immediate savings of 0.50%…until the Fed cuts

i. Don’t call it a no brainer

e. Don’t swap because “rates can’t go lower”. They can, just ask the rest of the world. Swap because the project works at 1.00% + loan spread.

2. Swaptions

a. Hedge a future fixed rate pricing

b. Locking next week and worried about a rebound? Hedge against implied 10 Year Treasury yields above 1.36% for 16bps of the loan amount

c. Or what if you have a development deal that’s going permanent in a year? Hedging against the implied 10 Year Treasury exceeding 1.36% might cost 200bps, but breaks even if the 10 Year Treasury is north of 1.56% in a year.

Just remember – interest rates going to 0% doesn’t necessarily do you any good if you can’t get a loan. Locking in a longer term deal is more about mitigating refi risk than taking advantage of the rate environment.

I remember how hard it was to get a loan between 2009-2012. Mitigating that in the face of an economic downturn is more critical in my mind that interest rates being 1.00% vs 2.00%

Week Ahead

Lots of data, culminating in Friday’s job report. If the data comes out strong, it probably has limited upside. If it comes out weak, however, rates can keep plunging.

And be on the lookout for an FOMC announcement, I think they might need to move before March 18th.