What if Markets Played in Bowl Games?

The newsletter that answers the question no one asked, “What If Markets Played in Bowl Games?” There is nothing subjective about the following list. It is epic in its infallibility. I have never been more confident of anything in my life than I am of the following predictions. Its accuracy is matched only by its length, so if you care about predicting the future with 100% accuracy and have 15 minutes to spare, this newsletter is for you.

Bad Boy Mowers Gasparilla Bowl

Real Matchup – Temple vs FIU

Markets Matchup – Yellen’s legacy vs Powell

This matchup is really only here because of the name. It used to be named the magicJack Bowl, then the Beef ‘O’ Brady Bowl, and Bitpay Bowl. It gives me hope that there might eventually be a Pensford Bowl.

Despite a pretty impressive track record, Yellen becomes the first Fed chair to not serve a second term since the 1970’s. When Yellen took the helm in February 2014 (has it really been four years already?), the unemployment rate was 6.7%. The DJIA was 15,500.

Buuuuutttttt……GDP was 2.6% in the year prior to her taking over. Over the last year, GDP has been 2.35%.

Core PCE was 1.4%. Today, Core PCE is…1.4%.

Perhaps Yellen will be best remembered for avoiding a recession. Perhaps her tenure showed us the limitations of monetary policy. Perhaps the gentle but persistent removal of accommodation (rate hikes, passive tightening) will be looked back upon as an artful piece of monetary mastery.

Powell, a very strong appointment in our estimation, is likely to continue Yellen’s gradual pace of tightening. Unlike Yellen, however, Powell wants to streamline banking regulations. Yellen has handed Powell a strong economy and a plan for removal of accommodation, can he couple that with banking incentives to prompt real growth instead of asset bubble creation?

Prediction – we have very high hopes for Powell and believe his appointment could be the Fed’s version of the Gorsuch nomination. He will continue the gradual pace of tightening while rolling back the more onerous DF regulations that have stifled traditional lending activity. One potential concern is Powell’s lack of a PhD in economics, which may mean he leans on the other Fed members more than his predecessors. If Trump appoints deeply hawkish members, rate hikes could come faster than the market is prepared for.

Texas Bowl

Real Matchup – Texas vs Missouri

Markets Matchup – Inflation vs Swap Spreads

Tickets to this matchup are about as hard to get as a Discover card. Texas has been rebuilding ever since Colt McCoy went down in the title game eight year ago (ignoring that sweet Alamo Bowl win in 2012), but is back in a bowl game for the first time in three years. Tom Herman’s arrival may not have translated into a lot more wins this year, but he pulled in one of the top recruiting classes in the nation this year. College football is better when Texas is good. Texas is staring longingly at UGA and hope Herman can bring that type of second year to Austin next year.

The Missouri Tigers…actually, I don’t know anything about them. They had a quarterback named Chase a while ago, but honestly I have no idea what they did this year.

Texas, like inflation, is not really significant right now but seems to be lurking just beneath the surface.

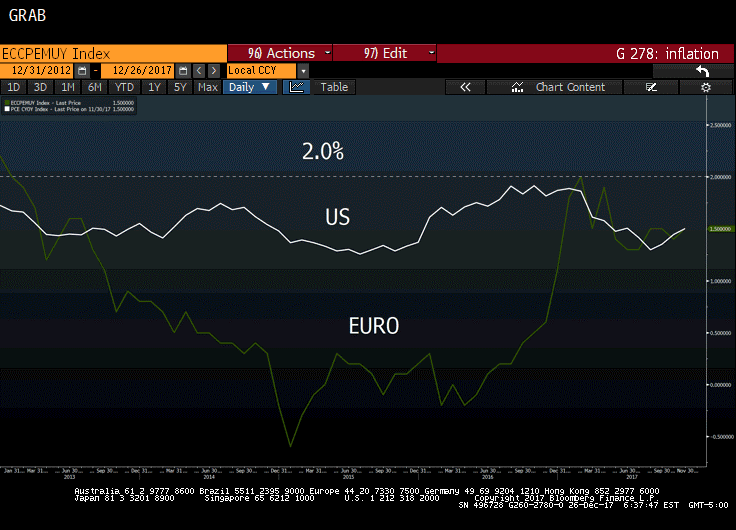

How can the Fed pump $4.5T into the market and have no impact on inflation? Core PCE, the Fed’s preferred measure of inflation, hasn’t hit 2.0% in over five years. The Fed continues to tell us that the softness in inflation readings is “transitory”, but at some point they will have to abandon that theory if inflation doesn’t push higher. The Fed really really really hopes inflation starts creeping higher. If the unemployment rate drops below 4% and inflation is absent, the Fed may need to acknowledge the flaws in the UR metric.

But maybeeeee……inflation is going to start ramping up. The Fed finally has some Congressional involvement in supporting the economy. Inflation just feels like it is poised to heat up. Like football in Austin, maybe inflation is just getting started.

At this time last year, the Fed projected Core PCE would finish 2017 at 1.8%. Instead, it finished at 1.5% and was just 1.3% as recently as three months ago.

The Fed is projecting Core PCE to finish 2018 at 1.9%, just below its target of 2.0%.

10 year swap spreads briefly touched positive territory for the first time in two years. You may have heard about it on a 10 year fixed deal that reflected the higher of the 10yr Treasury or the 10yr swap.

A key reason swap spreads went negative a few years ago was the impact of Dodd-Frank regulation on the credit risk of swaps. Trump’s focus on fewer regulations and the appointment of Powell increase the risk of swaps, and so swap spreads have been slowly climbing higher and hovering closer to 0.

Prediction – like the Missouri football program, swap spreads are unlikely to generate many headlines in 2018. We expect spreads to remain close to 0% and won’t climb significantly positive unless there’s a shock to the markets.

Inflation won’t blow through 2.0%, but it will climb higher and apply pressure to the Fed. Inflation is a greater threat than last year and there is upside risk of exceeding 2.0% that has been missing for five years. Global (cough cough Eurozone) economies are seeing signs of inflation, which may increase expectations.

Belk Bowl

Real Matchup – Wake Forest vs Texas A&M

Markets Matchup – jk, no one really cares about either of these teams

Fiesta Bowl

Real Matchup – Penn State vs Washington

Markets Matchup – Inverted Yield Curve vs German Bund

Penn State lost two games by a combined four points, and both involved blowing a lead late in the game. James Franklin is 0 for infinity on the road vs ranked teams and OC Joe Moorhead left to take the head coaching job at Mississippi State. Barkley was contained late in the season and PSU failed to adjust.

If Washington was located in Columbus, OH or Ann Arbor, MI, they would be getting a lot more love (and benefit of the doubt) than they do. Chris Petersen is arguably one of the top 3 coaches in football and they boast the #1 defense against the run.

Like Penn State football, talk about the potential for an inverted yield curve has ramped up over the last two years. Everyone knows an inverted yield curve means a recession is coming, usually 12-24 months later. Recall that the traditional measure of inversion is the delta between the 2 Year Treasury (which itself is a predictor of Fed Funds) and the 10 Year Treasury (the barometer of the overall economy).

If the 10T refuses to move higher while the Fed pushes up front end rates, the yield curve flattens. In late 2005, the Fed kept hiking even though the 10T was hovering around 4.40%. First the 2T, predicting more hikes, exceeded the 10T. The Fed failed to heed that warning and kept hiking in early 2006 and pushed Fed Funds above the 10T.

We think hope the Fed has learned its lesson and will be slower to hike if the 10T hasn’t climbed. More and more economists are predicting an inverted yield curve in 2018.

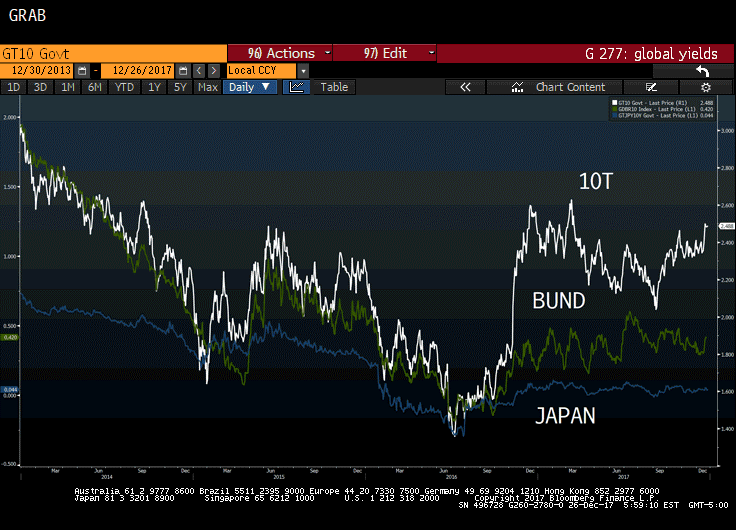

The German bund, like the Huskies, finished the year in mostly the same place as it finished last year. The Huskies had two losses last year and two losses this year. The Bund has been as low as 0.20% and as high as 0.60% and spent most of the year hovering around 0.40%.

The Bund’s significance to the 10T can not be overstated. If Eurozone inflation picks up, the ECB ends up tapering more aggressively than expected, the eurozone recovery gains steam, etc, it will apply upward pressure on the Bund, which in turn will give the 10T room to move higher.

Prediction – unlike most economists, we believe the threat to an inverted yield curve is in the second half of 2018, not the first half. This is based on the theory that the Fed will only hike if the 10T has already climbed.

Imagine a scenario where the 10T runs up to 2.75% in early 2018. The Fed hikes opportunistically, much like it did after the election. Fed Funds is 2.25% and the 2T is 2.75%…what if the 10T starts to reverse course at that point?

We think the Fed, under Powell’s leadership, will be very slow to hike for this very reason. A sudden jump in the 10T doesn’t mean it will remain at those levels.

The yield curve will not invert in 2018 and the Bund will finish above 0.60%.

Cotton Bowl

Real Matchup – USC vs Ohio State

Markets Matchup – Republicans vs Democrats

If you treat this newsletter like a Thanksgiving dinner and don’t want to discuss politics, feel free to skip this bowl game. It’s about two old guard programs back in the spotlight. No matter how distasteful politics may be, they have a direct impact on markets, so we address them here. And if we can’t discuss our differences, doesn’t that say more about us than about the politics themselves?

Unlike last year against PSU, USC doesn’t get a home game as its bowl game this year. Maybe Sam Darnold won’t play like Superman without the support of a home crowd.

Ohio State…oh, Ohio State.

You were 11-2 this year.

You won the Big 10 East.

You won the Big 10 conference championship game.

You complained that Alabama got into the playoffs instead of you. How short your memory is…

Last year Penn State was 11-2. Won its division. Won the Big 10 championship. Beat YOU HEAD TO HEAD. And yet YOU, not PSU, made it into the playoffs.

In other words, imagine if on top of everything else this year you had also beaten Alabama in a head to head match up…and Bama STILL got picked over you. That’s what happened to PSU last year. My head would have exploded if OSU was put into the playoffs. But I’m not bitter.

Oh yeah, how did you do last year when you played Clemson? You lost 31-0? Oh, got it. Yeah, you totally deserve the benefit of the doubt. Quit your whining.

OSU (and Urban Meyer specifically) are like the Democrats, constantly whining and complaining. The Electoral College is their Playoff Committee. These rules have been in place for a while. If you didn’t plan accordingly, that probably means you shouldn’t be in charge anyway.

If you make every issue an impeachable offense, nothing is an impeachable offense. And if Trump is as awful as you claim, why does the market keep spiking to all-time highs? The market movement is an indictment on the Dems approach to business, and yet they don’t seem to accept that. If you believe Trump is the worst president of all time, and the market is at all time highs, what does that say about you?

Is an impeachment really how you want to defeat this president? You were totally blindsided by Trump’s win because you had lost touch with a lot of Americans. Attempting to invalidate their vote isn’t going to change hearts and minds. If anything, it will make them dig in their heels. Stop being just anti-Trump and stand for something.

Hang on Republicans, you aren’t off the hook, either. I have caught flak over the last year from conservatives for my views on Trump, but Trump is not a conservative. The general defense is, “I love what he’s doing with my wallet.” Fair enough. But at what cost? I’m not just talking about the $1.5T deficit from the recent tax cuts (and no, growth will not more than offset that and where have all the fiscal conservatives gone?). I’m talking bigger picture.

If Alabama can elect a Democrat, the GOP is in trouble. I don’t think Republicans are adequately pricing in the long-term damage to the GOP of a Trump presidency. In 2008, the Democrats swept to victory as a reaction to George W. Then, Obama galvanized the right, who swept to victory and ultimately put Trump in office. With each election, the pendulum swings further and we become more extreme, more polarized.

The next swing in response to Trump might not be liberalism – it might be socialism. The Democrats created an environment where a suddenly-and-very-conveniently-conservative Trump could become president. I wonder who the GOP is creating an environment for?

Instead of cramming as much legislative retribution down the throats of Americans during a two-year window before you lose power, what if you moved at a slower pace but with bipartisan support? Infrastructure feels like a potential candidate here, why not work with Democrats and exhibit true leadership? From an economic/business standpoint, we could be looking at a good two year run with the cost being the loss of control in Congress and permanent damage to the reputation of the Republican party.

Last week’s tax cuts are a perfect example. Where have all the fiscal conservatives gone? While markets are enthusiastic, initial polling of Americans are disappointing. Do we really live in a world where Republicans cut taxes and the majority of Americans aren’t happy? Couldn’t that be tied to the skepticism Americans have of the current administration?

In other words, if President Kasich had just helped enact these tax cuts, would more Americans be happy with the cuts?

As for the Mueller investigation, here’s what I hope for:

Democrats – If Trump is not implicated, drop it and move on. It’s a good thing. It’s the outcome we should be hoping for.

Republicans – If Trump is directly implicated, stop making excuses. Four very close members of the administration have been charged, and two have pled guilty. Two have pled guilty. Do you know lots of people that have pled guilty to crimes they didn’t commit? This is not a hoax. This is not a witch hunt. Russia is a bigger threat to the US than Hillary, stop behaving to the contrary.

Prediction – The Democrats will win the House in November while the Republicans retain control of the Senate. Talk of impeachment will heat up after the mid-terms; however, as long as Trump is at the helm, businesses will generally feel like the government will not be out to get them. A Republican-controlled Senate gives business assurance that legislative gridlock will not interfere with the economy. Markets generally cool off, but don’t stall entirely. Democrats fail to appreciate the irony as they focus on a sweep in 2020.

Bonus Prediction – Mueller completes his investigation before the mid-terms. President Trump is implicated, but not directly so. Republicans dig in their heels to hold the line at all costs, galvanizing the left. No impeachment until after the mid-terms.

Conditional Prediction – IF Trump feels the investigation will directly implicate him, THEN he instructs the acting AG to fire Mueller. The AG refuses. Trump fires AG after AG and appoints an AG yes man/woman that will fire Mueller. Mueller is eventually fired.

- IF Mueller is fired, THEN Trump is not There is no second coming of the Saturday Night Massacre.

- IF Trump pardons those involved (potentially including himself), THEN he is still not impeached (the only explicitly non-pardonable offense).

(Editor’s note – I really really really hope this scenario doesn’t come to pass. Democrats embarrassed themselves by defending Bill Clinton at all costs during the Starr investigation, but an Oval Office affair and lying under oath about it are not in the same league as colluding with Russia. If we continue to view the opposing party as a greater threat than Russia, we could have a Constitutional crisis. We are better than this.)

Future Prediction for 2019 – The Democratic-controlled House will pass Articles of Impeachment and the Republican-controlled Senate will not convict. All legislative progress grinds to a halt and we relive 2014-2016.

Caveat – betting markets have a 37% chance that Trump is not even president at the end of 2018, so these predictions may not even have a chance to come to pass.

Rose Bowl

Real Matchup – Oklahoma vs UGA

Rates Matchup – Inflation vs Global Removal of Accommodation

Oklahoma is a fraud. It beat an OSU fraud. It lost at home to Iowa St. It beat Baylor by 8. It beat Texas by 5. It beat KSU by 7. It beat TCU twice, which is like beating…I don’t know what it’s like, but TCU may be the only ranked team less impressive than Oklahoma. PS – the QB didn’t deserve the Heisman. I’m not sure if you can tell, but I am not impressed by Oklahoma. Let the hate mail begin.

UGA feels like a team that is peaking at the right time. After getting smoked by the-hottest-team-in-the-country-Auburn in early November, they returned the favor a few weeks ago in the SEC Championship game. The only thing standing in the way of a UGA national championship would be a showdown with Bama because no Saban student ever defeats the master. Oklahoma better hope the four weeks off puts some rust on the UGA machine.

“We’ve never had QE like this before; we’ve never had unwinding like this before. Obviously, that should say something to you about the risk that might mean, because we’ve never lived with it before. . . . The tide is going out.” – Jamie Dimon

Like an Oklahoma team that plays in January, the global removal of accommodation is a new experiment. No matter how orderly and structured central banks will try to make this process, we don’t actually know how rates will react. We’ve never been down this path before. And just like the Fed, Oklahoma is being helmed by new leadership.

This year will reduce the Fed’s balance sheet by nearly $300B, a relatively minor amount. After 2018, the pace will be $600B per year. This should put a gradual, upward pressure on yields domestically.

Just as importantly, the ECB should conclude its own QE program in late 2018. The goal of shrinking the balance sheet the way the Fed has started to do is probably several more years off, but remember that even talk of that reduction could cause Eurozone yields to spike (a la Taper Tantrum 2013). If Draghi starts publicly talking about a balance sheet normalization process, it could drive rates higher.

UGA is the 2 Year Treasury, rising from the ashes after a few years in obscurity. It began November 2016 at 0.78% and it closed this week at 1.88%.

We cautioned in a January newsletter that the 2T could hit 1.40% by the end of Q1. That didn’t happen. In fact, the 2T didn’t really breach 1.40% until September. But in the last three months, it has spiked almost another half point.

If the 2T is considered the barometer for Fed monetary policy, it suggests the market is finally buying what the Fed is selling. If the Fed ends up hiking the way it is currently suggesting, the 2T should be about 2.50%-2.75% this time next year.

This dramatic move higher has increased the cost of caps, primarily those with low strikes. The more commonly found 3% strikes still haven’t been impacted because the market is not expecting a much higher movement from here.

Prediction – balance sheet normalization will have a relatively minor impact on rates in 2018 as the Fed dips its toes into the balance sheet normalization water and the ECB slows the pace of purchases…but this is a theme that could dominate markets for the next several years. More people will have heard of “balance sheet normalization” this time next year than today. Central banks are trying to unwind the emergency policies from the 2008 crisis. There is risk this doesn’t go smoothly, but we believe that is a bigger threat in 2019 and beyond.

We think the 2 Year Treasury climb will cool off. This is a bold prediction, even if it doesn’t feel like one. We are basically suggesting the Fed will slow its pace of hikes, which in turn will dampen 2T rate movements. The 2T finishes 2018 between 2.00% – 2.25% (this one could sting in next year’s review).

Sugar Bowl

Real Matchup – Clemson vs Bama

Rates Matchup – 10 Year Treasury vs LIBOR

A rematch of last year’s national championship game and this year’s defacto title game. How often does Bama get to play the disrespect card? The winner of this game wins it all, regardless of the opponent. UGA and the Sooners are not ready for the big stage yet.

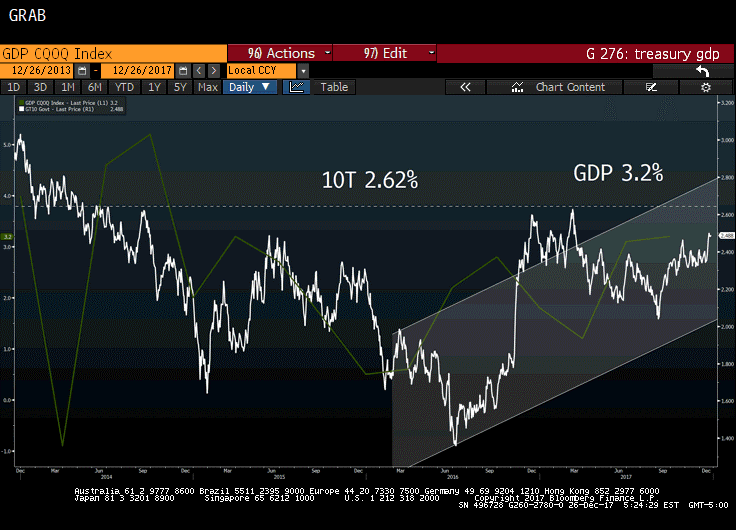

What have been some of the key drivers keeping the 10T below 2.62% for the last 3.5 years?

- QE

- Low growth

- Global yields

- Lack of inflation

Quantitative Easing

The Fed began reducing its balance sheet in October, essentially reversing QE. The projected pace of reduction is as follows:

- $10B per month through year end 2017

- $20B per month Q1 2018

- $30B per month Q2 2018

- $40B per month Q3 2018

- $50B per month thereafter

This would reduce the Fed balance sheet by $300B by October 2018 ($4.2T) and an additional $600B per year thereafter ($3.6T by October 2019).

Timeline Balance Sheet Size 10 Year Treasury

Oct 2018 $4.2T 2.85%

Oct 2019 $3.6T 3.00%

This is an incredibly simplistic view, but it suggests there may be gradual, upward pressure on long term rates that we haven’t had to deal with before.

Just as importantly, the ECB has begun its tapering program, slowing the pace of monthly bond purchases. Draghi suggested the ECB should be done making monthly purchases by October 2018. This could drive up German Bund yields, which in turn give the UST room to move higher.

Low Growth

GDP has been reasonably strong, but not strong enough to drive the 10T meaningful higher. Most economists expect the tax cuts to pump up GDP in 2018 by about 0.4%.

If GDP forecasts increase, the 10T could rise with it.

US Yields Tied to Global Yields

According to a Bloomberg survey of economic forecasters, G7 growth beat forecasts for the first time since 2010. Global GDP grew by 3.7% vs a forecasted 3.3%. Although central banks are withdrawing accommodation, financial conditions remain very loose (taking the foot off the gas rather than applying the brakes).

Fitch reports global negative yielding sovereign debt totals $9.7T, up slightly from this time last year. It is tough to envision a 10T north of 3% in this type of environment. Every tick up in 10T yields makes them look that much more attractive and money flows into bonds, pulling the yield back down. But, if global economies continue to improve, it gives domestic yields room to move higher.

Here’s a graph illustrating the 10T, German Bund, and Japan’s 10 Year. The 10T detached from global yields following the election. What will be interesting to watch is whether US yields wait for global yields to catch up, or whether US yields will with those rates. We doubt seriously whether Japan can move meaningfully above 0%, but we can envision a scenario where the Bund breaks 0.60% and gives the 10T room to test 3.00%.

Low Inflation

Inflation is confounding the Fed, who evidently doesn’t check in on construction costs when measuring it.

While inflation domestically has remained within a tight band over the last five years, the Eurozone has seen a sharp increase over the last year.

The IMF released a study last year that concluded the single best predictor of inflation next quarter was where it was last quarter (you can see this on the white line below). Huge swings are very unlikely and we likely won’t see 1.5% jump to 2.0% from one report to the next, but we could see a steady climb higher.

An increase of inflation could cause Treasury holders to sell, apply, as inflation is Public Enemy #1 of bond values. If Core PCE grinds higher towards 1.9% like the Fed is projecting, we could see the 10T climb with it.

LIBOR is also poised to have an interesting year. Keep in mind that all current market projections of Fed Funds are based on a Fed that will no longer be in power after February 3, 2018.

Jay Powell is largely accepted as a continuation of Yellen’s monetary policies. We agree with this assessment. But we don’t know for sure. What if the Fed takes a hawkish turn and ends up hiking four times next year instead of the projected three hikes?

The Fed is projecting Fed Funds at 2.25% by the end of 2018, which would put LIBOR around the same level. The market is discounting this, but by less than usual. The market (and I) were wrong about the Fed getting three hikes in 2017, so it is licking its wounds a bit (as am I).

Powell will have his hands full. This is the flattest yield curve since the crisis. What impact will tax cuts have on the economy? Will inflation ever show up? Could too many hikes push us into a recession?

Prediction – Powell is a continuation of Yellen and sends all the right dovish signals the market needs to avoid a meltdown. Powell will be very sensitive to the possibility of an inverted curve and will suggest the Fed is turning its attention to the long end of the curve through balance sheet normalization and may even suggest Fed Funds is at/near neutral rate.

The Fed hikes twice in the first half of the year, moving opportunistically with a steeper yield curve (a la post-election) to restock the ammo bin for the next recession. But the Fed does not hike a third time.

LIBOR finishes the year around 2.00%.

For the first time in a long time, we think the 10T tests 3.00% in the first half of the year, maybe even spending some time north of there. While many economists are calling for an inverted yield curve in the first half of the year, we think markets will be feeling optimistic with the tax cuts, possible infrastructure bill, and generally strong data. The four factors we addressed (QE reversal, low growth, global yields, inflation) conspire for a general upward trend on long term rates.

The 10T finishes 2018 between 2.75% – 3.00%.

Last Year’s Predictions – 12.18.16

German Bund vs 10yr Treasury

Prediction – Bund (0.31%) would outgain the 10T (2.25%) and close the gap between the two yields.

What Actually Happened – The spread remained largely unchanged and, until the tax bill passed this week, both were essentially unchanged from the year prior.

Trump Tax Cut vs Dodd-Frank Regulation

Prediction – “Although it seems unlikely Trump will be able to enact all of his tax cut promises, any sort of relief should help in the near term, particularly if it involves repatriation and a simplification of the tax code. The dilution of DF will take more time to have an effect and could ultimately result in more risk taking that led to the crash of 2008, so I’m not entirely confident it will be scrapped.”

What Actually Happened – DF hasn’t been formally touched, but some anecdotal evidence of less emphasis being place on the rules. Tax cuts passed Wednesday.

Trump Keeping His Promises vs Trump Showing Twitter Restraint

Prediction – Neither would happen.

What Actually Happened – I think the Twitter question answers itself, but the promises kept is a tad more challenging.

Many of the most boisterous campaign promises have not been kept, such as Lock Her Up, Build the Wall (and get Mexico to pay for it), repeal Obamacare Day 1, releasing his tax returns, eliminating the AMT, etc.

But he has also kept many campaign promises, not the least of which include this week’s tax cuts. He has scaled back regulations to create a more business friendly environment, canceled the Paris Climate Agreement, appointed a truly conservative Gorsuch to the SC, withdrawal from TPP, etc.

Whether you agree or disagree with the policies, Trump certainly is trying to keep many of his America First promises.

Trump vs Yellen

Prediction – “Trump appoints two Fed governors early next year, one of which is the presumptive Fed Chair. He formally appoints an old white man from Goldman Sachs candidate around September and Yellen rides off into the private sector sunset in early 2018.”

What Actually Happened – Powell didn’t work at GS, but he did work at Carlyle, which is kinda the same thing.

Trump vs Black Swan

Prediction – “Both sides of any international dispute have a tremendous amount at stake and so this is not a “most likely” scenario. But I think the market is underestimating the possibility of a black swan and the reality may eventually set in that we could spend the next four years with a tail risk event looming over us at all time.”

What Actually Happened – markets (and maybe foreign leaders?) don’t seem react to each tweet any more.

Swaps vs Caps

Prediction – this was a really lengthy section, so I need to break it down into its two elements to better dissect it.

What Actually Happened

Wrong – I said the Fed would hike two times, not three, in 2017. It hiked three. Coal for JP.

Right – The spike in Treasury yields and cap costs were overdone and borrowers that weren’t required to hedge at that time were better off waiting.

Inconclusive – The 10T is more likely to finish 2017 below 2.00% than above 3.00%, but it did get as low as 2.02% while it never got above 2.62%.