Is This the 1970s All Over Again?

I’ve spoken at several conferences recently and have taken a lot more questions about concerns over repeating the 1970s. The general theme is that rates were hiked north of 20% to break the back of inflation then, why won’t that be necessary now?

More and more opinion pieces are being dedicated to the topic, with this one calling for Fed Funds to exceed 10% next year: https://www.washingtonpost.com/opinions/2022/08/30/high-interest-rates-2023-possible-recession/

Since I take the “labor” in Labor Day very literally, I spent the day examining what that decade looked like. I was born smack dab in the middle of it so I don’t have any firsthand memories, but I look forward to the old timers on this newsletter refreshing my memory.

Last Week This Morning

- 10 Year Treasury up to 3.20% and tested 3.25% again

- German bund up to 1.51%

- 2 Year Treasury at 3.40%

- LIBOR at 2.66%

- SOFR at 2.29%

- Term SOFR at 2.62%

- Nonfarm Payrolls came in at 315,000 vs expected 298,000

- Unemployment rate (August) came in at 3.7% vs 3.5%

- Consumer confidence index came in at 103.2 vs expected 97.4

- OPEC+ reduced global supply by 100k barrels a day, which is pretty negligible given the 44mm daily output

- Instead, this was intended as a shot across the bow from OPEC that it will intervene against any more drop in price

- Perhaps more importantly, Russia has indefinitely shut down the Nord Stream gas pipeline to Germany

- European consumer pains will increase, particularly if we hit the winter months without a resolution

- Serena Williams, who once won the Australian Open while being pregnant, maybe retired. I ruffled some feathers during the Summer Olympics when I questioned whether someone quitting deserved to be heralded as a hero. I would submit that if we are looking for athletic heroes, Serena is far more deserving. And that toughness is also why she’s the GOAT.

- I’ve never liked Brian Kelly and his move to LSU didn’t help his cause…can’t say I’m bummed to see him start off with an L.

- I’ll take Bama/UGA and you can take the field – deal?

Repeating the 1970s?

Do you ever wonder if you were born in the wrong decade? I came to age in the 1990s, which feels about right for me. Penn State was still good at football. Grunge was in. People still believed in 5 day work weeks. It was a glorious time to be alive.

The 1970s, by contrast, were about disco. Bellbottom jeans. The Bee Gees. Anti-Vietnam protests. My wife is pretty sure that should have been her decade. She would have crushed it, but I’m pretty sure it’s the polar opposite of mine. Can you picture me in bellbottoms with feathered hair? Me neither. The only way that ride makes sense if it’s with Austin Powers.

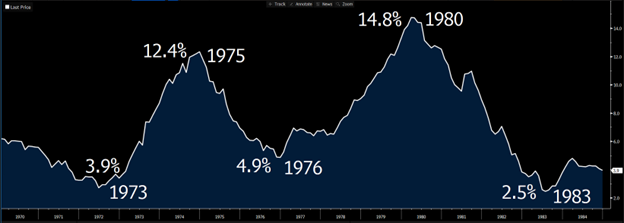

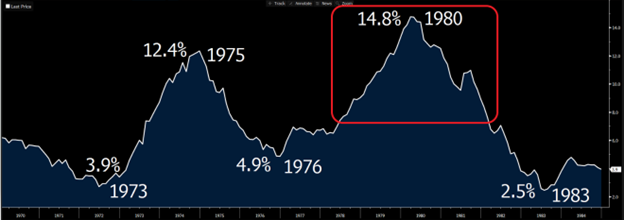

Inflation, oil, war, etc were all persistent themes for the decade. Inflation had two protracted bouts that each lasted three years before experiencing a cooling off.

Let’s set a baseline. The 1970s were a wild ride. CPI averaged 7.1% in the 1970s. By comparison, CPI averaged 2.3% in the 1960s.

Source: Bloomberg Finance, LP

Source: Bloomberg Finance, LP

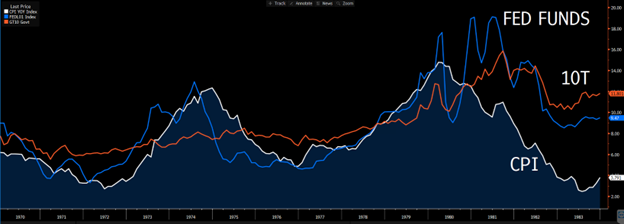

Here’s Fed Funds, which averaged 7.10% for the decade. In the 1960s, it averaged 4.15%.

Source: Bloomberg Finance, LP

Source: Bloomberg Finance, LP

By comparison, the 10 Year Treasury looks positively benign. It averaged 7.50% for the decade. In the 1960s, it averaged 4.85%.

Source: Bloomberg Finance, LP

Source: Bloomberg Finance, LP

And just for sh*ts and giggles, here’s all three on one graph.

Source: Bloomberg Finance, LP

Source: Bloomberg Finance, LP

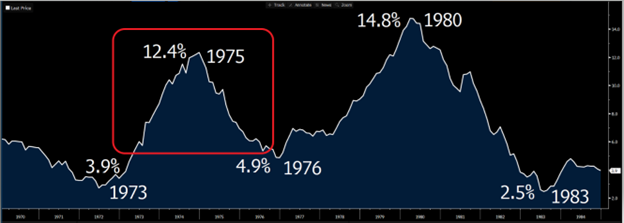

Let’s start by diggin into that first peak.

Peak 1: 1/1/1973 – 1/1/1977

The K2 of inflation in the 1970s lasted about four years.

Source: Bloomberg Finance, LP

Source: Bloomberg Finance, LP

Primary culprit: OPEC more than tripled the price of oil beginning in one year, from 1973 to 1974. In 2021, oil averaged about $65/gallon, so imagine it north of $200/barrel today for a proportionate move.

It was a rough four years overall. Unemployment climbed from 4.9% to a peak of 9.0%.

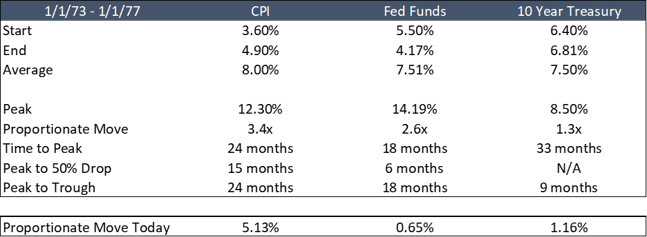

Here’s how CPI, Fed Funds, and the 10 Year Treasury behaved during this four year window.

CPI got north of 12% and never got below 4.9%.

Fed Funds got north of 14%, but had started at 5.50%.

The 10 Year Treasury ran up from 6.4% to a peak of 8.5%.

Those are pretty startling moves, but what sticks out the most to me is how protracted the climb was. Inflation climbed for two straight years. The 10T climbed for almost three straight years.

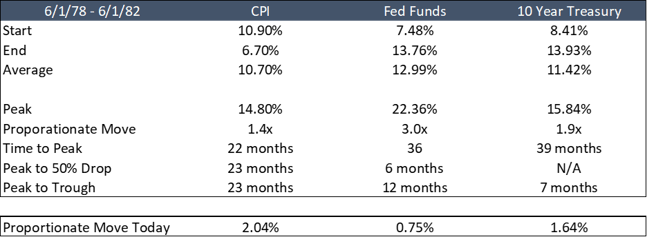

Peak 2: 6/1/78 – 6/1/82

The Mount Everest of inflation in the 1970s, the duration was also four years but had began at higher levels.

Source: Bloomberg Finance, LP

Source: Bloomberg Finance, LP

During just this window, oil again increased 2.3x. From 1973 to 1982, oil was up more than 8x. Again, using 2021 as our baseline at $65/barrel, that would imply oil over $500/barrel by 2030.

Again, what jumps out at me is the duration of the climb. CPI took two years to peak, while rates took over 3 years.

A key event during Peak 2 was the appointment of Paul Volcker. He was confirmed in August and on October 6, 1979, hiked rates 4.00%.

This caused not one but two distinct recessions within a few years of each other. The 1980 recession was relatively mild, but the 1982 recession was far more severe.

Unemployment had never fully received after Peak 1. It got back as low as 5.7%, but the 1980 recession pushed it back up to 7.9%.

The 1982 recession took it all the way to 10.9%.

Unemployment would not get back below 5% until 1997. Yowza.

What’s My Takeaway?

I think of the 1970s as an instructional manual for Fed decisions today. The Fed was slow to act, slow to convince the market it was serious about fighting inflation, and ultimately had to overreact to win the battle.

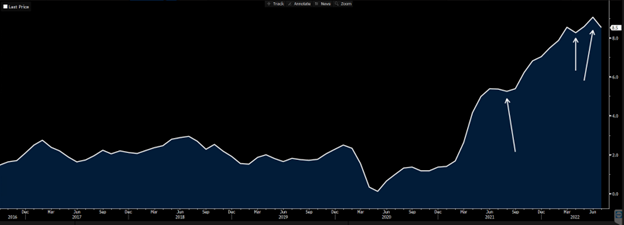

Here’s current CPI. We’ve had a few dips recently that provide some hope. In fact, last week’s newsletter was entitled, “Did Inflation Just Peak?”

Source: Bloomberg Finance, LP

Source: Bloomberg Finance, LP

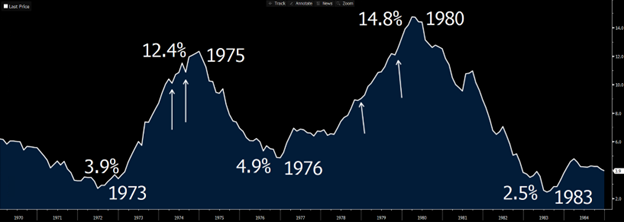

Powell wants to avoid those little reversals becoming a minor blips in an unabated climb higher like we saw in the 1970s.

Source: Bloomberg Finance, LP

Source: Bloomberg Finance, LP

But if the recent data is an actual trend lower, I just don’t see why rates need to hit 5%, let alone double digits. Obviously, the huge assumption there is that inflation continues to trend lower.

The WaPo article suggests rates need to go to 10% to beat inflation. But Einstein taught us everything is relative. Volcker, a hero to many, “just” doubled rates. In that context, a move from 0% to 4% seems very dramatic.

With the benefit of hindsight, Volcker probably overdid it. Unemployment spiked dramatically. His hikes caused two recessions in a short amount of time. Kicked off shockwaves in emerging markets.

It wasn’t his fault - he had to compensate for his predecessors. They had failed to tackle inflation and as a result, markets refused to believe the Fed had the spine to do what was necessary. Every time he hiked and markets puked, everyone assumed he would ease off. He had to hike more than necessary just so there was no doubt the Fed was committed, even if it meant considerable economic pain.

Sound familiar?

The Fed is in search of neutral rate, or an equilibrium. And that is a moving target. It is different today than it was in the 1970s.

In the 1960s, CPI averaged 2.3% with rates averaging 4.50%.

In the 2010s, CPI averaged 1.7% with rates averaging sub 2.0%.

Fifty years ago, it took higher rates to maintain a 2.0% CPI than it does today. This is already too long to begin speculating why here, but what we know objectively is that it recently took a lower level of rates to maintain 2.0% inflation than it used to.

So why wouldn’t it take a lower level of rates to pull inflation back down?

During the 1970s inflation was entrenched for years. Right now, we’ve been dealing with inflation for a year.

It took about two years for inflation to peak in both cycles. And it took two years for inflation to fall back down. If we see inflation falling faster than that now, doesn’t that suggest its different this time around?

Add in the fact that some amount of inflation is attributable to supply chain issues, and not demand, and we shouldn’t have to raise rates as high because supply chain resolution will be chipping in.

Source: Bloomberg Finance, LP

Source: Bloomberg Finance, LP

Lastly, Powell wants to avoid unemployment doubling like it did in the 1970s, so he will be more inclined to ease off the brakes and coast into 2023 than driving higher towards 5%.

This pandemic-induced oscillation will bring inflation back down faster than what we saw in the 1970s.

Bottom Line – I think the fear of repeating the 1970s is helping to guide Fed policy as it relates to signaling and decisiveness, but don’t yet see any reason why rates need to mimic movements from the 1970s to break the back of inflation.

Risks to this View

Recency Bias

Confirmation Bias

Dunning-Kruger Effect

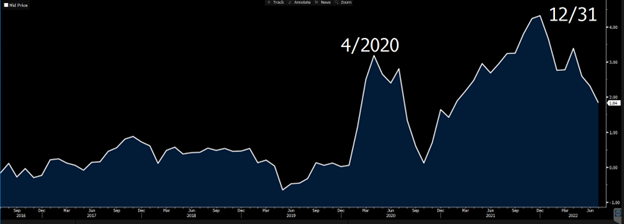

Fed Funds

The Fed is going to keep hiking. The next meeting is September 21st, with odds evenly split between 50bps and 75bps. It almost doesn’t matter though, Fed Funds will be close to if not at 4% by year end.

The next CPI print is on the 13th and that may swing the decision one way or another.

10 Year Treasury

3.25% is being tested again, so don’t fall asleep at the wheel.

The recession in Europe could be worse than expected with Russia formally cutting off the gas supply, which could drive more money under the world’s mattress.

Week Ahead

Mostly Fed-speak this week. The Fed will go dark next week, so this is their last chance to massage the message before the decision.