Inflation is Already 2%

Last Week This Morning

- 10 Year Treasury at 4.58%

- German bund at 2.85%

- 2 Year Treasury at 5.05%

- SOFR a 5.31%

- Term SOFR at 5.32%

- GDP came in at 2.1%, respectable enough, right?

- Last two quarters: 2.15%

- 2nd half 2022: 2.65%

- 2nd half 2021: 5.15%

- We temporarily avoided a shut down and the bar is so low that Matt Gaetz leading the charge against McCarthy for…reaching across the aisle. That’s about the most GOP thing I can imagine right now.

Inflation

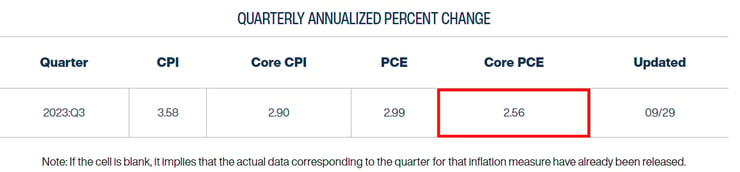

Core PCE came in at its lowest level in two years, 3.9%. A year ago, it was 5.5%.

More importantly, the monthly Core PCE came in at its lowest level since November 2020. At 0.14%, that annualizes at 1.68%. That’s cheating, however, and economists would say, “take the last three monthly reports and annualize those.” Cool, will do.

0.14%

0.22%

0.17%

= 2.12% Core PCE

I totally get the argument that surging oil will push up inflation, but keep in mind two things:

- Winning the war on inflation was never dependent on $70/barrel

- Rate hikes don’t drive down oil prices

- Oil quadrupled in one year in the 1970s. That means oil needs to surge to $280/barrel before you tell me how we are repeating the 1970s.

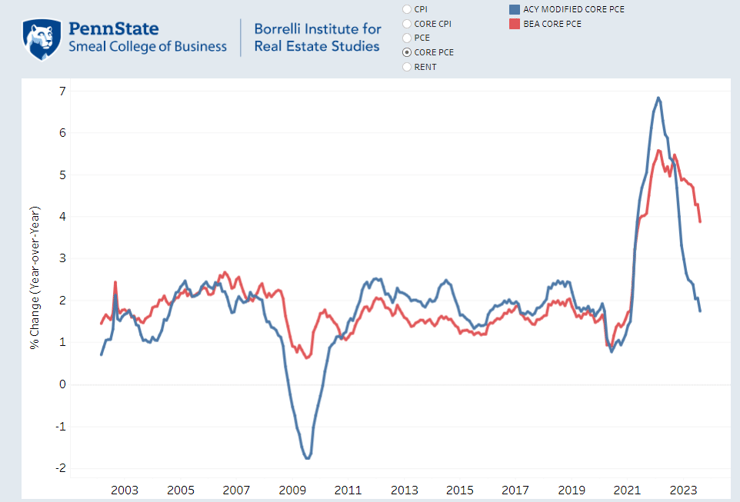

The Penn State/ACY Core PCE Inflation Rate decreased from July to August, from 2.056% to 1.745%. The BEA Core PCE inflation rate also decreased from 4.291% to 3.876%. In the graph below:

Red line: government Core PCE (with the shelter component lag)

Blue line: PSU’s Alternative (which tries to account for the lag)

A shallow recession will likely not force the Fed to cut. The decision to cut will be driven by one of three factors:

- Inflation confidently falling towards 2% (but they won’t wait until it is there)

- Labor market wheels fall off

- Financial instability

Economic contraction is a feature, not a bug, of 5%+ rate hikes in one year. That alone won’t cause the Fed to cut.

10 Year Treasury

When even my grandmother believes the 10 Year Treasury yield is headed to 5%, I start wondering if the move is overdone. Tough to envision right now, but there have been three different instances in the last year where the 10T dropped 0.50%+ in two weeks. It’s not impossible that the 10T finishes October at 4%.

That being said, Treasury supply will make it harder for rates to plunge until the market has swallowed the government’s deficit, and that will take a few more months. For that reason, positioning is unabashedly for higher rates right now.

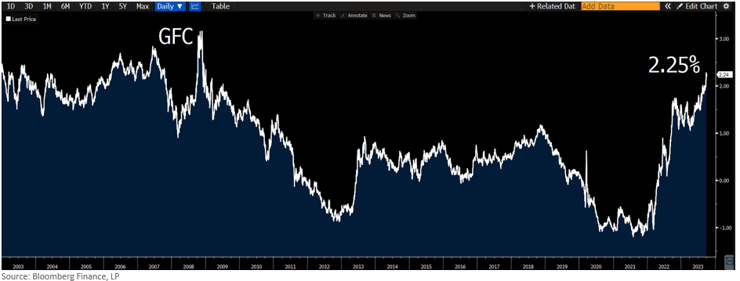

Real 10 Year Rates are at 2.25%, the highest level since the financial crisis. Anyone 35 and under has never experienced rates this restrictive before.

Upper bound resistance: 4.72%, then 5%

Lower bound resistance: 4.35%, then 4%

Week Ahead

With the government staying open, we will continue to get eco data for now. That means we still get the most important economic data point in the universe – that JOLTS tho!

Then the boring old labor report Friday and about 8,000 Fed speeches.