Inflation Data Should Confirm the Fed is Done

When our kids turn 16, we take them on a weekend trip with just us and let them pick the spot. Last weekend, we took our fifth and final 16th birthday trip and he chose NYC. Hard to believe the kid that I once wrote about hiding urine bottles in his bedroom is nearly all grown up.

Broadway show. Subway ride. Top of the Rock. Ice skating. Central Park. Peter Luger’s introduced a new word into our vocabulary, “schlag”, as in “You’ll get your schlag.” We hope to teach the value of experiences over material goods plus the value of traveling to new cities just to see other parts of the country. NYC might have broke him, though. He kept crashing from being overstimulated.

Our first 16th birthday trip was also to NYC and is best remembered for the midnight dinner in one of those secretive places you have to walk through a hidden staircase behind the bread rack of a bodega. While the entrance was fun, I’m usually a few hours away from waking up at that time. We ate in like 30 minutes so I could escape. I hated it. The noise. The chaos. The crowd. Too much everything.

I recalled this as we headed out of the city last weekend, glad to have survived another weekend against my will in the Big Apple. My wife asked him if he had any last words for New York before we departed.

“Bye.”

I’ve never been more proud.

Last Week This Morning

- 10 Year Treasury at 4.47%

- German bund at 2.63%

- 2 Year Treasury at 4.96%

- SOFR at 5.33%

- Term SOFR at 5.33%

- Japan’s GDP contracted 2.3% in Q3

- WTI $75/barrel

- Leading Indicators fell for the 19th month in row…nothing to see here

- That shitty halftime show of the Lions game was about the most Detroit thing I’ve ever seen

Black Friday

No, I’m not talking about Penn State’s beat down of Sparty. Initial results look good for online sales, but forecasters weren’t expecting a strong weekend overall. In fact, NerdWallet conducted a survey of consumers and found some pretty depressing things:

- 25% of all consumers still have credit card debt from last year’s holiday shopping

- 20% will apply for a credit card to pay for this year’s shopping

- 1 in 3 are foregoing presents entirely this year

- 28% said they would spend less than last year

Biden needs to hurry up and wave that magic wand to disappear those student loan payments so people can splurge on that one thing a talentless influencer tells them they can’t live without.

Inflation

We get the next round of Core PCE data this week, with a consensus forecast of 3.5%. Last year at this time, it was 5.5%. Everyone seems to be focusing on not hitting 2% instead of the progress being made.

Monthly Core PCE matters more, though. Last month popped to 0.3%, putting markets on edge that inflation is reaccelerating. If it comes out at 0.2% as expected, markets will exhale a bit. If that happens, the three month average annualizes at 2.4%. We might not be at 2% yet, but we’ve experienced quite a bit of progress in the last year.

Markets were caught off guard last week, however, by a sudden surge in inflation expectations from the Univ of Michigan bi-monthly survey. Powell doesn’t want inflation expectations to push higher because the psychology is tough to break once it settles in. This is the sort of report that forces the Fed to keep talking about the possibility of more rate hikes not cutting for a while.

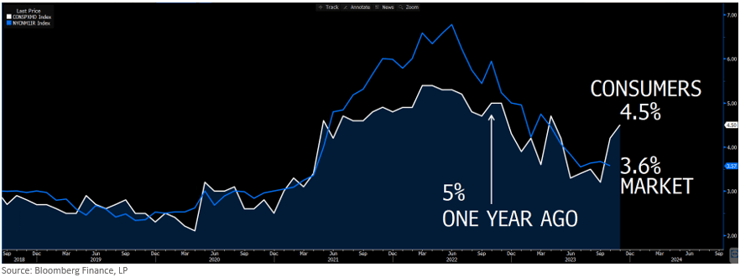

In the graph below, note the white line jumping to 4.5%. That’s from the Michigan survey. But expectations are notoriously bad predictors of how inflation ultimately plays out. A year ago, consumers thought CPI would be 5% this month, and it’s actually 3.2%.

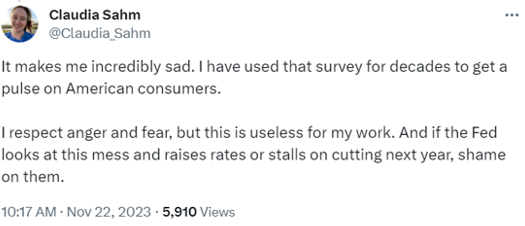

Unfortunately, there’s a problem with this survey and no, it’s not because Michigan just steals the results. The response rate from this survey is so low as to be rendered statistically irrelevant.

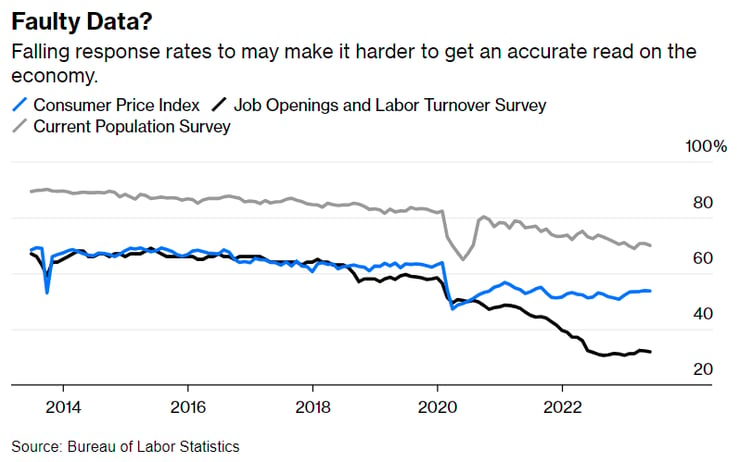

In fact, it doesn’t stop there. In this Bloomberg article, many government survey response rates are down so much as to question their usefulness at all.

Look at that bottom line – that’s the JOLTS Survey I hate so much!

Oh, the author of that article is the same one from the tweet. Claudia Sahm…as in Dr. Claudia Sahm…as in the Sahm Rule.

Turns out someone with actual qualifications hates how much the Fed cited the JOLTS survey, too!

“Bloomberg Businessweek reported earlier this year that the response rate to the survey had plunged by half to 31%. At the same time the response rate fell, the Federal Reserve drew increasing attention to the record high unfilled openings that the survey reported. What the Fed viewed as an “extremely tight labor market” was part of its rationale for raising interest rates so rapidly, boosting the cost of everything from mortgages to credit cards and student loans.”

Guess where she got her PhD in Economics from?

The University of Michigan.

Glad to see not all Michigan alum are willing to sacrifice their integrity just to support their alma mater.

Rates and Stuff

4.50% on the 10 Year Treasury is increasingly feeling like the new ceiling. With last week’s inflation expectations report, I wouldn’t be surprised to hear tough talk from the Fed which could put upward pressure on the 10T. Whether we break through will likely be dictated by Thursday’s Core PCE report.

That same expectations survey moved odds of another rate hike off of <1% all the way up to 10%.

The bumpy inflation ride thus far makes me think 10% is potentially still too low even though I believe the Fed is done.

If Core PCE comes out as expected or lower, cap prices may continue to fall as traders can stop overcharging for outlier outcomes to the upside.

Week Ahead

Busy week ahead, with a few Fed officials speeches throughout the week, GDP on Wednesday, and inflation data on Thursday.

Although the labor report is typically released on the first Friday of each month, that is not the case when the 1st day of the month falls on a Friday. That means we won’t get the jobs data until the following Friday.