Fears of a Taper Tantrum are Overblown

Two of my sister’s three boys have birthdays very close together. The oldest turned 7 a week ago, and the middle boy turned 5 yesterday. With vaccines coming fast and furious, she decided to hold a joint, outdoor, birthday party and host 28 (yes, 28!) people all at once.

This made the 7-year-old so angry he protested. During the Happy Birthday song, he and his brother were presented with a huge joint birthday cake. He got up and stormed off in front of everyone. He shares the spotlight with no one!

The 5-year-old got all the attention and loved it. You don’t need to be faster than the bear, you just need to be less petulant than your sibling.

Last Week This Morning

- 10 Year Treasury unchanged at 1.62%

- German bund up 1bp to -0.13%

- 2 Year Treasury unch at 0.15%

- LIBOR at 0.09%

- SOFR at 0.01%

- Biden countered the Republican proposal by lowering the price tag on the infrastructure bill from $2.3T to $1.7T

- Median home sales price hit a record high of $341k

- Existing home sales fell 2.7% while housing starts plunged 9.5% as surging costs and limited supply influence transaction volume

- This, along with the most recent job report, are prime examples of how uneven the recovery is likely to be and reinforces why the Fed is committed to patience

- Philly and Dallas are on the same side for the first time ever, with both Fed presidents saying the FOMC needs to begin discussing tapering

- Raising taxes domestically apparently isn’t enough, now Biden wants a global 15% minimum corporate tax

- Enhanced unemployment is set to expire in September, but 22 states are moving to end that earlier

- A SF Fed research paper last week concluded 1 in 7 unemployed would turn down a job offer because of enhanced unemployment

- It was painful to hear ESPN describe Phil Mickelson heading into Sunday as a borderline miracle because he’s 50!

Tapering Fears Are Overblown

Rates surged Wednesday on the minutes from April’s Fed meeting, which revealed “a number of participants suggested that if the economy continued to make rapid progress toward the Committee’s goals, it might be appropriate at some point in upcoming meetings to begin discussing a plan for adjusting the pace of asset purchases.”

Why is this whole tapering thing such a big deal?

Back in 2013, Bernanke made an off-hand remark about eventually needing to taper the pace of bond purchases and the market puked. The 10T spiked 100bps in 6 weeks. The market basically stormed off in front of everyone.

Markets are worried about a repeat. Why?

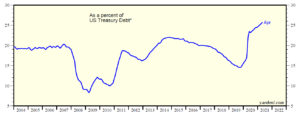

Because the Fed owns 25% of the US Treasury market.

We all know the Fed’s balance sheet has ballooned over the last 10 years, but check out this graph from Yardeni Research. This illustrates how the Fed’s share of the market has jumped since COVID.

The current mentality is that if the biggest buyer of Treasurys slows the pace of buying, that should impact demand, which in turn drives up yields.

Traders want to be in front of it, but don’t want to move too early and get caught offsides.

Either way, I think it’s overblown. Here’s why.

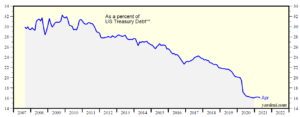

Reason #1 – Foreign Central Bank Ownership Has Plunged

The Fed’s increased market share has largely come at the expense of foreign central banks, whose ownership as a percentage of the overall market has plunged. This is why, “What if China decided to sell Treasurys” has been replaced with, “When will the Fed start tapering?”

But this is also why I don’t see tapering having as big of an impact as it did during the infamous Taper Tantrum in 2013. Back then, foreign central banks accounted for about 30% of the Treasury market. Today, it’s about 16%.

March saw the largest amount of foreign purchasing of Treasurys ever. As the Fed slows its own pace of purchases, there is plenty of slack in the foreign central bank appetite to step in and buy.

Reason #2 – The Fed is Mostly Focused on the Front End of the Curve

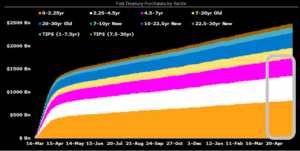

Plus, the Fed isn’t as active on the long end of the curve as I thought. According to Bloomberg, the Fed has purchased more than $2.5T in Treasurys since March 15th. Of that, 54% have been securities with maturities less than 5 years. Just 13% has been for 20 years or longer.

This Bloomberg graph illustrates those holdings over the last two months. It’s a little tricky with all the colors, but I inserted a grey box on the far right to illustrate Treasury holdings with tenors of 7 years or less. Above that box is 10-30 years, so the 10 year sector is just a small amount of the overall portfolio.

That’s another reason why I’m not sure the impact on the 10 year part of the curve will be as dramatic as we fear it might be.

Reason #3 – Powell is Sending All Sorts of Signals

We have talked ad nauseum about tapering. Primary dealers surveyed expect tapering to begin in Q1 2022 and conclude at year end. Since this is exactly what we are expecting, it means the Fed is doing a good job of managing expectations. Sizable market reactions will be the result of a deviation from those expectations.

My grandmother in central PA knows the Fed is set to begin tapering early next year. Powell learned the lessons from Bernanke’s missteps eight years ago and the Fed will be talking up a storm so as not to catch the market off guard.

In 2013, no one was talking about Tapering. Bernanke caught everyone off guard. There is a 0% chance of that happening this time around.

Bottom Line

Markets will gyrate on news/expectations about tapering. It will still make headlines. But the effect won’t be the same as it was in 2013.

Fun Little Tidbit

Aside from a simple duration explanation, maybe the Treasury knows that short term floating rates will be low for the foreseeable future and are actively targeting that part of the curve in the same way many floating rate borrowers are doing. You don’t think Yellen and Powell are coordinating on that front?

“I’m going to keep loading up on short term debt, you aren’t planning on raising any time soon, right?” Janet asks.

“Don’t call me, I’ll call you,” Powell responded.

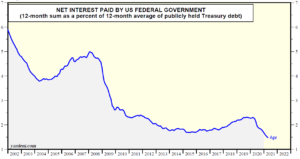

And the federal government continues to fund itself largely with cheap, short term debt.

Check out how interest expense has plunged even as federal debt has exploded.

I wonder how many real estate firms would have similar looking charts…

If you can fog a mirror, you can fund US government spending when rates are at 0%.

Week Ahead

Huge data week ahead, headlined by Core PCE (Fed’s preferred measure of inflation) and GDP.