Even With 3 Rate Cuts Priced In, the Market is Probably Too Optimistic

Kids say the darndest things, don’t they? My wife keeps a journal of adorable things kids say so we don’t forget them. For example, we had a parent teacher conference with our fourth grader and the teacher was encouraging him to try harder in English class. He put his hands behind his head, leaned back, and said, “Yeah…I’m not really a fan…of reading…” It was perfect. Or a few years ago on a summer vacation, our three-year old nephew saw the ocean for the first time and said, “I want to pet it.” Cute, right?

These sayings get less adorable as they get older. I have two daughters, both of whom would major in Activism if that was a thing. I got into a…discussion…with one of them Friday night. Socialism vs capitalism type of stuff. As I walked away, my desire to go to bed exceeding my desire to change her mind, she blurted out.

“Gender is a construct created by capitalism!”

Hmmmm. “What?” I asked. Surely, I have misheard (and don’t call me Shirley).

“Capitalism created gender!”

Oh boy. Wait. Oh…darn?

What do I do with that? What would you do with that? I walked off to bed, totally disheartened.

I have failed as a dad.

I don’t deserve Father’s Day.

Should it even be called “Father’s” Day? Is father also a construct created by capitalism?

I assume all of you are doing a better job than me, so I will instead wish you a happy Father’s Day and hope you enjoyed the golf and all your other capitalistic constructs.

Last Week This Morning

- 10 Year Treasury finished the week down slightly to 2.08%

- German bund unchanged at -0.26%

- Japan 10yr at -0.13%

- 2 Year Treasury closed at 1.84%

- LIBOR at 2.38% and SOFR at 2.35%

- Market now has just a 16% probability that the Fed hasn’t cut rates by July 31

- Market has a 56% probability of three cuts by year end

- Core CPI came in at 2.0% vs 2.1% forecast (and April’s 2.1%)

- Retail Sales came in much stronger than last month, up 0.5% vs 0.2% in April

- The Sixers are clearly the second-best team in the NBA, so I have hope for next year

- Elizabeth Warren wants to forgive all student debt, so I must have a different definition of “forgive”

FOMC Meeting – Wednesday

The FOMC meets Tuesday and Wednesday, with the rate decision coming Wednesday afternoon.

While I don’t think the Fed will cut rates this week, it’s tough to envision a scenario where Powell doesn’t acknowledge market fears over a slowing economy and lack of inflation. Most likely, the Fed will hold rates unchanged but send signals about cuts over the rest of the year to help reassure markets.

There’s also a decent chance the market will be disappointed with the Fed’s statement. Considering the market is pricing in 2 cuts by year end, it may be disappointed if the Fed isn’t that dovish yet.

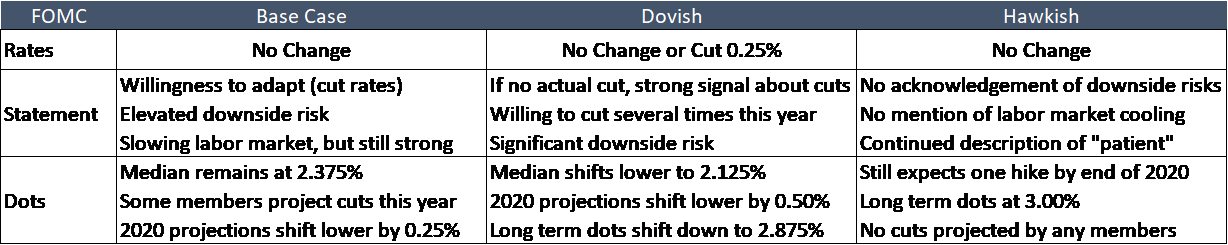

Potential Outcomes

A sampling of market probabilities for Fed decisions:

- An 86% probability of at least one rate cut by the July 31st meeting

- A 72% probability of at least two cuts by the September 18th meeting

- Just a 2.8% chance the Fed has not cut by the September 18th meeting

- A 29% probability the Fed has cut at least 1.00% by this time next year

In other words, the market is aggressively pricing in rate cuts, and it just seems unlikely to me that the Fed will send signals that are as dovish as current market expectations.

Graph Happy

Graphs are usually my lazy way of compensating for a lack of time to write a worthwhile newsletter, but this week’s graphs are unusually cool.

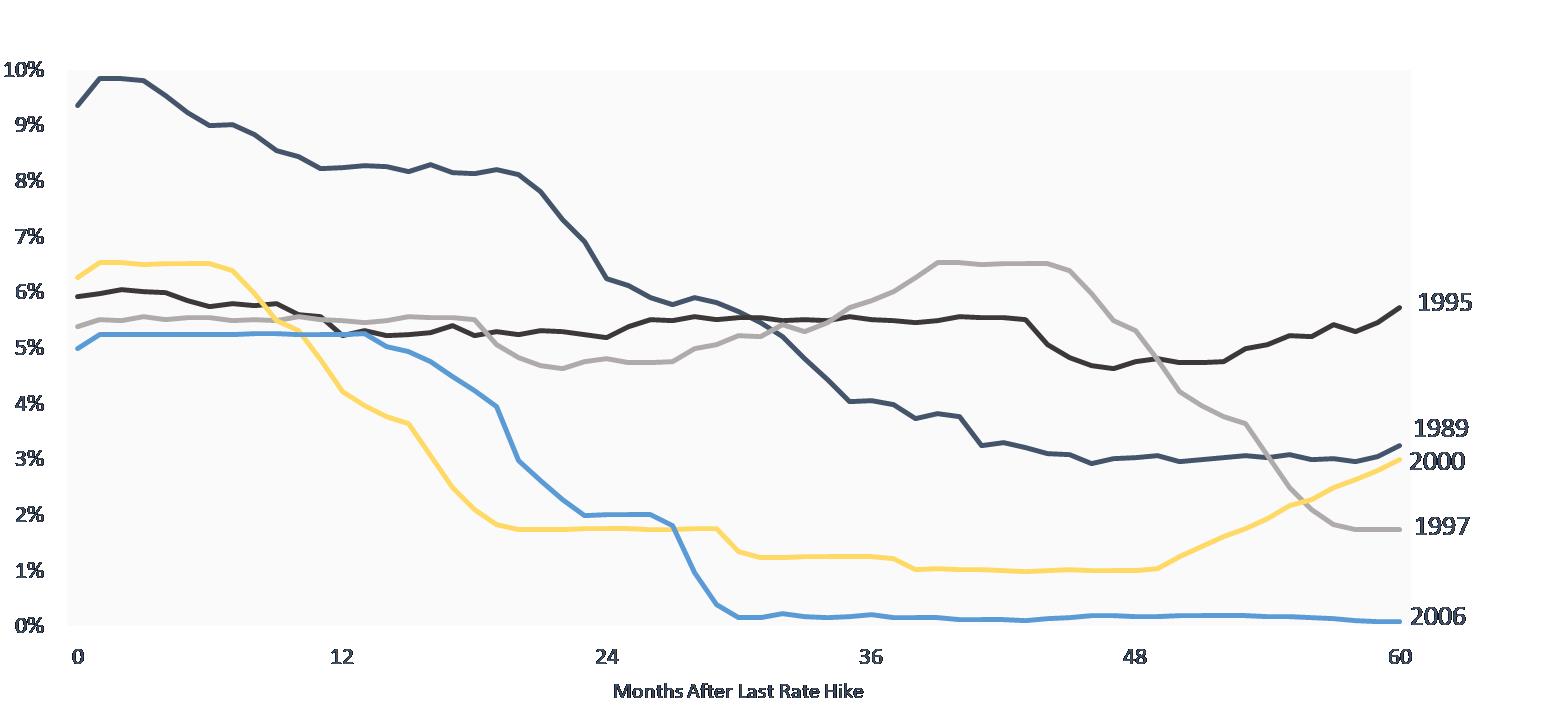

We’ve been peppering you with the consistent message that the Fed was done hiking and that once the Fed stops hiking, they usually don’t hike again for five years.

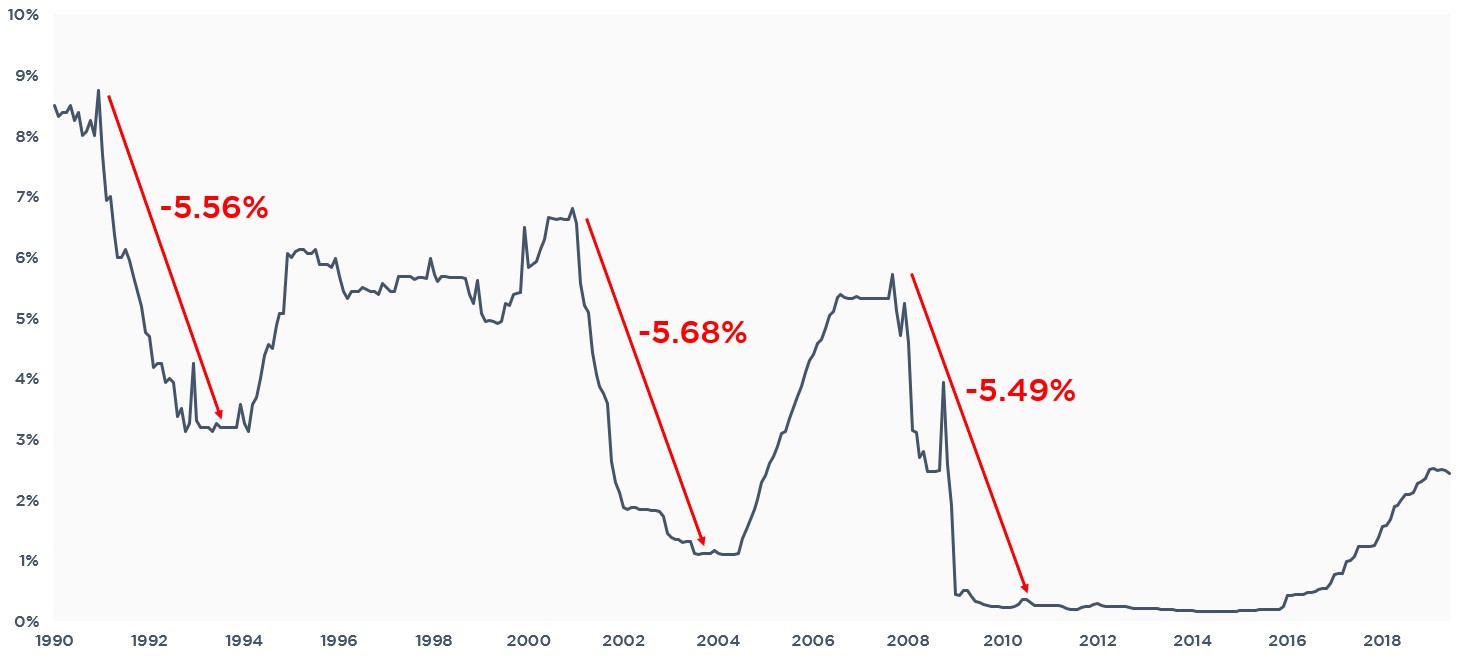

Let’s use a graph you should have seen before now to set the stage. Here’s a graph illustrating what happens to LIBOR over a five-year timeframe once the Fed stops hiking. The takeaway – the Fed has never hiked again within 36 months and usually cuts rates pretty dramatically within two years.

But how accurate is the market at predicting the path of rates once the Fed is done hiking?

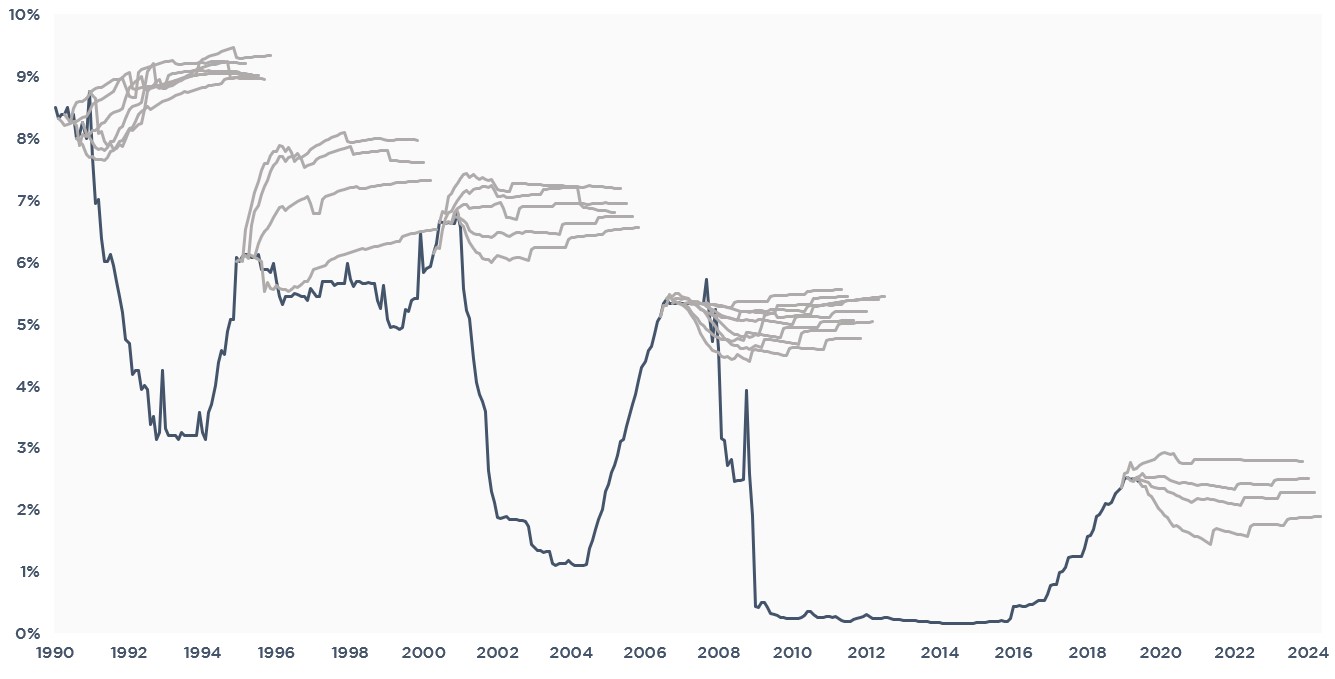

Hairy Graph – End of Tightening Cycle

Here’s our infamous hairy graph. The solid blue line is actual LIBOR. The grey lines are forward curves at various times once the Fed has stopped hiking. As you can see, the market usually overestimates the path of LIBOR. I suspect this is where we were in December.

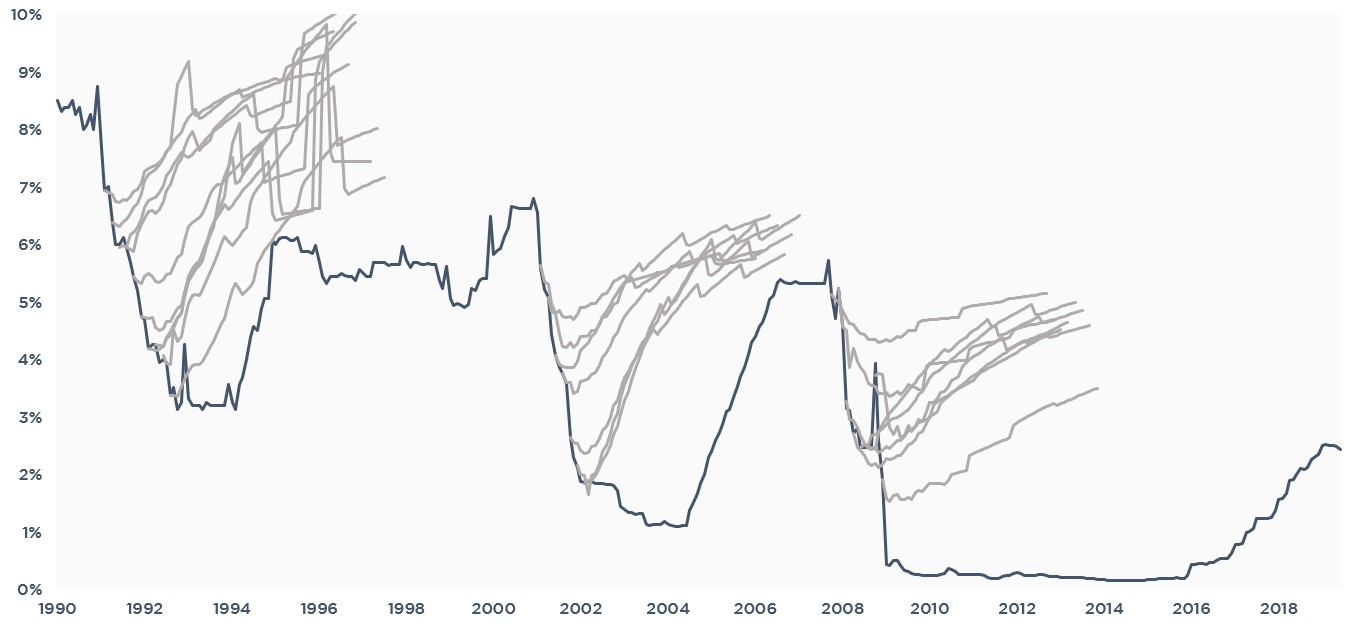

Hairy Graph – During Cut Cycle

How accurate is the market at predicting the path of rates once the Fed actually starts cutting rates? Turns out the market is consistently too optimistic about the path of LIBOR. When actual LIBOR falls, the forward curve consistently projects a return to higher rates.

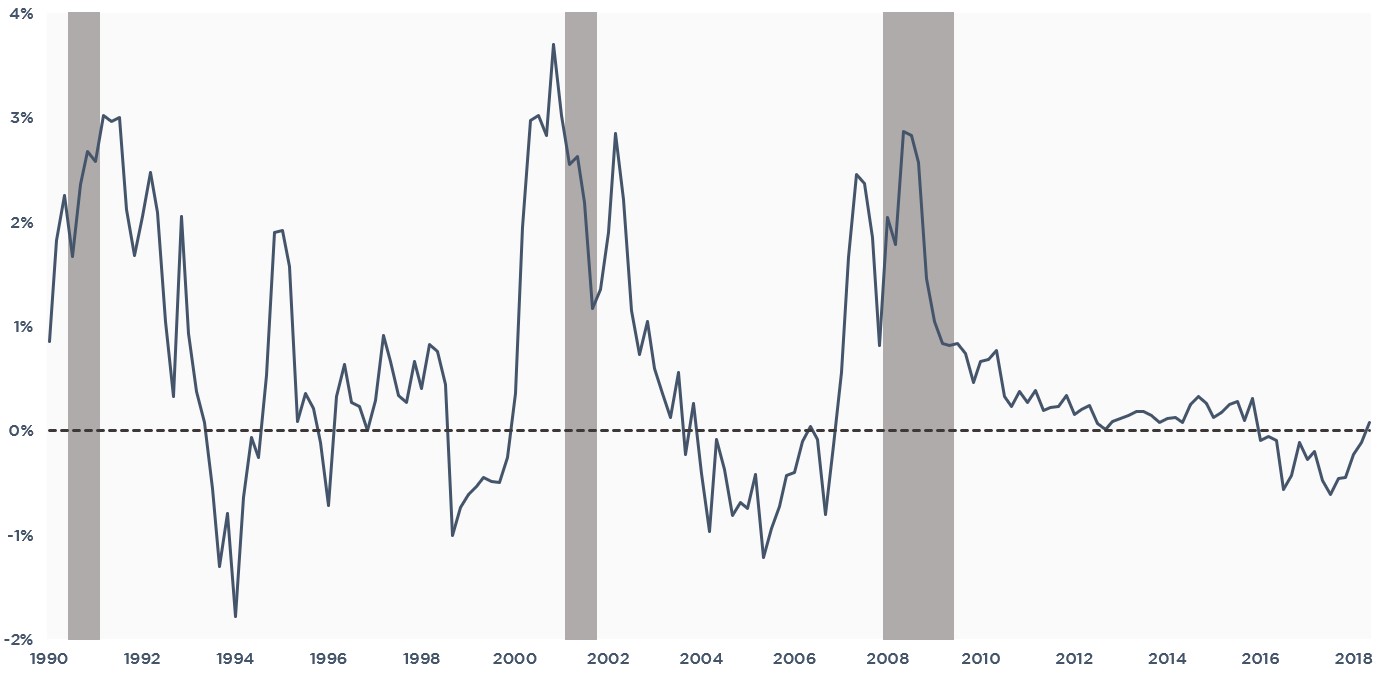

Forward Curve Accuracy – 1 Year Out (Curve – Actual 1mL)

What’s the magnitude of inaccuracy? This graph shows how much the market overestimated or underestimated the path of LIBOR. The peaks usually come right before a recession, meaning that the market overestimated LIBOR by at least 3.00%. Again, there’s a chance December was a peak.

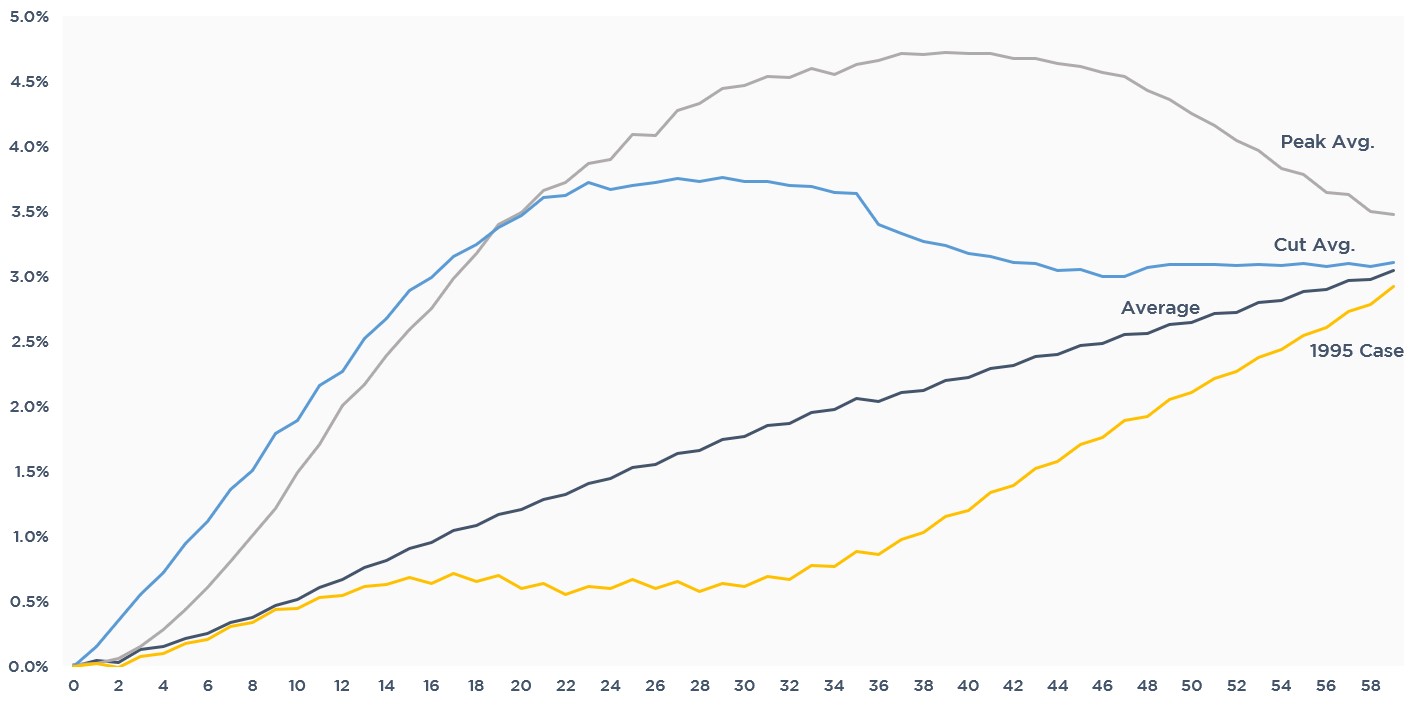

Forward Curve Accuracy (X-axis = Months from Forecast Date)

The market almost always overestimates the path of LIBOR. It doesn’t matter if the Fed is hiking or cutting, the market expects LIBOR to be higher than it ends up being. Over a 60-month timeframe, the market is usually wrong by about 3.0%.

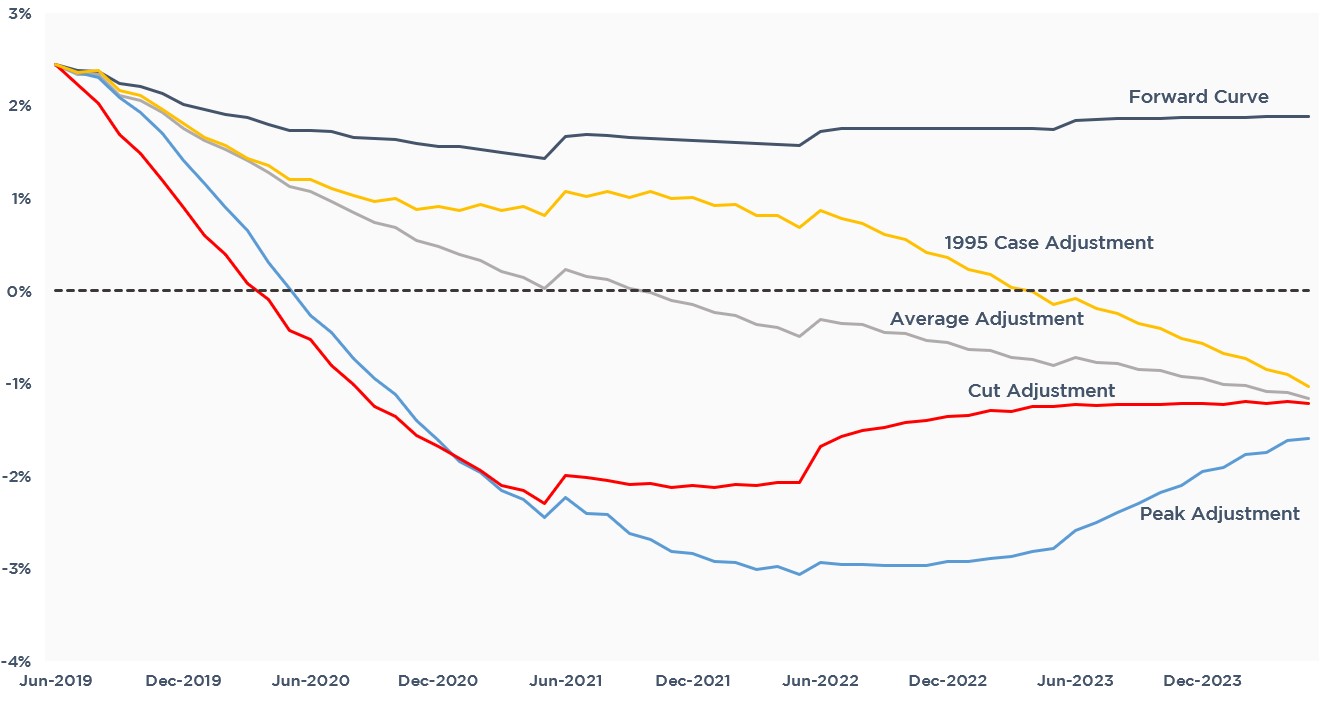

What do Those Adjustments to Today’s Forward Curve Look Like?

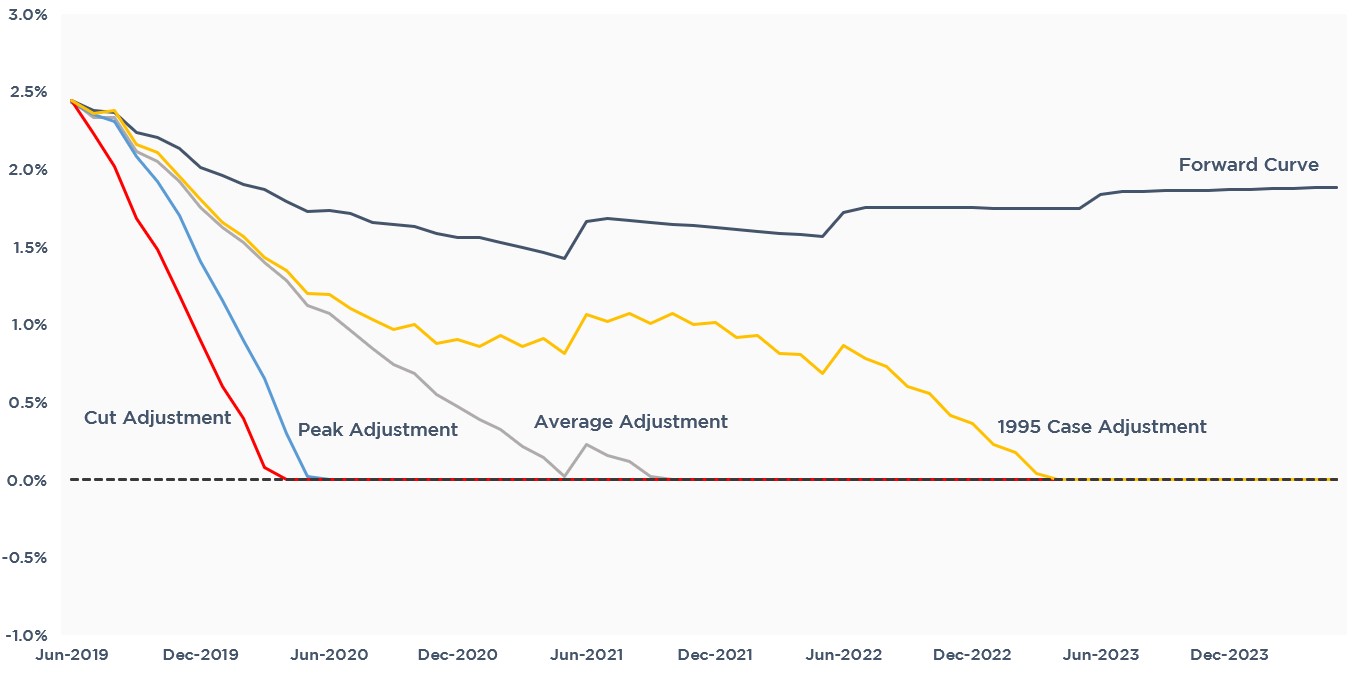

Correcting the current forward curve to account for that inaccuracy would look like this over the next four years.

Even if you believe (like I do) that December was the peak and the current forward curve should be adjusted back to those higher levels, every one of those scenarios still results in negative interest rates at some point in the next 5 years.

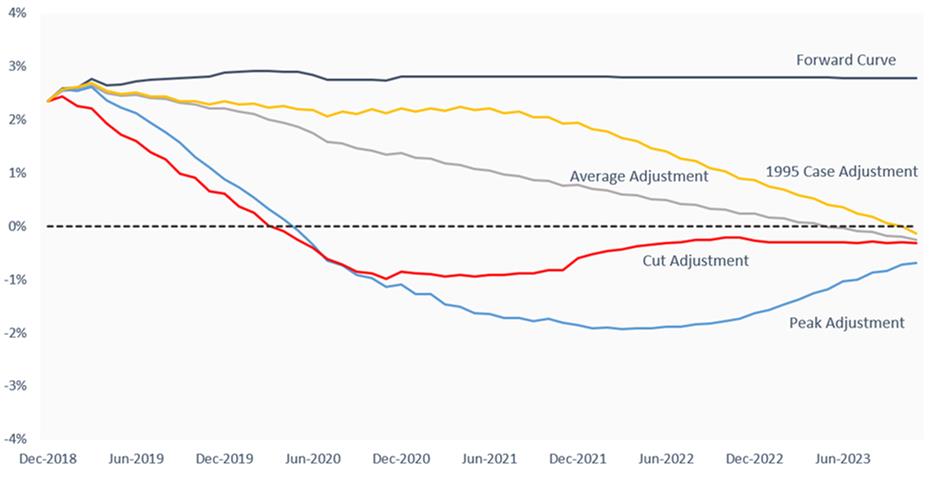

What if December Was the Peak?

1995 Redux?

If you’ve been reading the newsletter recently, another consistent theme has been that 1994 – 1995 was a bit of an oddball in Fed cycles. The Fed hiked rates 2.50% and then quickly cut rates by 0.75%. This likely extended the economic expansion and helped avoid a recession.

If Powell follows suit this year, it could help extend the expansion as well. But even if that happens, it only delays an eventual cut to 0%. Instead of ending up at 0% in a year, we get there in four years.

0% Boundary – Negative Rates

But I don’t think the Fed is bound by 0%. Sure, they may ramp up QE again and take other measures like interest on excess reserves, but I think the Fed will start sending signals about its ability (not desire) to take rates negative, even if they have no intentions of doing so.

The Fed wanted to get to 3.25%. It stalled out at 2.50%, falling 0.75% short. The market is worried that 2.50% worth of room to cut rates is not enough to fend off a recession. But that assumes the Fed is limited by 0% interest rates.

If, instead, the Fed can convince the market it can take rates to -0.75%, then it really has 3.25% worth of room to cut rates…the same amount of ammo it would have had if it had gotten to 3.25% and the floor was 0%.

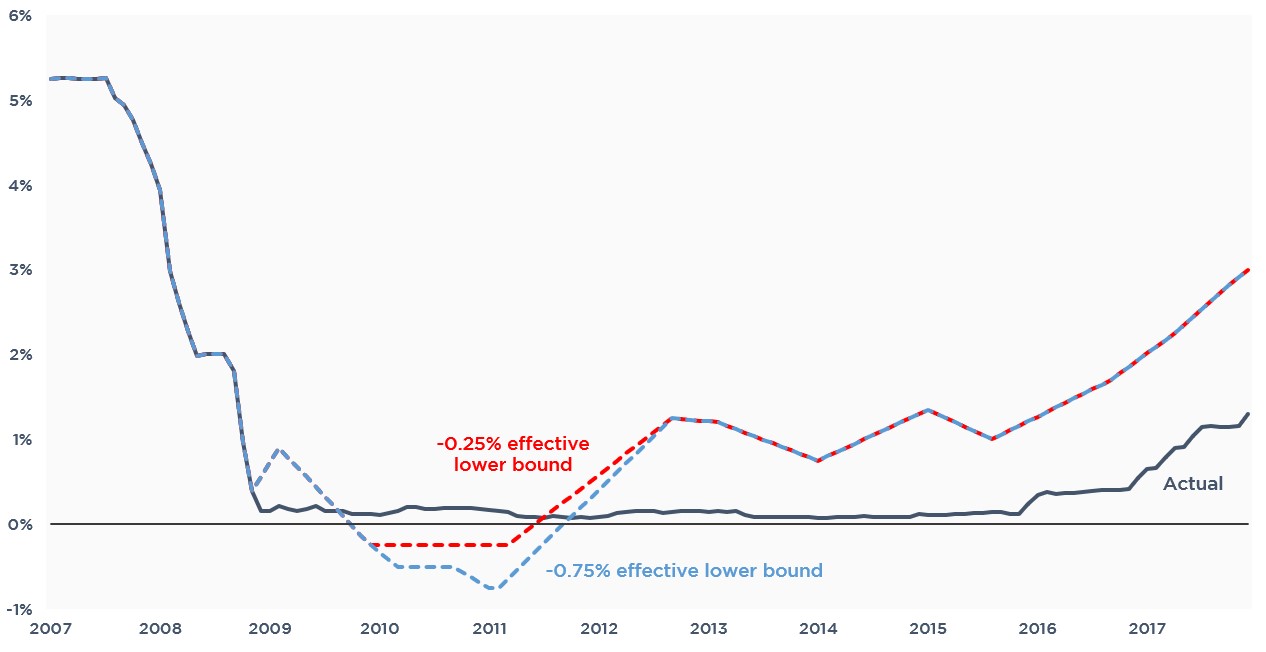

Oh, and don’t forget the Fed released a research paper earlier this year that concluded the recession would have been less severe and the recovery faster if the FOMC had taken rates negative.

Here’s a graph from that research paper that suggested rates would have rebounded much more quickly had the Fed gone negative.

Negative rates chatter doesn’t suggest the Fed actually believes it will have to take rates negative, just that it wants to convince the market it has more ammo than it is being given credit for.

Do not be surprised if we hear more and more about negative interest rates over the next year if the economy weakens significantly.

Enough Ammo?

Notice how in the last three easing cycles, the Fed has cut rates about 5.50% – and the starting point didn’t matter. It didn’t matter if rates were at 9% or 7% or 6%, the Fed had to cut 5.50%.

And that is why the market is worried the Fed won’t have enough ammunition to fight the next recession.

Takeaway

You got bored with the graphs and my poor descriptions, so you scrolled down to get to the punchline, didn’t you?

So here it is – even with 3 rate cuts priced in the next year, the market is still probably too optimistic. There is a very real chance that LIBOR is at 1.00% or less in 18-24 months.

The 1995 cycle continues to offer hope. If the Fed can intervene quickly enough and aggressively enough, we may experience a temporary reprieve. But even then, LIBOR was materially lower within a few years.

It seems increasingly likely that we have experienced the top of the LIBOR market and we will not be talking about 3% LIBOR for at least 5 years.

This Week

China, Iran, and an FOMC meeting. What could go wrong?