CDC Says the Fed is Hiking in March?

What a crazy end to the year. We had multiple months this year that were the busiest ever, and then December was 2x any of those. It was insanity.

I never got around to my lead pipe lock predictions or my review of last year’s predictions. Some have emailed me to politely suggest that maybe I was avoiding the review given how wrong I have been about inflation. Life hack – you don’t have to swallow your pride if you don’t have any to begin with!

With a sport tournament all weekend, I still haven’t found the time for my predictions, but I did review last year’s predictions and have included that report card at the end of today’s newsletter.

Last Week This Morning

- 10 Year Treasury hit 1.78%, the highest level since January 2020

- German bund testing positive territory at -0.05%

- 2 Year Treasury spiked again to 0.86%

- LIBOR at 0.11%

- SOFR at 0.05%

- The economy added 199k jobs last month, well below forecast

- Although the unemployment rate dropped to 3.9%, that is heavily influenced by the labor force participation rate

- The underemployment rate fell from 7.8% to 7.3%

- I’m going to start auctioning off newsletters as NFT’s so I can keep pace with wage inflation

Jobs Report

The economy added 199k jobs last month, far less than the forecasted 450k. And that’s really before the effect omicron will have. But rates jumped?

Part of it is that the unemployment rate dropped to 3.9% vs 4.1% forecasted. I’m going to come back to that in a second.

I think the real reason is that average hourly earnings were up 0.6%. That’s 5 out of 6 months with surprise to the high side. Pair that with lots of job openings, and we have a very tight labor market that is struggling to induce people to return to work. You know what would probably help? More stimulus and another extension on student loan forgiveness.

The 3.9% UR isn’t as good as it appears when you consider the labor force participation rate. Using the participation rate from Feb 2020, the unemployment rate would be 6.3%. Plus, the “underemployment rate” is still 7.3%.

Black unemployment increased from 6.5% to 7.1%, which matters given how much focus Powell has put on a broad based and inclusive labor market recovery.

Yet none of this seemed to matter to markets as front end rates spiked.

The CDC says Don’t Fight the Fed

Following the job report, odds of a March rate hike hit 90%. This was basically 0% a few weeks ago. Only one of 66 economists surveyed three weeks ago predicted a hike in March.

Isn’t it possible the economy will be slowing just as the Fed starts hiking? Omicron could put a quick halt on the labor market recovery. Inflation may be peaking. GDP is being revised lower. I think the pendulum has swung too far too fast.

I think that’s why Powell is struggling to transition into rate hikes while the rest of the Fed grows increasingly hawkish. The minutes released last week showed growing support for hikes. Bullard even said the Fed should start hiking in March. Powell is increasingly in the minority.

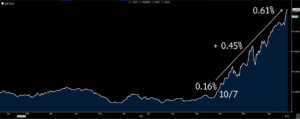

The one year swap rate is 0.61%, a staggering 45bp increase in three months. Over that time, the market went from expecting no hikes to expecting four hikes this year.

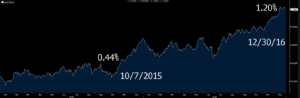

This pattern looks eerily similar to late 2015 right before Yellen hiked.

What happened next? There was a short-term retracing, but generally rates continued higher. I’m not sure we can dismiss this run up as being overdone.

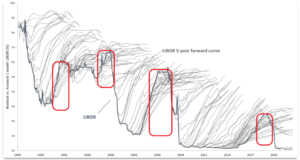

Here’s the part that really worries me – we might still be underestimating the path of rates. I sent this a month ago but it bears repeating. Right before a tightening cycle, the market underestimates the ultimate number of hikes.

What’s interesting about the recent spike in front end rates is that the ultimate landing spot hasn’t changed that much – just under 2.00%.

What has changed dramatically is the pace at which we arrive there. Three months ago, the market thought we would hit 1.50% in October 2025. Today, that timeframe is two years sooner – October 2023.

In other words, the market thinks the Fed hikes faster than expected but then levels off.

Treasurys

The 10T is unlikely to climb much above 2.00% unless the market changes its mind about the ultimate landing spot for Fed Funds. I think this will be a key theme in the months ahead.

Long term rates usually spike ahead of the tightening cycle, and then wait for short term rates to catch up, so don’t be surprised if the long end of the curve doesn’t experience as much upward pressure.

Bloomberg’s rate strategy team thinks the 10T will finish the year at 2.00%. Then again, last year at this time they thought it would finish 2021 at 1.00%…

Week Ahead

Nice quiet week oh wait no we get inflation data this week. CPI, PPI, and Michigan inflation expectations. It could be another crazy week.

UGA vs Bama…it’s the match up we deserve. Does UGA slay the Bama dragon finally?

As much as I want to think so, the CDC says don’t bet against Saban when he plays his former coaches.

Bama wins again, 35-27.

Read on to see what it feels like to make predictions in writing.

2021 Report Card – 12/31/2020 Predictions

Prediction #1 – Markets will do better than the economy

It’s hard to remember now, but heading into year end JPM was calling for a double-dip recession. I thought we would avoid negative GDP, but just barely. I was wrong! GDP did pretty darn well.

Q1 = 6.3%

Q2 = 6.7%

Q3 = 2.1%

Grade: D-

Prediction #2 – Inflation will not be a problem in 2021

Unless you’ve been living under a rock, you know I really nailed this one! Here’s Core PCE this year:

Q1 = 1.7%

Q2 = 3.4%

Q3 = 3.6%

Q4 is TBD, but should shake out around 4.5%.

I went so far as to include a Bart Simpson meme where on a chalkboard writes, “Inflation is not a thing.” Good call! Not only was inflation a thing in 2021, it was the only thing.

Grade: whatever is below an F- is what I got here

Prediction #3 – Vaccines will reveal our self-centeredness

This one is tougher to evaluate because vaccines were plentiful in NC. I was vaccinated right out of the gate, while our friends in NYC waited several months. I was surprised, however, by the vaccine backlash.

Grade: Incomplete

Prediction #4 – Lenders will increasingly issue new loans on SOFR, but LIBOR will still be around

Eat it! I finally got something right!

Grade: A++++++ (because I need a respectable average)

Prediction #5 – Financial Conditions will set the stage for a strong recovery…eventually

If you locked me away for a few years and then said, “JP, I’ll let you out if you can successfully predict how busy the company is. I will let you choose a single data point to use as a hint, what would you like to use?” I would choose financial conditions.

The end of 2015 and the first half of 2016 was very slow for us, which corresponds nicely with the graph below. Last year and this year have both been record years, which also corresponds nicely.

I was right about financial conditions being super accommodative, but surprised at how quickly “eventually” materialized. Grasping for respectability, I successfully negotiate with the teacher for partial credit here over what I meant by “eventually” and convince her I meant “by the end of Q1”.

Grade: B-

Prediction #6 – James Franklin will lose 5 games again yet be given a 10 year contract extension

OK, I made this one up, but I am still so stunned I had to include it. What are we doing!?! Nick Saban, the greatest of all time, only got an eight year contract!!

Prediction #7 – Fed Balance sheet never gets paid down

Time will tell, but I think the Fed will have a tough time reducing the balance sheet. By the time they really put a dent in it, it will be time for another recession.

Grade: TBD

Prediction #8 – An Inflation Shock is the Biggest Risk to Rates

Here’s what I wrote:

“I know I said inflation isn’t a thing. And I believe that. Certainly for the foreseeable future. But as my annual recap shows, I am wrong. A lot.

If inflation somehow becomes a threat, we could experience a dramatic spike in yields.

This could come in many forms. A surprise in the actual data. A misstep by Powell about tapering bond purchases. Massive stimulus (eg Dems win both Senate seats in GA and a $3T package is back on the table).

The prediction here isn’t that inflation will take off in 2021, but rather that a surprise represents the biggest risk to higher rates.”

Not only did I correctly call that, but I included the possibility of a Dem sweep in the GA special election!!! That counts for something right!?!?!

Grade: B+ because using a prediction as a hedge against an earlier prediction is just a cop out.

Prediction #9 – The Fed Remains Max Dovish

“The Fed won’t even so much as hint at the possibility for higher rates in 2021. Even though the country should be vaccinated by the second half, the true recovery will still be one to two years away.”

Welp, darn. I was looking good for most of the year because the Fed was max dovish right up until the end of the year. Those last few weeks tho…

Grade: B

Prediction #10 – The 10 Year Treasury will finish the year below 1.50%

In August 2020, I had made a wager with a client on where the 10T would finish the year in 2021. At first he wanted to wager that the 10T would break 1.50% at anytime during the year, but I balked. That felt possible. So I countered with where the 10T would finish the year. That wager was then memorialized as a year end lead pipe lock prediction.

On December 31st, the 10 Year Treasury began the day at 1.48%. I was hanging on by a thread. I had been wrong about inflation and GDP all year and the Fed was turning increasingly hawkish in the final weeks of the year…couldn’t the markets just toss me this bone? Please. Save some face as the sun set on the year?

Nope…the 10T slowly grinded higher over the course of the day and finished at 1.512%. FML. It was that kind of year.

Grade: B-, only because I have to believe the grading teacher is benevolent.