A Strong Job Report Doesn’t Mean the Fed is Hiking

Last Week This Morning

- 10 Year Treasury at 3.69%

- German bund at 2.33%

- 2 Year Treasury at 4.50%

- LIBOR at 5.19%

- SOFR at 5.08%

- Term SOFR at 5.14%

- Dallas Fed Manufacturing Activity Index came in at -29.1 vs-18.0 expected

- Nonfarm Payroll came in at 339K vs 195K expected

- Unemployment Rate increased to 3.7% from last month’s 3.4%

- Notably, the participation rate was unchanged so the jump isn’t attributable to more people looking for work

Jobs and June 14th FOMC Meeting

The economy added 339k jobs last month, well above the forecast of 190k. Plus, the last two months were revised higher. So why does the market have just a 25% chance of a hike next week?

Because everything else about the report was pretty weak. Consider:

- The unemployment rate climbed to 3.7%, up significantly from 3.4%, and the biggest jump since April 2020

- The number of unemployed persons actually increased by 440k

- The household survey showed the biggest single-month increase in jobless rate since April 2020

- Jobless rate hit a seven month high

- Average hourly earnings m/m fell from 0.5% to 0.3%, which would translate into 3.6% on an annualized basis. The main takeaway here is that strong job growth is not creating material upward pressure on wages. This time last year, AHE peaked at 5.9%.

- Average hours worked in the week dropped to 34.3, the lowest since April 2020. This is considered a leading indicator as companies reduce hours before cutting staff.

This is one of those reports that fancy PhD wielding economists would described as “mixed”, which only reinforces in my mind that the Fed will hold off next week while stressing that a July hike is on the table.

While the odds of a hike next week are just 25%, the odds of a hike at either of the next two meetings is 68%. I think this overestimates the probability of a hike in July, but I do believe the Fed will position a pause as an opportunity to evaluate more data before making a decision.

More importantly, the odds of a cut by year end have dropped from 99% to 42%. That makes way more sense to me.

Remember - the goal is to tame inflation, not make Americans lose jobs. Most of us believe that the job market must contract in order for inflation to fall back to acceptable levels, but what if it doesn’t? Or if the lag is long enough that we can’t really make an informed decision today.

We get CPI in one week, which is expected to fall from 4.9% to 4.1%. Remember, this was 9.1% less than a year ago. The Fed views this as substantial progress. Is this progress meaningless without job losses? I don’t think so.

And that’s why a strong job report alone doesn’t mean the Fed is hiking next week.

Hi QT, Bye QT

The good news is that we survived the debt ceiling debate. The bad news is that the resulting surge in Treasury issuance is going to significantly impact liquidity.

Since January, the Treasury has been living off of cash, rather than issuing new bills/bonds. Cash that would have otherwise moved into Treasury obligations have been sitting on bank balance sheets. Now, that process is going to reverse course in very short order, roughly 5x the typical pace. The Treasury will flood the market with new IOUs, they will be snatched up, and money will flow out of banks and into the Fed’s coffers, where it shall sit.

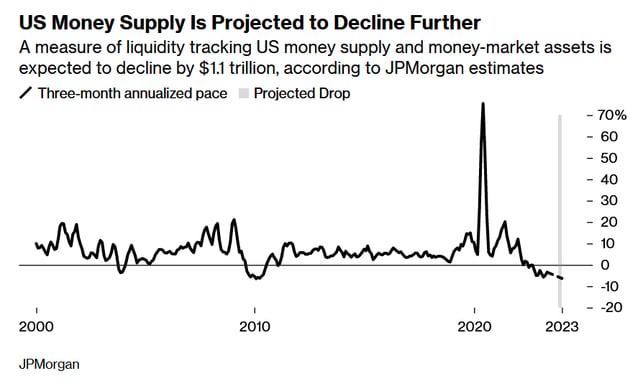

JPM expects this to reduce total market liquidity by over $1T in a very short amount of time. Remember, the Fed initiated QT about a year ago and thus far has reduced holdings by just $600mm. Now we’re going to reduce liquidity by $1T in a couple of months? And that’s on top of QT? And that’s when money supply is shrinking for the first time in history?

“We are shifting from a very significant tailwind of global central bank liquidity over the last six months to probably a significant headwind,” said King, a global markets strategist. “What we really care about is reserves, which should be falling. So I’m strongly leaning to risk-off at this point.”

By Bank of America Corp.’s estimate it would have the same economic impact as a quarter-point interest-rate hike. There’s another reason for the Fed to pause next week. I also think it means they pause QT.

Three of the four biggest bank failures in US history have occurred in the last 3 months and liquidity is being removed from the system at an unprecedented pace.

Although I wish the Fed would just announce a pause, I give them credit for at least taking a more nuanced approach to hikes. Three months ago, Friday’s job report would have caused debate between 50bps and 75bps. Despite the headlines suggesting a rate hike is locked in, I think that’s a stale mentality.

I am not even sure the Fed is that data-dependent anymore. Or, at least not data dependent on things like jobs and inflation.

The Fed’s dual mandate is labor and inflation, but the supermandate is financial stability. The cracks in the system suggest the Fed shouldn’t pile on right now.

Week Ahead

Pretty quite week, with minimal data and the Fed going dark ahead of next week’s meeting.