A Resilient Job Market Doesn’t Normally Dictate FOMC Policy

Last Week This Morning

- 10 Year Treasury down to 3.49%, the lowest level in two months

- German down 15bps to 1.82%

- 2 Year Treasury down to 4.27%

- LIBOR at 4.18%

- SOFR at 3.82%

- Term SOFR at 4.19%

- Nonfarm payrolls came in at 263,000 vs expected 200,000

- PCE MoM came in as expected 0.3%

- Core PCE MoM came in at 0.2% vs expected 0.3%

- Unemployment came in as expectation at 3.7%

- Average Hourly Earnings MoM came in at 0.6% vs expected 0.3%

- Average Hourly Earnings YoY came in at 5.1% vs expected 4.6%

Are We Too Focused on Jobs?

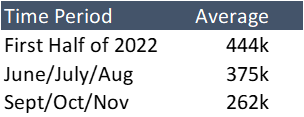

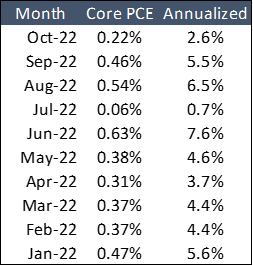

The labor market continues to be described as “resilient”, but is it? Hiring is clearly slowing.

Furthermore, rate hikes don’t immediately translate into jobs losses. Here’s Fed Funds and Nonfarm Payrolls (red) with a dashed line at 0 jobs gained/lost. In previous cycles, we don’t don’t start experiencing job losses until at least a year after the Fed started hiking.

Source: Bloomberg Finance, LP

Source: Bloomberg Finance, LP

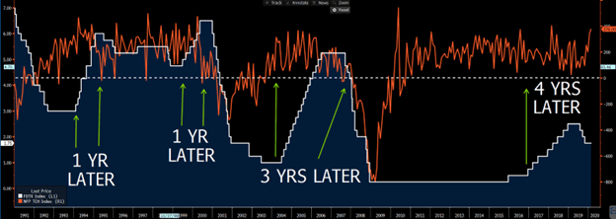

In fact, take a look at how jobs typically perform in the six months leading up to the Fed pause. Does the current job data really feel that much different?

With this context, why are we treating a 260k print as if it’s an outlier when it’s following the same pattern as before.

I’m not suggesting the labor market is weak. I’m suggesting it’s a poor indicator of when the Fed will pause.

Inflation

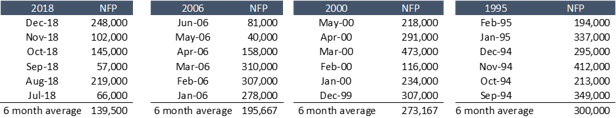

Core PCE, the Fed’s preferred measure of inflation, mercifully showed some progress. The monthly data was forecasted to come in at 0.5%, but came in at just 0.22%. This is a huge win.

While it’s not quite as straightforward as multiplying by 12 to arrive at an annualized number, it’s directionally correct. Below is what an annualized number looks like. Now it’s really a matter of whether this is the new trend or another pump fake like we saw over the summer.

This all but guarantees a 50bps hike next week, which will put Fed Funds upper bound at 4.50%. The Fed will get one more CPI print before the rate announcement.

Week Ahead

Next week may start off quiet with no Fed commentary ahead of the December FOMC meeting. Markets will be watching for PPI and UMich inflation expectations later in the week.