A 1.00% 2.00% 10 Year Treasury?

Last Week This Morning

- 10 Year Treasury spiked to 1.896%

- German bund spiked to -0.45%, the biggest weekly sell-off in four years

- German 30yr flipped positive

- Japan 10yr also moved up to -0.24%

- 2 Year Treasury spiked to 1.80%

- LIBOR at 2.02% and SOFR at 2.20%

- Inflation data came in above expectations

- US budget deficit surpassed $1T through first 11 months of the fiscal year, the highest since 2012

- AB Bernstein released a report suggesting total US debt is approaching 2,000% of GDP

- Trump called for the Fed to cut rates to “0% or less” and referred to the FOMC as “boneheads”

- The UK is definitely not barreling towards a constitutional crisis

- Argentina is set to default again and the market doesn’t seem to care

WTF Just Happened?

The 10 Year Treasury had one of its biggest weekly spikes in history. Fortunately for me, it came during the week of a newsletter I entitled, “A 1.00% 10 Year Treasury?” Perfect timing. I even doubled down in my concluding paragraph, “As we discussed at length above, inflation is a big influence on 10T yields. Barring a shocking number one way or the other, it seems unlikely the 10T will move dramatically ahead of next week’s FOMC meeting.” While inflation did surprise to the upside, it wasn’t by a shocking amount. So what happened?

Reason # 1 – The ECB Brought the Dovish Hammer

In 2012, ECB President Mario Draghi proclaimed he stood ready to do “whatever it takes” to backstop the eurozone economy. He slashed rates, turned on the printing presses with QE, and enacted several other policies all meant to help Europe avoid a freefall into the financial abyss. When you wonder why Italian bonds are yielding the same as US Treasurys, it’s because of that statement. Buyers of Italian bonds believe it comes with an implicit ECB guarantee. Bond investors aren’t buying Italian credit, they are buying ECB credit.

Draghi’s intervention worked. While the eurozone never recovered quite as strongly as the US did, it also avoided a meltdown. Peripheral countries like Portugal and Spain did not default on debt, which was a huge topic back in 2012.

As Draghi’s eight-year term as ECB President comes to a close next month, this week’s announcement likely served as his penultimate dovish farewell. The ECB cut rates to even more negative, started up QE again, and said it stands ready to intervene even more aggressively if needed.

“The Governing Council reiterated the need for a highly accommodative stance of monetary policy for a prolonged period of time and continues to stand ready to adjust all of its instruments as appropriate to ensure that inflation moves towards its aim in a sustained manner, in line with its commitment to symmetry.”

It is the open-ended nature of the commitment that warmed the hearts of investors. There’s no financially responsible light at the end of the tunnel we need to worry about. Liquidity forever! The market rejoiced. Rates spiked. The central bank backstop is still in play – risk on!

A more cynical observer (not me) would note that the ECB just exited accommodative measures just nine months ago. Trillions of euros in accommodation bought 9 months of hands-off monetary policy. Congratulations, I guess? More of the same sounds like a great plan.

Never mind that that the ECB also lowered growth and inflation forecasts, or that Germany is flirting with a recession, or the fact that the ECB felt it necessary to take these steps in the first place. The government is back in the bail out business, so get out of those bonds and into something with a little more yield.

Reason #2 – Inflation Expectations

Core CPI increased by the most in a year, coming in at 2.4% vs expected 2.2%. While CPI is not the Fed’s preferred measure of inflation, at a minimum it suggests inflation isn’t falling.

It is hard to overstate the correlation between inflation and bond yields.

The Democratic debate featured fights over who could spend the most on healthcare. Somehow, impossibly, Biden’s $750 billion is the fiscally responsible number. The Bernie plan, according to a George Mason study, could cost as much as $32 trillion.

Rates spiked after Trump was elected as traders tried to front run inflationary policies. If a Democrat wins next year, it sounds like we can expect a lot of government spending. And with Trump getting more and more nervous about the economy, markets are starting to price in more stimulus before the election. Maybe more tax cuts? A spending package? Infrastructure bill? Removal of Powell and the appointment of Draghi? Are there any steps Trump won’t take to avoid a market swoon right before an election?

Never mind that the Fed’s target of 2.0% references Core PCE, which doesn’t come out until the end of each month. Last month’s reading is just a few weeks old and we’re already forgetting that it was just 1.6%?

Reason #3 – China

Increasing tensions with China have been pushing down yields all year. Global manufacturing is already in a recession and this dispute will only make things worse.

At the start of the week, China announced it would exempt 16 categories of US goods from additional tariffs. Trump responded by postponing the tariff increases from Oct 1 to Oct 15 as a “good faith” gesture (Oct 1 marks this government’s 70th birthday). Trump then suggested he could accept an interim deal with China.

China announced that it will exclude imports of U.S. soybeans, pork and other farm goods from additional trade tariffs. Both sides are sending signals that they wish to avoid further escalation. If these guys aren’t careful, people are going to start wondering if there’s something going on…

Here’s the thing – the market doesn’t care if it’s a good deal or not, it just wants the pain to stop. Trump could make all sorts of concessions just to get a deal done to avoid losing the election, and markets won’t care one bit. Markets are about immediate gratification and positive news on the China front translates into…wait for it…wait for it…risk on!

Never mind that we’ve been down this road before, pump fake after pump fake. Or that the lasting economic damage will really be felt 6-12 months from now. Or that China holds all the cards knowing Trump has an election to deal with…

Reason #4 – Jay Powell & Co

The market took the aggressive ECB measures and extrapolated it into our own central bank’s policies. We’ve been saying all year that one of the key requirements for higher 10 Year Treasury yields are rate cuts by the FOMC. It sounds counterintuitive, but rate cuts imply a government backstop, lower interest expense for businesses (good for stocks), lower mortgage rates, etc… and market sentiment turns risk on! Are you sensing a theme here yet?

The Fed will cut rates 25bps this week. The recent market optimism means future cuts are less likely, but this one is baked in.

The market reaction won’t be driven by the rate decision itself because 25bps is a done deal. It will be driven by the Fed-speak around the decision. Consider two extreme examples to illustrate the point:

– 25bps cut with a statement that the Fed won’t cut again because everything is great and there’s no recession coming

– 25bps cut with a statement that the Fed will be cutting rates an additional 75bps over the next 12 months

Neither of those are likely and the message will probably fall somewhere in between. But if you think of those two outcomes on a dove/hawk spectrum, where Powell lands will dictate market response.

Market Happy/Risk On/Higher Rates Market Disappointed/Risk Off/Lower Rates

Dove ————————————————————-Neutral————————————————————-Hawk

Collectively, the actual FOMC statement, the updated forecast for Fed Funds, and Powell’s Q&A will drive the market’s interpretation of the Fed’s position and thus the response.

Never mind that as recently as a month ago the market was puking over Powell’s refusal to describe the last rate cut as anything except a mid-cycle adjustment. Or that Powell has never been as dovish as Draghi. If Powell disappoints, not just this week but for the rest of the year, the recent move up in 10yr rates could reverse.

If you’ve started skimming and are now reading this without the benefit of everything before it, I want to really drive a point home: the 10 Year Treasury will not fall on Wednesday because of a 25bps cut by the FOMC.

Say it with me again: the 10 Year Treasury will not fall on Wednesday because of a 25bps cut by the FOMC.

A 25bps cut is already priced in. If the 10T falls on Wednesday, it will be due to a deviation from expectations. The market expected one thing and got another. But if the market gets exactly what it is expecting, rates won’t move. The most likely cause of a deviation isn’t the rate decision itself, but the message the Fed delivers through the statement and Powell’s Q&A.

10 Year Treasury

Now that we’ve discussed why the 10 Year Treasury spiked last week, let’s dive into some graphs.

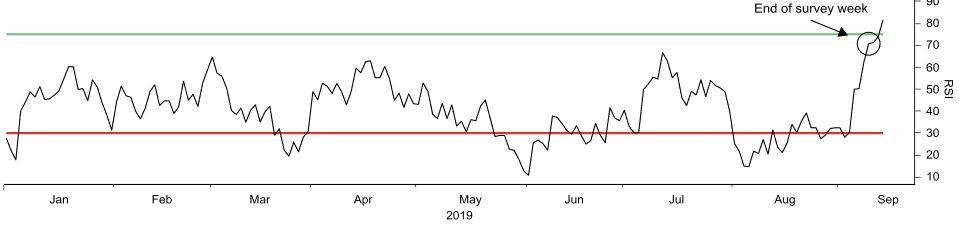

Here’s that same Relative Value graph that BNP puts out. As you can see, last week’s spike put the 10T into dramatically oversold territory. That suggests there should be some retracement.

In addition to the reasons outlined above, the magnitude of the movement was exacerbated by algo trading platforms, not human traders. As we’ve discussed in the past, there’s a mentality among real traders to get out of the way once the computers start triggering buy/sell orders.

In the good ole days, a big movement would be limited because eventually someone would say, “that’s absurd, I will buy/sell now.” Today, they get out of the way and wait for the dust to settle. This creates an environment where really large swings are possible in short order.

The 10 Year Treasury has now tested 1.40%-ish three times in history, all within the last 7 years.

On the previous two occasions, the 10 Year Treasury rebounded sharply in the subsequent six months. And I mean sharply. We’re up 30bps on the week, so we could have more than 1.00% to go.

Here’s a really interesting takeaway – the amount of global negative yielding debt dropped $4 trillion because of the recent uptick in rates. For example, the German 30 year bund spiked to 0.12%. All that 30yr debt became positive yielding overnight (albeit just barely).

Takeaways

Remember, there is a difference between markets and economies. The movement last week was driven by market euphoria, not a fundamental change in the health of the global economy. The weight of slow growth and low inflation will likely serve as a drag on yields over the long term, but that doesn’t mean markets won’t oscillate violently along the way.

This Week

FOMC meeting is the headliner. Trump will probably complain the decision wasn’t dovish enough and blame Hillary’s emails for appointing Powell as Fed Chair. Any news on the China front will also be significant.