75bps or 100bps?

Our weekly Rate Guy podcast marks its 100th episode this today. The podcast is my wife’s passion project, not mine. Two years ago, trapped in quarantine, I decided to humor her and give it a shot. I figured it would die a natural death because who wants to listen to interest rate talk on a Monday morning?

Against my best efforts, that has not been the case. Every “I love your podcast!” email we get puts me that much further away from not having to do it. Making matters worse, I am not receiving the diva treatment I so richly deserve if this podcast is indeed such a smashing success. It’s the worst of both worlds.

So if you haven’t been listening - thank you.

Last Week This Morning

- 10 Year Treasury down to 2.75%

- German bund down to 1.04%

- 2 Year Treasury at 2.97%

- LIBOR at 2.25%

- SOFR at 1.53%

- Term SOFR at 2.28%

- The ECB hiked more than expected, 50bps, officially exiting negative interest rate territory

- NAHB home builder sentiment experienced the second largest drop on record, after only April 2020

- Every possible measure of housing shows that the 2% increase in mortgage rates since the start of the year is cooling off the market rapidly

- Philadelphia Fed manufacturing index came in at -12.3 vs expected 1.6

- Leading economic indicators came in at -0.8% vs expected -0.6%

A Tale of Two Inflations

The question for Wednesday’s FOMC meeting is 75bps or 100bps? Last week I wondered whether SOFR might be at 4% by year end. Bloomberg economists are now calling for 5% Fed Funds. Floating rates are moving higher, faster.

We spent last week illustrating the pain in current inflation readings. It’s undoubtedly brutal.

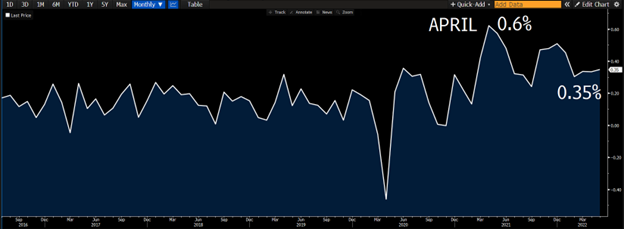

Core PCE, the Fed’s preferred measure of inflation, appears to be accelerating again. It comes out Friday and is forecasted at 0.5%, up from 0.3% last month. Remember, right now monthly data is more important than annual data.

Source: Bloomberg Finance, LP

Source: Bloomberg Finance, LP

But this reading is a result of missteps last year, not anything in the last few months.

That is the challenge the Fed is facing – pull a lever today, wait a year, measure the impact. Toss in a Russian war, a huge economic slowdown in China, and some political pressure and the impossible becomes the impossibler.

The Fed’s challenge is a tale of two inflations.

- Backward looking inflation readings are out of control - do more!

- Forward looking inflation readings are collapsing - you are putting us into a recession!

Pull a lever, wait a year, measure the impact. Good luck.

The reason the market is puking is because it believes the Fed policy will have the intended effect of breaking the back of inflation, but at the expense of the economy.

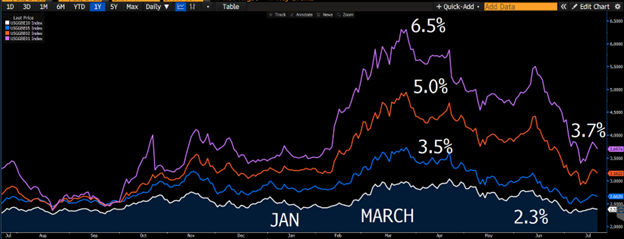

Since the first hike in March, market inflation breakevens have dropped considerably. In the graph below, we’ve included 1yr, 2yr, 5yr, and 10yr inflation expectations. The one year has dropped from 6.5% to 3.7%. Mark this down as a W for the Fed so far. I would expect Powell to highlight this Wednesday. I know I would.

Source: Bloomberg Finance, LP

Source: Bloomberg Finance, LP

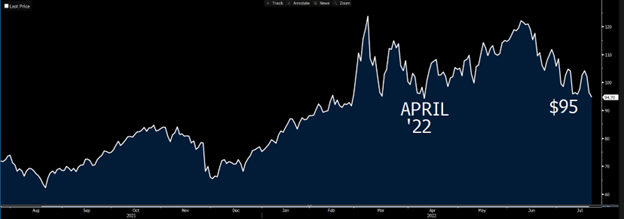

Oil is below $100/barrel, its lowest point since April. This isn’t necessarily tied directly to Fed policy, but it will help Powell paint a picture that relief is on the horizon and he shouldn’t overreact today.

Source: Bloomberg Finance, LP

Source: Bloomberg Finance, LP

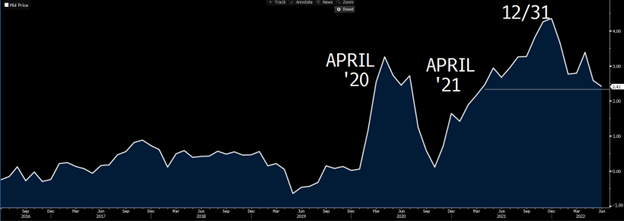

Supply chain pressures are at the lowest point since April of last year.

Source: Bloomberg Finance, LP

Source: Bloomberg Finance, LP

Anything that is forward looking suggests falling inflation.

Anything that is backward looking suggests we are in the thick of it.

Powell will spend Wednesday’s Q&A reinforcing a message of vigilance and patience. It is working, it will just take time.

Demanding more action today doesn’t mean a lower CPI reading next month.

75bps or 100bps?

I see three potential scenarios for Wednesday’s decision.

Scenario 1 - 75bps Hike

This is the most likely outcome, pushing Fed Funds to 2.25%. It’s tough to say what the market response will be since Powell’s Q&A will outweigh the decision. Here’s my best guess barring an outlier statement by Powell.

- 2T higher

- 10T higher

- Stocks higher

The market will just be relieved it wasn’t any worse than 75bps.

Scenario 2 – 100bps Hike

The market is pricing in about a 30% chance of a full point hike, which would push Fed Funds to 2.50%. The market takeaway here would be “the pain is going to be worse than expected.”

- 2T much higher, maybe 3.25%+

- Caps more expensive

- 10T flat-ish

- Stocks down

Scenario 3 – Other

This is incredibly unlikely, but if the Fed were to hike by something more dramatic, say 150bps, the market will puke.

- 2T much higher, maybe 3.75%

- 10T lower

- Stocks way down

Note that “other” does not contemplate a 50bps hike. That is not happening. Other means something more than 100bps.

My Best Guess?

I think the Fed will hike 75bps and Powell will emphasize the lag effect rate hikes have on inflation. Overreacting to current inflation could deepen the pain on the other side. It’s a matter of when, not if. Inflation will break. Overdoing it now just makes the fallout worse.

Doing 100bps Wednesday won’t change next month’s inflation reading. Powell will focus on this message while pointing out the impact Fed policy is having on forward looking metrics as a success.

2 Year Treasury

Friday’s plunge below 3.0% feels overdone and even just using back of the envelope math from the forward curve, it should really be around 3.15%.

Current inflationary readings are elevated and accelerating. The Fed has not been given signs of hope that would allow it to ease off the brakes. Why the 2T is falling is a mystery to me.

Caps got cheaper last week. Don’t be surprised if that was a short-term blip. I expect the 2T to climb again.

10 Year Treasury

The 10T falling is less of a mystery. The Fed has not gotten the monthly inflationary relief it was hoping for and when state school kids in NC are suddenly worrying about the potential for 4% Fed Funds, that means a more painful recession.

The result - flight to safety.

Inversion

We’ve talked about how the typical yield curve inversion is about 16bps, so the current inversion of 22bps is more than usual.

But I think it could be much deeper.

The 2T has to react to Fed policy. If it starts looking like the Fed will hike to 4%, the 2T has to move higher, otherwise you would take your money out of 2T’s and put it into Fed Funds.

But the 10T stretches out the investment time horizon. Even if you think the Fed is hiking to 4%, the 10T could stay flat or even fall. Sure, rates might pop over the next 12 months or so, but what about the 9 years after that?

A deeper inversion implies fears of a deeper recession. The soft landing is looking more impossibler by the minute.

Cap Escrows

You’re probably getting emails about escow reserves. If you haven’t, a $5k monthly cap escrow is now likely $60k. These get recalculated every six months and there’s a chance the next revision will actually be lower. But in the meantime, it will be much more painful.

Week Ahead

Aside from Jay$ on Wednesday, Thursday brings our first look at Q2 GDP. This is notable because Q1 was negative and Q2 is flirting with negative territory as well.

If Q2 shows contraction, the headlines you will read Friday in major newspapers will say, “The US is in a recession.”

Then, the more specialized periodicals and research emails you receive will say, “While the commonly accepted definition of a recession is two consecutive quarters of contraction, that’s not actually the official definition. “The NBER's definition emphasizes that a recession involves a significant decline in economic activity that is spread across the economy and lasts more than a few months.”

I don’t know what the economic equivalent of virtue signaling is, but this would be an example of it. Also, don’t invite these people to parties.

Whether we see actual contraction or just something anemic, the takeaway should be the economic universe has changed considerably in the last six months.

More earnings, inflation data, etc. And of course the Fed meeting.

This week is going to be nuts.