10 Year Treasury – First 100 Days

Last Week This Morning

- 10 Year Treasury settled into 1.08%

- German bund at -0.54%

- 2 Year Treasury flat at 0.13%

- LIBOR at 0.13%

- SOFR is 0.08%

- Core CPI came in as expected at 1.6%

- Core PPI came in slightly lower than expected at 1.2%

- Retail Sales ex autos much weaker than forecasted, -1.4% vs expected -0.2%

- Empire Manufacturing much weaker than expected, 3.5% vs expected 6.0%

- University of Michigan 1 year forward expectations came in much higher than expected, 3.0% vs 2.5% forecasted

- An impeachment and an inauguration – 2021 is off to a whiz bang start!

- I hope someone reminds Biden that the real minimum wage is $0

10 Year Treasury – First 100 Days

I’m not going to bother covering Fed Funds/LIBOR/SOFR because they aren’t moving for years.

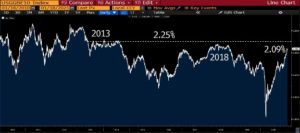

The 10T, however, is a different story. This is particularly true with the Democratic majority in the Senate now. Because of the expected additional stimulus, inflation expectations are also rising. Last week, the 10 Year Breakeven Inflation Rate climbed to its highest level since 2018.

Since the financial crisis, 2.25% on this index has been a key resistance level. Should expectations breach 2.25%, it suggests upward pressure on the 10T.

Kansas City Fed President Esther George may have frustrated some fellow Fed officials last week when she stated that inflation could hit the central bank’s average target inflation and also potentially push the Fed to taper its bond buying program earlier than expected. This is exactly the type of misstep we have been cautioning about. Bernanke casually mentioned tapering in 2013 and yields took off. What was she thinking?!

Fed Governors Brainard, Rosengren and Vice Chair Clarida immediately reassured markets by saying the current pace will continue through at least this year. Even Powell pushed back publicly. I suspect George got a text from Jay Money…

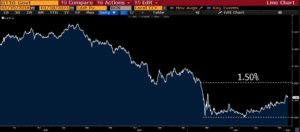

Goldman revised its year end forecast for the 10T to 1.50% (up from 1.30%). I can see that at year end, but I’m not so sure we will see that in the near term. It feels like the market is already pricing in everything going perfectly.

But what happens when vaccinations fall further behind schedule? Or Biden’s $1.9T stimulus plan encounters bumps in a narrowly controlled Congress? Increased restrictions as deaths surge and confidence plummets? Unemployment becomes more permanent?

And don’t forget our Treasury yields still look attractive relative to the alternatives. The German bund is deeply negative and Japan’s rates are being held at 0%. Once the 10T breaks through 1.25%, wouldn’t we expect to see foreign buying?

But the vaccine, right? Remember – the biggest risk to causing higher rates isn’t GDP, it’s supply. If supply spikes (more stimulus or reduced QE), that’s when yields take off. My cautious takeaway from that is positive news on the vaccine front will not necessarily create a dramatic movement higher.

Vaccine = GDP, not Treasury supply. We are likely rangebound for Biden’s first 100 days.

Boring call, I know. But in the six months following the worst of the financial crisis, the 10T doubled. That’s basically where the 10T is already trading. It’s tough to envision a dramatic spike from here over the next 100 days.

Election 2016 Review

I thought it might be interesting to review our first newsletter after the 2016 election.

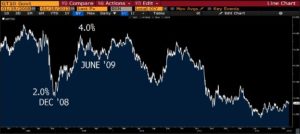

10 Year Treasury

Near term, we believe 2.25% is clearly in play, a key psychological level. In fact, the week after telling clients that 2.50% wasn’t possible on the T10 unless the German bund was at 0.80%, I have to concede 2.50% is a very real possibility.

Report Card: C-

The 10T hit 2.50% in mid-December and was range bound for over a year before starting a move toward 3.0%. Brownie points for admitting I was wrong so quickly, but a low grade for failing to realize how a Trump win would mean higher yields.

Fed Hikes

I think the FOMC will closely monitor events over the next month for signs of “tightening financial conditions”. I had mistakenly assumed a Trump victory would translate into tighter financial conditions, leading to another Fed pause. If the market continues to respond favorably and job reports come in as expected or better, the Fed may certainly hike.

Additionally, I spent much of 2016 talking about how the flat yield curve prevented the Fed from hiking because it begged inverted yield curve discussions. With a 40bps move higher in one day, the yield curve can now easily absorb a 25bps hike. And Yellen may feel like uncertainty may only increase in 2017, so let’s squeeze a hike in while we know the economy can handle it.

I don’t buy that Trump is going to be pushing Yellen for higher rates. Certainly not if it affects the stock market or housing, right? Trump was enamored with the polls during the election, couldn’t he be equally enamored with the wealth effect in 2017 and beyond?

Above all else, Trump is a real estate guy. You’re telling me that the first real estate guy in the White House is going to be a big advocate for higher rates?

One yuuuuuge flashing warning – if Trump successfully pushes through a massive tax cut coupled with a huge infrastructure bill, the odds of inflation increase. The Fed will try to front run inflationary pressures without throwing the economy into a recession and the path of rate hikes can shift higher. Piece of cake, right?

Report Card: B-

It’s funny looking back and recalling that many people thought Trump would be a proponent of higher rates. The Fed did hike a month later, to my surprise. The Fed ultimately hiked to 2.50%, but it took two years.

It’s also a little funny realizing we’ve been talking about an infrastructure bill for four years…

Stocks

With EPS straining all-time highs, it feels unlikely that stocks are dramatically undervalued.

The Dow was at 18k when I wrote that. Ouch. The only thing that aged worse in that newsletter was, “One of my favorite comedians is Louis CK…”. Yeah.

Report Card: F

Trade

One of the few things economists generally agree upon is that protectionist policies and trade wars damage the economy. Trump talked tough during the campaign, but I’m not convinced he’ll actually pursue those policies now that he’s in office with the same hardline stance.

Here’s a fun scenario. China has been gradually selling UST’s since it began devaluing its currency last August, dropping its known holdings from $3T to $2.8T. Imagine if Trump decides to pursue aggressive trade policy against China, who in turn decides it would be fun to inflict a little pain on the US. China starts dumping Treasurys rather than gradually selling. Yields spike.

Report Card: C

Trump took a harder line with China than I expected, even at the expense of economic growth. I should have realized his barometer was stocks, not GDP.

Conclusion

I began this newsletter with one hope for the next four years and I will end it with another.

I do not believe the recent spike in hate-driven encounters is a result of a biased media. The language Trump used during his campaign contributed to a divided nation. Neither side is without responsibility, but I have heard far more questionable language from the Trump camp than I heard from the Clinton camp. This morning, I heard Rudy Giuliani question whether protesters were actual Clinton supporters, saying they “didn’t like look like people carefully studying political science” to him. I’m not going to argue the semantics, I know how I interpreted that statement.

Societal pressures frequently serve as a line of defense against our less than ideal behavior. Saying misogynistic or racist things is frowned upon, and some people may filter their thoughts before they speak them out of fear of violating social norms.

When the president and his top advisors say these things, it normalizes this behavior. It helps remove that filter. That’s how we end up with high school iPhone videos of kids yelling racist comments at classmates. If the president can do it, why can’t I?

My business/taxes/healthcare may change under a Trump presidency, but my personal identity is not under attack. The middle-aged white guy typing on his laptop from a gated community doesn’t get to minimize how someone else might feel because I am not in their shoes. And before I say, “Sure, but they don’t know how it feels to be in my shoes” I probably need to ask myself if I would trade places with them. If not, some empathy might be in order.

I hope President-elect Trump recognizes this and commits the time and energy to promoting inclusion for all Americans, not just those that look and think like he does. We will all be better for it.

Report Card: I’ll let you be the judge.

Week Ahead

Light week ahead, and not sure it would matter given the eyeballs on DC. Here’s to hoping for a calm Wednesday.